Follow Us x

31ST ANNUAL GABELLI FUNDS PUMP, VALVE & WATER SYSTEMS SYMPOSIUM

By Tony Bancroft, José Garza, and Brett Kearney, CFA

March 15, 2021

Confidence Returning

Overview

On February 25th, 2021, Gabelli Funds hosted the 31st Annual Pump, Valve & Water Systems Symposium. Seventeen industry participants participated throughout the day in various forms. Companies were upbeat considering their abilities to guide their companies through the COVID-19 pandemic, as global demand for industrial products and services should see relatively strong demand as economies globally recover. Against this backdrop, inflationary pressures were a common topic, as these manufacturers have seen the prices of many of their major inputs dramatically increase in the short term.

The momentum toward the digitization of Industrials is likely to pick up pace post-pandemic, particularly in water markets that were impacted by an inability to service customers efficiently during the stay-at-home orders. This rate of adoption opens up the opportunity for recurring software revenue models in addition to what are largely replacement-driven markets, improving business quality and margin profiles. The retrofit opportunities this shift potentially represents is large and exploitable over the next several years, and companies are continuing to develop their connected product pipelines with next-generation offerings across a broader set of their product lines.

Companies continue to address the needs of their portfolio through M&A, and in some cases divestitures to enhance the focus of their product and service offerings. These deals were generally smaller in the past year, as the pandemic caused both buyers and seller to abandon their processes but for some of the smaller transactions that were completed in the back-half of the year. As an example, Badger Meter made two relatively small acquisitions in late 2020/early 2021 to expand its capabilities into water quality markets. Today, most of the participants are looking once again to transactions, having benefitted from some combination of the cost savings implemented over the past year, favorable working capital dynamics, and cheap cost of financing that have translated to improved balance sheets. Several companies noted how they develop their own proprietary funnels, which may enable a slightly lower multiple and an embedded familiarity with the targets.

Production Held Up In 2020

The supply chain was a concern one year ago, even before the COVID-19 pandemic was officially declared on March 11, 2020. While some production was temporarily halted in certain geographies, these “essential” businesses were able to adjust their production throughout the year and meet customer demands. In some cases, stronger than expected demand from residential markets created larger restocking dynamics, and companies were even able to adjust to these. Many companies had added redundancies to their supply chains in prior years to combat the US-China tariffs, and benefitted from such preparedness.

Markets Skewed Positively

The uneven and unpredictable demand picture that was experienced in 2020 is unlikely to be repeated in the short term, with signs of return to normalcy driven by lower COVID-19 infection rates and increased rates of vaccination, particularly in the US.

This is driving optimism in short-cycle industrials that serve a myriad of industries, in demand for oil, in food-and-beverage and hospitality markets, and in aerospace markets that some of the companies of interest also have exposure.

One exception is non-residential construction, which held up during the pandemic but has not backfilled projects that were completed or nearing completion, many of them in the affected hospitality or commercial real estate markets that were deeply impacted. This has led to companies with exposure such as Watts Water to point out the likely decline in the second-half of 2021.

While an improved oil market helps, the relative uncertainty of the market direction likely also holds back larger upstream capital projects. Similarly, municipal activity appears to likely shift marginally to operating expenditures

rather than capital expenditures until the full ramifications of the pandemic on operators’ budgets are known. Adding to that uncertainty is the prospect of a large infrastructure package, which could see earmarks for water investment across the country. In the recent past, the possibility of a large package has led to utilities holding off on large capital projects in the hopes of acquiring more attractive financing.

Residential construction strength seen in 2020 is likely to continue in 2021, as consumers broadly saved and spent more on their homes during the pandemic and contractors work through their backlogs. Lot inventories remain low given the dynamics in housing since the Great Recession, and homebuilders are working hard to meet strong demand. Consumer-driven residential spending had an excellent year, as evidenced by strong interest in pool equipment and point-of-use filtration, and this should continue indefinitely.

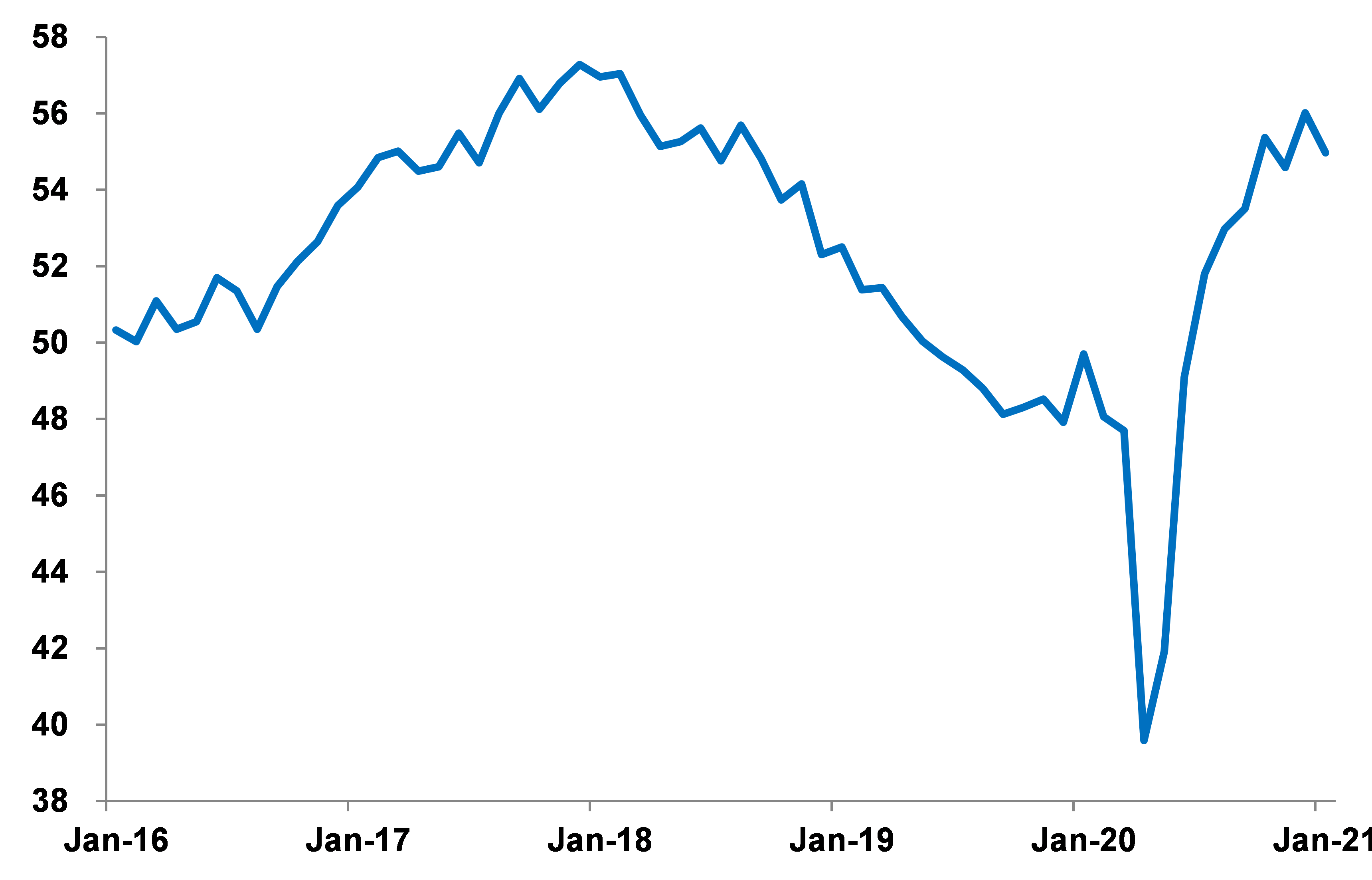

Europe experienced an uptick in activity in the back-half of 2020 as economies opened back up and the region experienced more normalcy. Overall, global PMIs have roared back to an expansionary phase throughout the world, with the exception of Mexico, the country with the third most COVID-19 deaths, reading a PMI of 43.0.

Exhibit 1 Global PMI Composite, January 2016-2021

Source: Public Data; Gabelli Funds

PRICE COST DYNAMICS

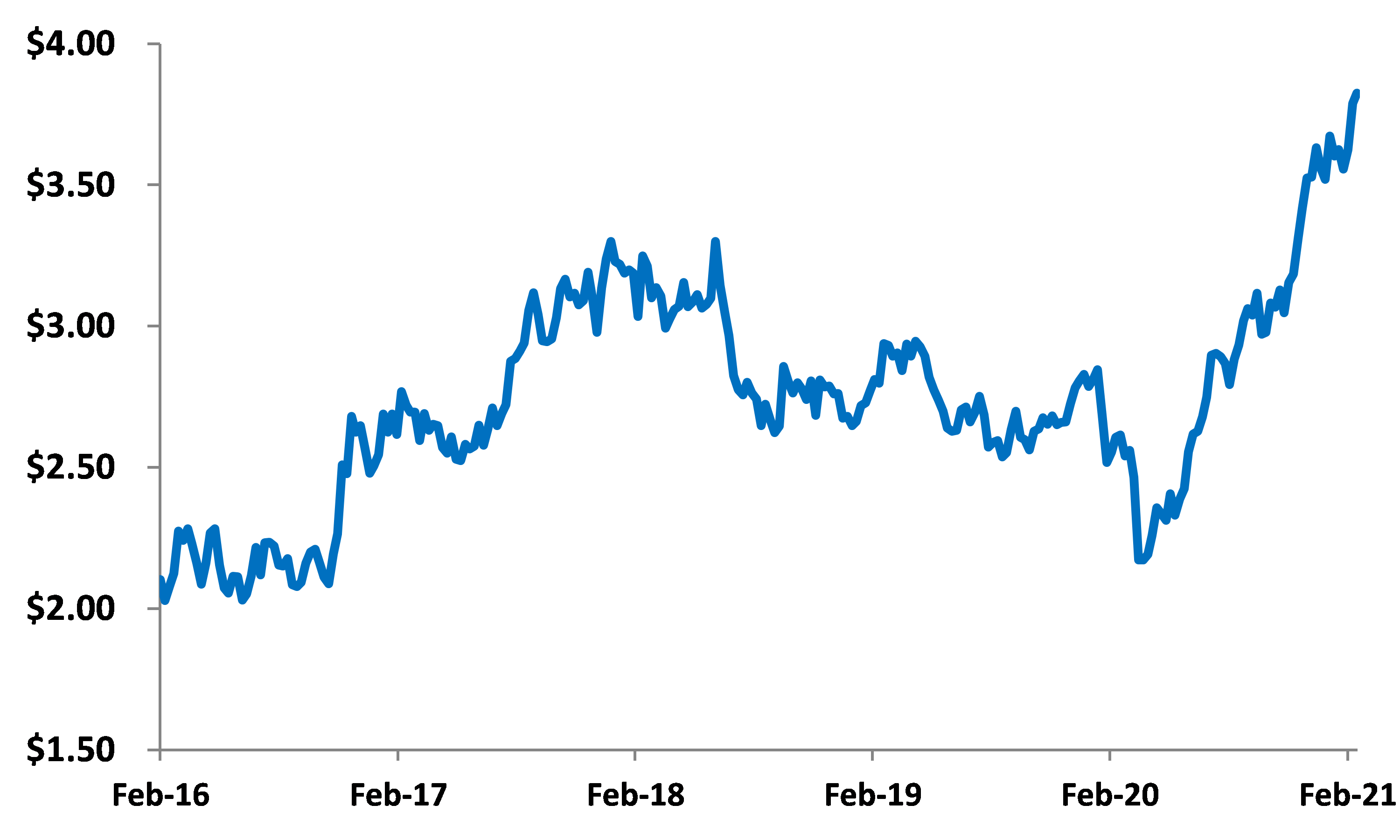

The rapid economic expansion has coincided with supply chains being disrupted throughout the past year, driving significant increases in input costs for many industrial companies. As an example, copper prices are up nearly 51% vs. one year ago (Exhibit 2). Companies have improved their profiles over the past several years and most presenting companies had already instituted a price increase in affected production prior to the new year, or were planning to at the beginning of 2021. These are able to be passed through to consumers, and companies feel that the price/cost mix will likely be positive in 2021 with a delayed impact as the year progresses.

Exhibit 2 LME Copper Price, February 2016-2021

Source: Thomson One

M&A: High Valuations Persist

The M&A appetite for most companies remains as it has in years past, with most interested in doing bolt-on transactions that offer a good fit at a justifiable price. Balance sheets are quite healthy across the landscape, as cash flows improved for most companies – if their markets rebounded then earnings were up, and if not their working capital releases drove higher cash flow conversion. Given less urgency to consummate a deal in the short-term, some companies prefer to let cash accumulate further while they await more attractive prices or balance acquisitions with divestitures of non-core assets.

Most companies have learned to adapt their M&A processes to the current environment, including conducting initial diligence meetings remotely. However, serial acquirers such as AMETEK noted that it remains critical to examine in-person the assets under consideration and that progress on global vaccinations (as well as the establishment of more accepted safety protocols) has accelerated the company’s ability to vet deals this year. Many participating companies spoke to keeping one eye on technology assets, as they become available, that could hasten their equipment digitization efforts.

Valuations and closing thoughts

The XLI Industrial ETF increased 9% vs. 18% for the S&P 500 in 2020, due to the cyclicality of industrial companies as well as a number of depressed end markets (including commercial aerospace and portions of non-residential construction). Year to date 2021, the XLI is up 7% vs the S&P’s +2% as industrials have benefitted from improving short-cycle demand along with a backup in yields. Re-opening dynamics are fully at the center focus, and with healthy balance sheets and a proven ability to weather the dramatic downturn in 2020, these companies should continue to be appreciated further.

Median forward EV/EBITDA multiples are the highest they have been over the past five years, while median P/E multiples are slightly below 2016/2017 levels, which we attribute mostly to the EPS-boosting effects of the Tax Cut and Jobs Act of 2017. Within the presenting companies, only two have multiples below 10x, compared to seven companies of 8-10x EV/EBITDA in 2019.

Table 1 Conference Attendees’ Median Forward Valuations, 2017-2021

AMETEK, Inc. (AME – $120.63 – NYSE) Dry Powder to Deploy

COMPANY OVERVIEW

AMETEK, headquartered in Berwyn, Pennsylvania, is a leading manufacturer of electronic instruments and electromechanical devices and conducts business in two segments named accordingly. The company operates around its four key strategies of operational excellence, strategic acquisitions, global and market expansion, and new products.

The Electronic Instruments Group (EIG) is a leader in advanced instruments for the process, aerospace, power and industrial markets. Examples of these products include process analyzers, emission monitors, spectrometers, power monitoring and metering systems, uninterruptable power systems, turbine engine temperature measurement, fluid and fuel measurement, sensors and switches, and heavy truck dashboard instrumentation.

The Electromechanical Group (EMG) supplies electrical interconnects, precision motion control solutions, specialty metals, thermal management systems, and floor care and technical motors. These products are used for medical devices, office and business equipment, factory automation, robotics, commercial appliances, fitness equipment, food and beverage machines, hydraulic pumps, industrial blowers, and vacuum cleaners. EMG also operates aviation MRO facilities on a global basis.

HIGHLIGHTS

The following are key takeaways from Vice President of Investor Relations, Kevin Coleman’s presentation at Gabelli Funds’ 31st Annual Pump, Valve & Water Systems Symposium:

· AMETEK’s automation platform (which accounts for approximately $460 million of sales, or 10% of total company revenue) is benefitting from accelerated demand across each of its geographic regions as customers increasingly turn to factory automation as a means of managing Covid-related staffing and safety issues. Management expects continued secular growth for this portion of the company as major customers localize production and supply chains and seek to do so in the most labor cost-efficient manner.

· In 2020, the company divested its Reading Alloys business for $250 million. Management indicated that Reading Alloys had become a highly cyclical business with more limited visibility than the rest of AMETEK’s portfolio. Following this divestiture, the company now believes that all of its businesses possess differentiated offerings in attractive niche markets that will allow AMETEK to more than offset cost inflation with pricing power. The company has historically captured approximately 50bps of net positive spread from pricing above cost inflation, and management anticipates achieving a similar outcome this year even in light of greater raw material and freight pressures.

· A majority of AMETEK products already possess an embedded software component and software has become a critical element of the company’s new product development process. AMETEK continued to invest aggressively in new product development throughout 2020, spending a total of $246 million on Research, Development, and Engineering during the year (which represents approximately 5.4% of sales, up from 5.1% in 2019). Management indicated that, in addition to its internal engineering work, the company also continues to evaluate software acquisition targets (primarily those operating in, or adjacent to, AMETEK’s core markets as opposed to software-as-a-service businesses).

· As of 12/31/20, AMETEK had only $1.2 billion of net debt and less than 1.0x net leverage. Management expects to deploy the over $1.0 billion of free cash flow generated this year largely on acquisitions. The company has experienced a significant uptick in deal activity since the start of 2021 and is in active diligence on several acquisition prospects, including additional targets within the medical and life sciences markets.

Badger Meter Inc. (BMI - $102.54 - NYSE) Acquisitions Get Thumbs Up

COMPANY OVERVIEW

Badger Meter, based in Milwaukee, WI, is a leading manufacturer of water meters in the US. Its products are used to measure the flow and quality of water, gases oil and lubricants. BMI’s largest business is its utility product line, which comprises residential and commercial water meters primarily sold to water utilities. BMI estimates that over 85% of its products are used in water applications.

The company is a leader in Automated Meter Reading (AMR) and Advanced Metering Infrastructure (AMI) systems, and Badger introduced Advanced Metering Analytics (AMA) in 2011. The company’s next-generation offerings include its ORION, BEACON, and E-series Ultrasonic products that provide increased connectivity through cellular networks, automation, real-time analytics capabilities, and precision. The company’s industrial product line consists of small precision valves, electromagnetic meters, impeller flow meters and industrial process meters.

Badger Meter and acquired s::can in November 2020 for $31 million and Analytical Technology, Inc. (ATI) in January 2021 for $44 million. S::can is based in Vienna, Austria and utilizes optical sensors for water quality parameters such as nitrates, dissolved oxygen, pH, and turbidity, mainly applied to pumping stations and wastewater treatment plants. ATI, based in Collegeville, PA, provides electrochemical monitoring. Other acquisitions include D-Flow Technology in May 2017 for $23 million, and several strategic acquisitions of distributors, including National Meter and Automation (2014), United Utilities (2105), Carolina Meter & Supply (2017), and Innovative Meter Solutions (2018).

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31st Annual Pump, Valve and Water Systems Symposium:

· CFO Bob Wrocklage provided an overview of the exciting acquisitions at the tail end of 2020 and in early 2021, which are allowing the company to expand beyond flow measurement and firmly into water quality measurement.

· Despite challenges presented by the pandemic in 2020, Badger Meter grew municipal sales by 4% and EPS by 5%. Macro drivers in the municipal water market continue, as both an aging infrastructure and aging workforce in the industry will continue to provide opportunities for smart water technology adoption. Additional secular trends that benefit Badger Meter’s broad, technology-driven product offering include the increased adoption of static metering as well as the digitization of radio communications. Municipal budgets appear resilient post-COVID, and the company’s funnel of opportunities remains robust as interest in their technologies grows.

· The two new acquisitions will add $35-40 million of annual revenue at mid-teens EBITDA margins, providing both optical and electromechanical quality readings as well as expanding BMIs international footprint. In particular, s::can does business in over 50 countries. While the s::can and ATI products do not possess their own software capabilities, they offer a longer-term opportunity to integrate into the company’s BEACON software platform. The company intends for software to represent 10% of revenue over time.

· Badger Meter believes it is on the cusp of additional success internationally, with smart water markets such as that of the UK, Middle East, and Australia. Notably, the company anticipates bringing a new, ISO-compliant meter to the market in 2021. Strong free cash flow generation is expected to continue, arising from demand and working capital management.

Consolidated Water Co. (CWCO - $15.06 - NASDAQ) Caribbean Life

COMPANY OVERVIEW

Consolidated Water Co. Ltd. develops and operates water supply and treatment plants and water distribution systems. The company operates water production facilities in the Cayman Islands, The Bahamas and the British Virgin Islands and operates water treatment facilities in the United States. Consolidated Water produces potable water from seawater using reverse osmosis technology and sells this water to a variety of customers, including public utilities, commercial and tourist properties, residential properties and government facilities. The company was established in 1973 as a private water utility in Grand Cayman, the largest island in the Cayman Islands group, and obtained its first public utility license in the Cayman Islands in 1979.

In addition, Consolidated Water also manufactures and services a wide range of products and provides design, engineering, management, operating and other services applicable to commercial and municipal water production, supply and treatment and industrial water and wastewater treatment. CWCO owns Aerex, a custom and specialty manufacturer of water treatment-related systems and products and a controlling interest in PERC Water Corporation, a water infrastructure company headquartered in Costa Mesa, CA that develops, designs, builds, operates and manages water and wastewater infrastructure throughout the Western U.S.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31stAnnual Pump, Valve and Water Systems Symposium:

· CEO Rick McTaggart and CFO David Sasnett provided an overview of their business and took questions. Consolidated Water’s long operating history and expertise drive consistent water supply operations and a solid margin profile. The company’s RO facilities generate approximately 4/10 of a gallon of drinking water for every one gallon of seawater. Of its roughly $75 million of annual revenue, approximately $25 million is for retail operations, $25 million for bulk water operations, $14 million in manufacturing, and $11 million for services.

· The company’s retail operations have experienced a roughly 20% drop in volumes, as the Cayman Islands have been closed to tourists since March 2020. Management expects the islands to re-open starting in April or May given vaccinations, and thus would expect volumes to be fully up to pre-pandemic levels in early 2022. The company’s bulk water operations, wherein the company produces water and sells to government-owned distributors, represents approximately 40% of revenue and has been largely not impacted by the pandemic.

· The company’s recovery proceedings in Mexico continue for its Rosarito desalination project. On June 29, 2020, the company received a letter from the State of Baja California terminating its contract for the construction and operation of a 100 MGPD desalination plant. The company’s estimate of expenses that were filed to be recovered is approximately $56 million.

· CWCO has a favorable balance sheet, with net cash and only $200K of debt, and is trying to grow through selective acquisitions. Management noted it is not interested in buying troubled companies. PERC Water, its latest acquisition, is an expert in wastewater and has interesting design-build-operate opportunities in the California market, where it generates approximately 70-75% of its revenue. CWCO believes that PERC can generate an 8% CAGR, and that their majority ownership of this business creates additional opportunities for its desalination expertise. Aerex is dealing with the loss of a major customer’s orders in 2021, which the company is confident they can manage through.

Crane Co. (CR - $89.40 - NYSE) Fluid Handling Recovery

COMPANY OVERVIEW

Crane Co. is a diversified industrial based in Stamford, CT. Crane operates in four segments. Fluid Handling’s primary products are on/off valves and the segment serves the chemical, power, oil & gas, nonresidential construction, and general industrial markets. Payment & Merchandising Technologies provides highly engineered cash payment and vending solutions. Aerospace & Electronics supplies critical systems and components for brake control, sensing and utility, power, cabin, landing, microwave, and fluid management applications. Engineered Materials manufactures fiberglass-reinforced plastic products for recreational vehicles, trucks, trailers, and buildings.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the 31st Annual Pump, Valve & Water Systems Symposium:

· Crane’s Chemical business returned to growth in 4Q2020 in most regions, except for the US, after turning negative in 2Q2020 due to COVID-19. In 2021, CR expects growth in the chemical market due to consumable packaging, durable goods, auto, and construction. Capex budgets are expected to increase as well as MRO work. Chemicals is 23% of the Fluids segment revenue.

· The Power/Oil & Gas markets, about 21% of sales, are expected to be flat in 2021. The majority of this business is in refining. In Power, most of the revenue is nuclear service work in NA along with work on coal and natural gas plants.

· The General Industrial market is 26% of the segment’s revenue with exposure to pharma, pulp & paper, mining, industrial automation, and transportation end markets. In 2021, sales are expected to recover similarly to the Chemical business. The company expects mid-to-long-term growth of 2-4% CAGR in the U.S. and to a lesser extent, in Europe.

· Management highlighted the Triple Offset Valve, which has shown double-digit growth year-over-year and believes it can generate $50 million in revenue by 2025 while increasing the addressable market by $500 million. The company is also building a new chopper pump for the muni-market which is a $400 million market. In this market, CR is expected to generate $30 million of revenue by 2025. The chopper market is focused on reducing clogging as waste drains have increasingly more debris, e.g. baby wipes have increased 60%, while low-flow appliances have reduced water usage by 35% over the last decade. Previously, CR made non-clogging pumps, but the chopper pump reduces maintenance and service costs by 75%.

· Crane is pleased with the I&S acquisition which it acquired from CIRCOR in 2019 for $172 million. The company sees fluid handling as a priority and is looking at other acquisitions to complement the I&S business. Management has seen a pickup in deals after a slowdown from COVID-19.

· As of December 2020, the company had about $1.2 billion of debt, $550 million of cash, total debt-to-EBITDA of 2.5x and a 10x interest coverage ratio. CR’s strong balance sheet is augmented by FCF, which is expected to be between $260-290 million in 2021.

Energy Recovery, Inc. (ERII - $17.49 - NASDAQ) Key Player in Desal

COMPANY OVERVIEW

Energy Recovery, Inc. is an energy solutions provider to industrial fluid flow markets. Energy Recovery’s solutions enable desalination plant operators to recover otherwise wasted hydraulic pressure energy from a high-pressure fluid flow and transfer the energy to a low-pressure fluid flow, reducing energy costs and carbon emissions associated with the reverse osmosis process.

The company offers energy recovery devices (ERDs) for the reverse osmosis water desalination market with its PX Pressure Exchanger and its hydraulic turbocharger technologies. ERII also manufactures high-performance and high efficiency pumps that are utilized in the reverse osmosis desalination process. Energy Recovery sells its ERDs, Turbochargers, high-pressure pumps, circulation “booster” pumps, and services to: 1) major international EPC firms that design, build, own and operate large-scale desalination plants; 2) original equipment manufacturers that supply equipment and packaged solutions for small- to medium-sized desalination plants; and 3) plant owners and/or operators for maintenance or retrofits. The company has developed or is developing the VorTeq, IsoBoost, and IsoGen product lines for the oil and gas market.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31stAnnual Pump, Valve and Water Systems Symposium:

· Chief Financial Officer Joshua Ballard gave an overview of Energy Recovery’s key product set and favorable outlook for the company’s growth given dynamics in the reverse osmosis desalination market. The PX Pressure Exchanger reduces energy consumption, the largest cost of a desalination plant, by up to 60%, utilizing innovative technology that has given the company near ubiquity in reverse osmosis (RO) systems globally.

· Energy Recovery expects to grow 20-25% in 2020, followed by 10% growth in 2021 and up to 25% in 2022, as the desalination industry shifts to RO from thermal desalination, the historically preferred method, but one that has fallen out of favor as RO has become cheaper and is less energy intensive. As these systems are retrofit and the industry shifts, ERII is poised to benefit at an accelerating rate. The company estimates that the 23 m3/day of installed thermal desalination capacity could translate to approximately $500 million of additional revenue for Energy Recovery.

· ERII spent significant resources over several management regimes developing its VorTeq platform, a pressure exchange device for use in oil & gas applications. While not completely abandoned, the current management team is applying more rigorous financial hurdles (20%+ ROI, 50%+ gross margin, cash neutral in three years) for its development as well as other projects.

· The company is continuing to develop additional products using its basic design architecture, as it would diversify the company’s revenue base, but appears very focused on minimizing risk on these development efforts. To do this, ERII is approaching smaller opportunities such as zero liquid discharge (ZLD) in wastewater treatment, which the company estimates could open up $100 million opportunities in China and India each, driving meaningful growth. The first order was received in October 2020 for a project in India, and the relatively small size of these systems ($100-150K) should reduce some of the quarterly lumpiness that comes from the desalination market. As the company’s topline grows and R&D spending is reduced from its high level of 25% of revenue, EBITDA margins and cash flows are expected to expand meaningfully.

EnPro Industries (NPO - $90.35 - NYSE) Portfolio Re-Shaping Continues

COMPANY OVERVIEW

EnPro Industries, headquartered in Charlotte, NC manufactures proprietary engineered industrial products. The new Sealing Technologies segment, comprised of the Garlock, Stemco, and Technetics businesses, makes innovative sealing solutions complemented by value-added systems integration. The Advanced Surface Technologies segment, composed of the LeanTeq, Alluxa, and Technetics Semiconductor businesses, utilizes proprietary technologies, processes, and capabilities to serve the most challenging applications for semiconductor equipment, specialized optical filters, and thin-film coatings. Finally, the Engineered Materials segment, composed of the GGB and CPI businesses, produces bearing products for automotive and industrial markets and compressor components for refining, petrochemical, and natural gas markets.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31thAnnual Pump, Valve and Water Systems Symposium in New York:

· CEO Marvin Riley and CFO Milt Childress highlighted the company’s leadership in high margin material science related businesses with strong free cash flow and plans to further reshape its portfolio to accelerate growth in these areas, with an eye towards faster growth end markets and high aftermarket exposure. Riley pointed to his thirteen year tenure at the company as key for providing him with the insights to gauge where EnPro has an advantage and where it does not. Beyond pure portfolio reshaping, Riley wants the organization to view itself as unleashing the power of material science to move humanity forward.

· EnPro is committed to disciplined capital allocation and a strong balance sheet, with current Net Debt to EBITDA about 1.6 times, but will prioritize strategic acquisitions while also considering capital return. EnPro likes its existing base of businesses, having exited most of the non-core, lower value add parts of its portfolio.

· Acquisitions closed in the last 18 months are performing very well, with a strong backlog in the Aseptic Group, LeanTeq growing 40% in 2020, and Alluxa shaping up for a strong Q1’21. These businesses share a material science focus, and in the case of the latter two, the placing of a thin coating on a substrate. EnPro views its role as supporting these businesses, including technical know-how in coatings, sales force effectiveness tools, and a more global reach, but is careful not to disrupt the quality of the acquired business and the underlying team.

· Riley feels that EnPro is improving its execution with each acquisition, with Alluxa integration proceeding very well. Alluxa has meaningful upside from participation in Europe and expansion in Asia. EnPro also sees the ability to increase Alluxa penetration in aerospace and defense and life sciences, two core end markets.

· EnPro is seeing good momentum across its end markets, from strong growth in semiconductors to good trailer build and ton mile growth in Stemco, not to mention auto and broader IP oriented businesses. Aerospace and oil and gas remain drags, comprising close to $140mm of 2020 revenues.

· Riley believes that EnPro trades at a discount to its peers but acknowledged the lack of straight-up peers in most businesses, for example LeanTeq as a semiconductor equipment cleaning company. While competitive landscapes differ, EnPro is trying to carve out niches where the competitive dynamic is muted and EnPro’s offerings have barriers to entry.

· The EnPro Capability Center remains a focus, allowing for further margin improvement and increasing returns on invested capital through continuous improvement. The Center has been instrumental in driving efficiencies in existing businesses like Stemco (heavy duty truck) while helping quickly bring EnPro’s supply chain framework and other best practices to acquired businesses.

Evoqua Water Technologies Corp. (AQUA - $25.48 – NYSE) Treatment Leader

COMPANY OVERVIEW

Evoqua, headquartered in Pittsburgh, PA, is a leading provider of mission critical water treatment solutions, services, systems and technologies to support industrial, commercial, and municipal customers' water needs. The company offers a comprehensive portfolio of differentiated, proprietary technology solutions sold under a number of market-leading and well-established brands such as Envirex, DeltaUV, Magneto and Neptune Benson. Evoqua maintains these treatment assets through what it believes is the largest service network in North America, consisting of 92 branches. With over 200,000 installations worldwide, AQUA holds leading positions in the industrial, commercial and municipal water treatment markets in North America. Evoqua became a public company in November 2017 when it offered 31.9 million shares at $18 per share on the NYSE.

AQUA has two segments: Integrated Solutions and Services (ISS) and Applied Product Technologies (APT). The $944 million ISS segment provides service solutions that selectively utilize its comprehensive portfolio of water treatment technologies. The $485 million APT segment sells equipment that is used as components in integrated solutions specified by water treatment designers and offered by OEMs, engineering firms, integrators and Evoqua itself. Recent acquisitions include Ultrapure, an industrial water services provider in Texas, Aquapure Technologies, an Ohio-based water service and equipment company, Frontier Water (60%), and ATG UV. In fiscal 2020, Evoqua sold its MEMCOR membrane filtration business to DuPont for $110 million.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31stAnnual Pump, Valve and Water Systems Symposium:

· Chief Growth Officer Snehal Desai detailed the digital and growth initiatives that Evoqua in undergoing. These investments have, under his eye, have taken off since the company’s two-sector realignment starting in late 2018. As a result, several of the company’s functions such as R&D and IT have converged to drive the digital transformation across the company.

· Initially, the company’s digital efforts were a single product line around outsourced water for light industrial customers, but has been expanded further to municipal applications now as well. Ultimately, the goal would be for predictive analytics in the ISS segment, which would help better manage assets while reducing downtime. In APT, the goal is to drive digital opportunities around connected products. Notably, Desai feels it is very early in the company’s digital journey, and the company’s margin uplift of 1000 bps on deployments has continued to hold.

· AQUA not only benefits from the digitization trends, but from the continued interest in outsourced water and reuse given the aging of the water infrastructure. Value for industrial customers utilizing Evoqua in their facilities comes from reduced complexity, particularly as it relates to meeting changes in local discharge requirements. These customers prefer to outsource these to someone more knowledgeable and instead focus on their own production requirements. Reuse continues to gain traction due to the rising costs and/or decreased water quality that are passed onto industrial customers by utilities, which makes taking control of their systems more favorable.

· AQUA is positioned as one of the potential leaders in emerging PFAS treatments. The company estimates that there are roughly 100 large sites in the US with PFAS treatment needs and that it is in ~35 of them. While the company believes that local regulations and activities will determine much of the activity, tackling these contaminants is a bipartisan goal and the new administration could drive the conversation further along.

Flowserve Corp. (FLS – $39.68 - NYSE) Capturing Emerging Opportunities

COMPANY OVERVIEW

Flowserve Corporation, headquartered in Irving, Texas, is a world leading manufacturer and aftermarket service provider of comprehensive flow control systems. The company’s product portfolio of pumps, valves, seals, automation, and aftermarket services support global infrastructure industries, including oil & gas, chemical, power generation (including nuclear, fossil, and renewable), and water management, as well as certain general industrial markets. Through its manufacturing platform and global network of Quick Response Centers, Flowserve offers a broad array of aftermarket equipment services, such as installation, advanced diagnostics, repair, and retrofitting. The company operates in the two segments: Flowserve Pump Division and Flow Control Division.

The Flowserve Pump Division designs, manufactures, distributes, and services specialty and highly-engineered custom and pre-configured pumps and pump systems, mechanical seals, auxiliary systems, replacement parts and upgrades and related aftermarket services.

The Flow Control Division designs, manufactures, distributes, and services a broad portfolio of engineered and industrial valve and automation solutions, including isolation and control valves, actuation, controls, and related equipment.

HIGHLIGHTS

The following are key takeaways from CFO Amy Schwetz’s presentation at Gabelli Funds’ 31st Annual Pump, Valve & Water Systems Symposium:

· Management expects the combination of higher oil prices (with both brent and WTI back above $60 per barrel) and accelerating vaccinations to cause Flowserve’s refinery and petrochemical customers to begin addressing their backlogs of deferred equipment maintenance. Flowserve had difficulty accessing customer sites due to virus-related restrictions last year, but management has seen an improved environment thus far this year and noted that customer psychology has been on an upswing the past few months. The company expects aftermarket orders to begin inflecting positively by mid-2021 with larger project activity following in the subsequent six to nine months.

· Flowserve has been active in carbon capture and sequestration markets for more than five years, providing pumps used in carbon compression and injection back below ground. The company is seeing increasing interest from customers in this technology and expects to broaden its product offering to better capture available market opportunities. Flowserve also expects to grow its market share in the concentrated solar market, where it provides vertical turbine pumps and high temperature seals used in solar salt energy storage. Finally, the company has been introducing a range of next-generation products that help existing customers to improve energy efficiency at plants (including energy recovery pumps).

· Earlier this year, Flowserve formally launched and commercialized its comprehensive IoT platform called RedRaven. The company has already deployed more than 6,000 sensors on its installed base of pumps and valves and has been successful in proactively predicting equipment failure for several customers. Management believes this tool will enable the company to pull through a greater proportion of Flowserve parts and service and may ultimately allow for incremental revenue sources and business models.

· Flowserve finished December with only $632 million of net debt and 1.3x net leverage. The company expects to increase capex to approximately $75 million in 2021 (with half dedicated to maintenance spending and half towards enterprise-wide IT systems to drive productivity). Management noted that the company may utilize its $100 million of share repurchase authorization throughout this year and that Flowserve is also in a position to begin acquiring complementary flow control assets that would enable the company to more rapidly penetrate newer energy transition applications.

Franklin Electric Co. (FELE - $77.43 - NASDAQ) Groundwater Specialists

COMPANY OVERVIEW

Franklin Electric Company, Inc., headquartered in Ft. Wayne, Indiana, is a leading designer, manufacturer and distributor of water and fuel pumping systems and related equipment for specialty industrial and energy distributors, OEMs, utilities, and major oil & gas customers. The company’s products include submersible motors, pumps, electronic controls and related parts and equipment. Its segments include Water Systems, Fueling Systems, and Distribution.

The Water Systems segment is engaged in the production and marketing of water pumping systems and offers motors, pumps, drives, electronic controls and monitoring devices for groundwater, surface water, and wastewater applications. Its Fueling Systems segment is engaged in the manufacture and marketing of fuel pumping systems, fuel containment systems, pipes, sumps, fittings, vapor recovery components, and monitoring and control systems for use in submersible fueling applications. In 2017, FELE acquired three groundwater distributors for $89 million, forming its Headwater Companies distribution segment and further vertically integrating its business.

Recent acquisitions include Waterite, a residential and commercial water treatment products and services provider headquartered in Winnipeg, Manitoba, Canada and Gicon, a professional groundwater distributor operating seven locations in the state of Texas.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31stAnnual Pump, Valve and Water Systems Symposium:

· Chief Financial Officer John Haines discussed the company’s history and well-established presence in groundwater pumping, which accounts for $470 million of the company’s $735 million Water Systems segment. The company has forward-integrated several times through its history, from motors into pumps and electronic controls, and is now firmly into its distribution.

· Roughly 80% of the company’s Water Systems sales are replacement-driven, giving the company a stable demand base. The remaining 20% of its water revenue is driven by housing or new irrigation. The company’s more recent acquisitions in water treatment provide product line extensions.

· FELE has a meaningful international presence, gained through acquisitions over the years in countries such as Brazil, Argentina, Mexico and Turkey. Haines noted underperformance in its India operations, but will continue to look at other countries for sources of growth. While customers (distributors) vary across geographies, Franklin delivers on the five core factors that it feels are most important: quality, product availability, service via hotlines and training programs, product innovation, and cost.

· Franklin Electric estimates the US groundwater distribution channel is approximately $2 billion in size, and is a critical channel for the company’s groundwater business. The company acquired Gicon for $27.9 million in late 2020, which adds seven distribution outlets in Central and West Texas along the critical I-35 corridor.

· In its Fueling business, the company believes it has a very long runway in terms of demand despite increasing electrification efforts, noting that there will likely be more internal combustion engines in 20 years from now globally than there are today. Demand in China for its fueling products declined meaningfully in 2020

· For 2021, FELE expects 10% revenue growth to $1.365-1.395 billion and $2.50-2.75 earnings per share.

Graco Inc. (GGG – $66.24 – NYSE) Seizing Organic Opportunities

COMPANY OVERVIEW

Graco, based in Minneapolis, Minnesota, manufactures highly engineered fluid-handling equipment that measures, mixes, controls, dispenses, and sprays fluids for construction and industrial markets worldwide. The company operates in three segments: Industrial, Process, and Contractor.

Graco’s Industrial segment serves the automotive, wood and metal, rail, marine, aerospace, farm, construction, bus, recreational vehicle, and other markets with equipment and pre-engineered packages to move and apply paints, coatings, sealants, adhesives and other fluids.

The Process segment produces and markets pumps, valves, meters, and accessories to move and dispense chemicals, oil & natural gas, water, wastewater, petroleum, food, lubricants, and other fluids. It serves food & beverage, dairy, oil & natural gas, pharmaceutical, cosmetics, electronics, wastewater, mining, fast oil change, service garage, fleet service center, automobile dealer, and industrial lubrication customers.

The Contractor segment provides sprayers for architectural coatings for painting, corrosion control, texture, and line striping. It sells through both the pro paint and home center channels.

HIGHLIGHTS

The following are key takeaways from President of Process Division David Lowe and Director of Investor Relations Chris Knutson’s presentation at Gabelli Funds’ 31st Annual Pump, Valve & Water Systems Symposium:

· Graco expects to benefit from higher energy and commodity prices driving greater demand for the company’s products in emerging markets. The company’s process and lubrication businesses benefit from increased mining and infrastructure investment in developing countries (including water tower, road, and pipeline projects). Further Graco’s finishings, adhesives, and sealants businesses also typically benefit when emerging market economies are stronger as consumers in these markets are able to spend more on automotive and residential applications.

· The company has increasingly evolved its products and selling strategies to incorporate a greater digital component. Management estimates that Graco’s engineering staff is now about equally split between electrical (including coding and software) and mechanical engineers, relative to 10 years ago when the company employed only approximately one or two electrical engineers for every dozen mechanical engineers. The company continues to invest aggressively in talent and resources that will enable internal development of more connected and digital product offerings.

· Graco is spending an above-average level of capex presently to take advantage of a number of organic growth opportunities. In 2020, the company completed an expansion of its Contractor facility in Rodgers, MN and this year Graco expects to spend $115 million on capex, including upgrading its powder coating equipment facility in Switzerland that is experiencing robust growth. Lastly, the company also recently purchased adjacent land in Dayton, MN and will commence construction on a new factory for process and liquid finishing products this year (with completion expected by mid-2022).

· The company has a strong balance sheet with $207 million of net cash as of 12/31/20. Management expects to be opportunistic this year on both M&A as well as share repurchases. Graco has an active deal funnel of potential acquisition targets but management will remain disciplined on price and valuation. The company reduced its outstanding share count by 2.4 million shares during 2020 and Graco still maintains nearly 20 million shares of active repurchase authorization, which it expects to execute on during market dislocations.

Graham Corporation (GHM – $16.48 - NYSE) Naval Growth Strategy

COMPANY OVERVIEW

Graham Corporation is a global business that designs, manufactures and sells critical equipment for the energy, defense, and chemical/petrochemical industries. Its energy markets include oil refining, cogeneration, and alternative power. For the defense industry, its equipment is used in nuclear propulsion power systems for the U.S. Navy. For the chemical and petrochemical industries, its equipment is used in fertilizer, ethylene, methanol and downstream chemical facilities. Graham’s global brand is built upon its world-renowned engineering expertise in vacuum and heat transfer technology, responsive and flexible customer service and high quality standards. The company designs and manufactures customer-engineered ejectors, vacuum pumping systems, surface condensers and vacuum systems. Its equipment can also be found in other diverse applications such as metal refining, pulp and paper processing, water heating, refrigeration, desalination, food processing, pharmaceutical, heating, ventilating, and air conditioning.

Reason For Comment

The following are key takeaways from CEO Jim Lines and CFO Jeff Glajch’s presentation at Gabelli Funds’ 31st Annual Pump, Valve & Water Systems Symposium:

· Graham has built its defense business with the U.S. Navy over the past several years to now have platform exposures on each of the Virginia Class Submarine, Columbia Class Submarine, and nuclear powered aircraft carriers. As these programs now hit steady-state production rates, Graham expects to generate approximately $25 to $30 million of annual defense revenue for at least the next four to five years. Further, management believes there is an opportunity for Graham to organically expand its penetration of these programs with additional content and components surrounding the nuclear power island of the ships.

· The company is experiencing new market opportunities as part of the global energy transition. Within the U.S., several refiners have turned to Graham to provide its vacuum technology for use in renewable diesel and biodiesel projects. While these are smaller projects ($100K to $250K per opportunity, relative to the company’s traditional multi-million dollar refining orders), the margin profile is similar and the company is seeing a steady flow of opportunities. Similarly, Graham heat exchanger and heat transfer technology is finding new applications within compressed natural gas and hydrogen markets (both of which operate at very high pressures). These are similarly smaller projects but could accelerate in quantity and size as these markets expand globally.

· Two years ago, Graham revamped its strategy to win business in India by establishing a local sales and marketing subsidiary within the country and partnering with local fabrication partners. The approach has been successful, with Graham recently winning two $4 to $5 million project awards with new customers in India. Management sees a continued solid pipeline of new refinery and petrochemical project opportunities in India going forward.

· As of December, Graham had $69 million of net cash. The company intends to deploy this capital on an acquisition and is targeting a business with $20 to $60 million of annual revenue. Focus areas for Graham are primarily within the defense market (to expand the company’s share of wallet with the U.S. Navy and Tier 1 naval suppliers) and, to a lesser degree, refining aftermarket. The company’s CFO and Head of Business Development have been advancing numerous discussions with potential targets and are in active diligence on several deals. The company would ideally like to deploy half to all of Graham’s available cash on a single target.

ITT Inc. (ITT – $85.08 - NYSE) Conquering Market Adjacencies

COMPANY OVERVIEW

ITT Inc., headquartered in White Plains, NY, is a diversified manufacturer of highly engineered critical components and customized technology solutions for the transportation, industrial, and oil and gas markets. ITT operates in the three segments: Motion Technologies, Industrial Process, and Connect and Control Technologies.

The Motion Technologies segment is a manufacturer of brake pads, shims, shock absorbers, energy absorption components, and sealing technologies primarily for the transportation industry, including passenger cars, light- and heavy-duty commercial and military vehicles, buses, and rail.

The Industrial Process segment is an original equipment manufacturer and an aftermarket parts and service provider offering an extensive portfolio of industrial pumps, valves, and plant optimization systems and services for the chemical, oil and gas, mining, general industrial, pharmaceutical, and power markets.

The Connect and Control Technologies segment designs and manufactures a range of highly engineered connectors and specialized products for critical applications supporting various markets including aerospace and defense, industrial, transportation, medical, and oil & gas.

Reason For Comment

The following are key takeaways from CFO Emmanuel Caprais’ presentation at Gabelli Funds’ 31stAnnual Pump, Valve & Water Systems Symposium:

· During 2020, ITT won a total of 42 new electric vehicle platform awards, including wins across each major region of North America, Europe, and China. The company has been able to expand its global light vehicle brake pad market share by penetrating new hybrid and EV programs with Tesla, GM, and several European and Chinese auto OEMs. Four years ago, ITT established an R&D center in China dedicated to electric vehicles, which management believes is enabling the company to lead in the transition towards newer vehicle types (while continuing to serve customers on internal combustion engine vehicles).

· ITT has launched a number of new product innovations across each of its three segments in recent years. Within the company’s Industrial Process segment (i.e. pumps and valves business), ITT has released a new version of its i-Alert remote pump monitoring technology that proactively reads temperature and pressure measurements to predict and prevent equipment failure. Within the Motion Technologies segment, the company’s latest version of its smart pad technology not only reduces braking distance by 7% to 8% but also reduces vehicle carbon emissions by detecting where the pad is relative to the motor and eliminating residual drag. Lastly, the Connect & Control Technologies segment has launched new rotorcraft vibration control technology to support Bell Textron on its Future Attack Reconnaissance Aircraft.

· The company finished December in a strong net cash position of $740 million. In October 2020, ITT terminated its legacy pension plan (frozen, funded, and transferred to Mass Mutual for a payment of $8 million). Further, during 2020, the company negotiated favorable asbestos insurance settlements and drove an approximately $100 million increase in its insurance asset to finish the year at just a $487 million net asbestos liability (down from over $700 million in 2011).

· ITT is aggressively investing in internal growth, innovation, and productivity projects with capex expected to total approximately $100 million this year (up nearly $40 million, or 60%, year-over-year). Management has also been strengthening the company’s internal M&A resources and team to allow ITT to accelerate acquisition activity later this year. Further, the company has committed to $50 to $100 million of share repurchases in 2021, which could be upsized in the event of a market dislocation.

Mueller Water Products (MWA - $13.64 - NYSE) Digital Gaining Steam

COMPANY OVERVIEW

Mueller Water Products, headquartered in Atlanta, Georgia, manufactures and markets products and services used in the transmission, distribution and measurement of water primarily in the United States and Canada. Mueller products are deployed in water distribution networks, water and wastewater treatment facilities, gas distribution systems and fire protection piping systems. The company operates through two segments, Infrastructure, and Technologies.

The Infrastructure segment offers valves for water and gas systems, including iron gate, butterfly, tapping, check, plug and ball valves; dry-barrel and wet-barrel fire hydrants; pipe repair products, such as clamps and couplings used to repair leaks; small valves, meter bars, and line stopper fittings for use in gas systems; and machines and tools for tapping, drilling, extracting, installing, and stopping-off water and gas fittings. This segment sells its products primarily through waterworks distributors to various end user customers, including municipalities, water and wastewater utilities, gas utilities and contractors. The company acquired Krausz Industries, a manufacturer of pipe couplings and clamps, for $141 million in December 2018, and Singer Valve, a manufacturer of automatic control valves for water works, industrial, commercial and fire protection applications, for C$34 million in February 2017.

The company’s Technologies segment operates under the Mueller Systems and Echologics brands, providing residential and commercial metering products and systems as well as leak detection and pipe condition assessment products and services.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31stAnnual Pump, Valve and Water Systems Symposium:

· CEO Scott Hall highlighted the favorable attributes for Mueller Water that are not currently recognized by the market, notably the steps the company has made in developing technologies that will allow for a data-driven digital platform connecting municipal customers to their underground infrastructure, enabling them to make more informed investment decisions.

· As the incumbent experts on underground water infrastructure, the company believes it has a seat at the table and will be continue to make inroads now that it has a digital software platform called Sentryx in addition to its leak detection, pipe condition assessment, smart hydrant, and smart metering offerings. The company is currently working with Amazon AWS on predictive models around acoustic characterization and feels very good about its current positioning.

· MWA is benefitting from growth in residential construction throughout the country as homebuilders continue to increase their lot inventory. MWA believes it can achieve 4-6% revenue growth in 2021, as its break-fix business, which is roughly 60-65% of revenue, should continue to pace moderate growth, combined with the strong residential new construction backdrop. Municipal projects are being delayed in certain areas due to budget impacts from the pandemic. Municipal utilities are continuing to spend more of their budgets on operating expenses and may push out capital expenditures in an uncertain environment.

· The cold spell in Texas could create additional opportunities for those serving infrastructure markets, but this will take time to work itself out. MWAs large investments in Kimball, TN and Decatur remain on track, with elevated capital spend of $80-90 million in 2021 as the company invests in its facilities. After their 2023 completions, these projects are expected to generate $30 million of annual incremental gross profit.

Pentair plc (PNR - $59.05 - NYSE) Additional Cost-Out Possible

COMPANY OVERVIEW

Pentair, headquartered in London, UK, is a diversified industrial manufacturing company that designs, manufactures and distributes water products for use in residential, industrial, construction, food & beverage, and municipal applications. Pentair operates under two segments: Consumer Solutions ($1.7 billion), and Industrial & Flow Technologies ($1.3 billion).

Approximately 60% ($1.1 billion) of the Consumer Solutions segment is the company’s pool business which manufactures and markets energy-efficient residential and commercial pool equipment, including pumps, filters, heaters and heat pumps, lights, automatic controls, and automatic cleaners for pool maintenance, repair, and construction. The remaining 40% is the company’s Water Solutions business, which manufactures pressure tanks, control valves, activated carbon products, conventional filtration products, and point-of-entry and point-of-use systems. The Industrial & Flow Technologies (IFT) segment is comprised of the residential & irrigation flow business (40%, $500 million), which sells pumps for residential and agricultural applications, the industrial filtration business (30%), which is focused on industrial process filtration and sustainable gas, and infrastructure flow business (30%), which sell larger pumps focused on fire suppression, wastewater and flood control.

In February 2019, Pentair acquired Aquion, a manufacturer of water conditioners, iron filters, carbon filters, water purifiers and UV disinfection products for residential and commercial customers for $160 million and Pelican Water Systems, a provider of residential whole-home water treatment systems and services, for $120 million.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31stAnnual Pump, Valve and Water Systems Symposium:

· Senior Vice President of FP&A, Treasury and Investor Relations Jim Lucas discussed the company’s focused portfolio that drives efficiencies for customers and is underpinned by ESG principles. In 2020, Pentair’s pool business experienced 17% growth while the company’s other pieces of its residential exposure also did well, benefitting from stay-at-home dynamics and able to generate new leads and conversion in its water treatment business. In its IFT segment, the company saw higher demand for its sump pumps, well pumps, and booster pumps due to the pandemic.

· The company is working to further refine its omni-channel residential treatment offerings enabled by the Aquion and Pelican acquisitions. Notably, the company is expanding its Pentair brand in new geographies such as Austin, Nashville, and Minneapolis/St. Paul. The company has the ability to solve customer’s water issues by zip code and is expanding its presence both organically and inorganically. Its acquisition of Rocean provided an additional exciting consumer product that filters, flavors and carbonates water from the tap.

· The pool business is expected to continue growing in 2021 as contractors work through their long backlogs that were unfilled due to labor constraints. There are 5.3 million installed pools in the US, with 80-100K new pools installed annually and 80-90% of revenue from replacement, making the underlying market grow mid-to-high single digits consistently. PNR continues to maintain its leading position in the pool market, where it introduced the variable speed drive pump. Whereas Pentair’s mix is roughly 60%, the industry penetration is an estimated 50%, which the company expects to increase to 80-85%, spurred by new DOE regulations in July 2021.

· The company’s benchmarking has shown a 150-200 bps margin deficit to peers arising from SG&A spending, which they intend to go after with their PIMS business system. The company expects to continue R&D at 2.5% of revenue.

Watts Water Technologies, Inc. (WTS - $119.11 - NYSE) Cautious on Non-Res

COMPANY OVERVIEW

Watts Water Technologies, headquartered in North Andover, MA, is a leading manufacturer of valves for the plumbing, heating and water quality markets. The company distributes through four primary distribution channels: wholesale (60%), original equipment manufacturers (15%), specialty (20%), and DIY (5%). Residential and commercial flow control products include backflow preventers, water pressure regulators, temperature and pressure relief valves, and thermostatic mixing valves. HVAC and gas products include high-efficiency boilers and water heaters, hydronic and electric heating systems for under-floor radiant applications, and flexible stainless steel connectors for natural and liquid propane gas in commercial food service and residential applications. Drainage and water re-use products include drainage products and engineered rain water harvesting solutions. Water quality products include point-of-use and point-of-entry water filtration, conditioning and scale prevention systems for both commercial and residential applications. Watts has a goal of 25% of its products being connected devices by 2023.

In 2020, Watts acquired Australian Valve Group, which specializes in heating control valves for the Australian market, and The Detection Group, which specializes in wireless leak detection systems for commercial buildings, for $15.2 million. Prior acquisitions include Backflow Direct, a designer and manufacturer of backflow prevention valves used primarily in fire protection applications for $43 million in 2019, AERCO, a manufacturer of commercial high-efficiency boilers and water heaters, for $272 million in 2014, and PVI Industries, a maker of high capacity stainless steel water heaters, for $79 million in 2016.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31stAnnual Pump, Valve and Water Systems Symposium:

· CEO Bob Pagano discussed the company’s markets and described what they expect to be a transitional year for the company. The non-residential construction market appears likely to decline in the second half of the year. While projects that were started are being finished, indicators such as the Dodge and ABI portend a softening starting mid-year. Higher vaccination rates could have a positive impact as projects in multi-family housing, lodging, and restaurants are not being developed at present. The company is seeing the slowdown within its own operations, as drains, typically a leading indicator, have been down high single-digits and conversations with contractors and tradespeople indicate a cautious environment.

· Nevertheless, Watts maintains an attractive mix, with nearly 2/3 of business in the Americas and 60% of sales mix for repair and retrofit markets, providing underlying stability and steady cash flow. Additionally, in 2020 the company’s residential products benefitted from work-from-home dynamics and residential housing spend, which is expected to continue. For 2021, Watts expects revenue to decline 0-5% (Americas -5% to flat, Europe -5% to flat, APMEA +2-6%), and operating margins to contract by 50-90 bps. The company’s cost-cutting efforts in 2020 yielded $15 million in structural savings (out of $55 million total).

· Watts continues on its path to achieving 25% of its revenue from connected products by 2023, and achieved mid-teens percentage in 2020 despite the pandemic. With over 70,000 connected devices to date, the company is dedicating significant resources and has over 85 people in its organization working exclusively on digital. Management noted the product development pipeline is significant, with the aim to deliver value not just to installers but to maintenance organizations as well. Globally, Watts continues to pursue markets that tend to be specified or driven by regulations, such as the case with AVG. WTS provides products for energy efficiency in buildings with its condensing boilers and water heater offerings, and with technology-driven controls.

Xylem Inc. (XYL - $100.01 - NYSE) Smart Water Thought Leader

COMPANY OVERVIEW

Xylem, Inc., based in Rye Brook, NY, is a global leader in the design, manufacturing and application of highly engineered technologies for the transportation, treatment and testing of water. XYL is the world’s largest wastewater pump producer, and water utilities account for roughly $2.7 billion (55%) of the company’s revenue base.

With $2.1 billion of revenue, the Water Infrastructure segment produces pump systems and solutions that transport water and wastewater from aquifers, lakes, rivers and seas; ultraviolet and ozone water treatment applications and control systems. With $1.4 billion of revenue, the Applied Water segment primarily provides water pressure boosting systems for HVAC and fire protection systems for residential and commercial applications; pumps, heat exchangers, valves and controls for power, food, and industrial applications; and components for irrigation applications. Xylem generates more than 85% of its Applied Water sales through distributor relationships.

The $1.4 billion Measurement & Control Solutions segment was created when Xylem acquired Sensus in October 2016 for $1.7 billion. Sensus is a leading manufacturer of smart meters and smart network technologies for water, electric and gas applications, with an installed base of over 80 million meters globally and approximately 18% share of the North American water metering market. Other products that have been acquired for this segment include analytical instrumentation used to measure water quality, flow and levels such as Pure Technologies, EmNet, Visenti, and HYPACK.

HIGHLIGHTS

The following are key takeaways from the company’s presentation at the Gabelli Funds 31stAnnual Pump, Valve and Water Systems Symposium:

· Senior Vice President and Chief Marketing Officer Joe Vesey and Senior Director of Investor Relations Matt Latino provided a roadmap of where the water category leader saw success in 2020, a year in which organic revenue declined 6.9%, and how it is expecting an improved backdrop and performance going forward.

· While 2020 was a tough year, Xylem had notable wins for its technology businesses, including in Columbus, OH, in which Xylem was able to win a multi-utility contract due to its offerings for both water and energy, and in Winston-Salem, where the company deployed a Network-as-a-System model in order to deliver critical infrastructure to the client.

· The acquisition of Sensus was a catalyst for selling products at a higher level, as the AMI metering systems are an integral part of utilities’ revenue model. Considering the large scope and capabilities of its suite of products, Xylem has firmly planted itself in a consultative role that gives customers options to achieve the outcomes they want with varied solutions. Notably, the company has embarked on a journey to drive higher Net Promoter Scores throughout the organization.

· In its Water Infrastructure business, Xylem experienced a pickup in activity in the back-half of 2020, and while some have shifted further into the future, none have been cancelled. Overall, Xylem expects to generate low-to-mid single-digit growth in its utilities end markets in 2021, with wastewater demand seeing steady LSD growth and higher growth coming from metering deployments catching back up. Industrial (30% of revenue) is expected to be flat to up low single-digits.

· With a strong balance sheet, XYL is likely to do additional tuck-in acquisitions. The primary objectives in these deals will continue to be to drive the core franchises as well as to further drive the company’s digitization efforts.

We Tony Bancroft, Justin Bergner, CFA, Jose Garza and Brett Kearney, CFA the Research Analysts who prepared this report, hereby certify that the views expressed in this report accurately reflect the analyst’s personal views about the subject companies and their securities. The Research Analysts have not been, are not, and will not be receiving direct or indirect compensation for expressing the specific recommendation or view in this report.