Follow Us x

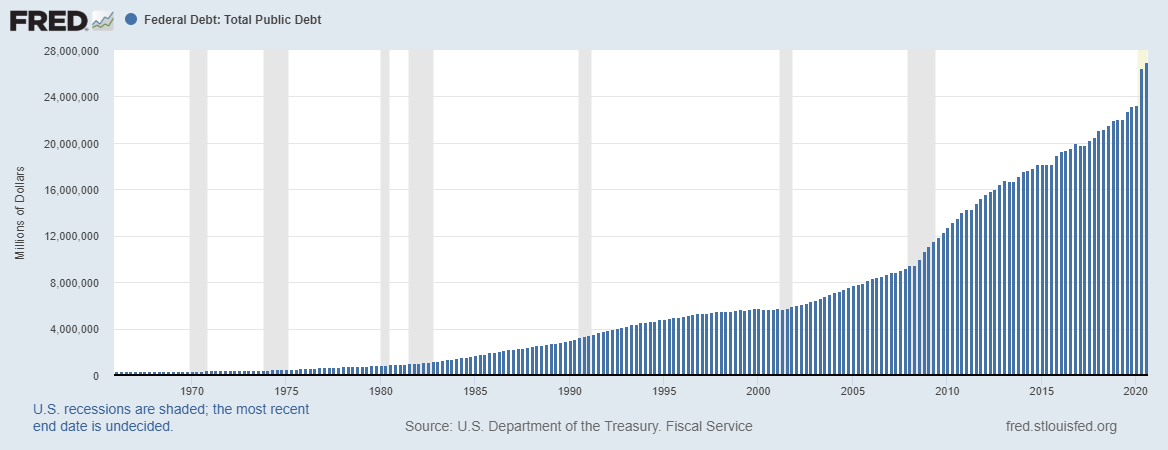

"US Federal Debt has been steadily increasing over time..."

OVERVIEW

In reaction to the global pandemic crisis, there has been an unprecedented coordinated monetary and fiscal policy by US Government Agencies. On March 11th, the “American Rescue Plan Act of 2021” was approved and provided an additional $1.9 trillion fiscal stimulus plan. That is a significant amount of money relative to the US GDP base of approximately $22 trillion. How does the United States government actually pay for this spending? What are the implications long-term to the monetary base, inflation expectations and interest rates?

“The US government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many US dollars as it wishes at essentially no cost. By increasing the number of US dollars in circulation, or even by credibly threatening to do so, the US government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.” -Ben Bernanke 2002

Points to Ponder

- In little more than a year, the United States government has provided combined fiscal stimulus plans exceeding $5.1 trillion ($2.3 trillion Coronavirus Aid, Relief and Economic Security Act – 3/6/2020; $900 billion Stimulus and Relief Bill – 12/27/2020; and $1.9 trillion American Rescue Plan Act – 3/11/2021)

- Of all dollars existing, approximately one-fifth were created in 2020, based on Federal Reserve M2 data.

- Currency in circulation rose by $300 billion (17% y/y) over the $1.8 trillion as of 2/20’.

The Role of the Federal Reserve and US Treasury

The Federal Reserve and US Treasury have separate roles, although both institutions are aligned in goals to ensure economic security. The central bank uses tools to set monetary policy, while the government sets fiscal policy.

Federal Reserve, Chairman Jerome Powell

- Monetary policy operations including buying and selling securities are made to fulfill legal obligations under its mandate of maximum employment, stable prices, and “moderate long-term interest rates.”

- The Fed purchases securities held by the public and not directly from the Treasury.

- Other primary tools include adjusting the federal funds rate (bank rate for borrowing funds overnight).

US Treasury, Secretary Janet Yellen (and former Head of the Federal Reserve)

- Operates critical accounting functions for the government.

- Responsible for collecting taxes, and paying US bills.

- Oversees Treasury issuance to fund deficits.

US Treasury Markets

If the government runs a deficit, the US Treasury must borrow capital through the issuance of securities sold to the public. It cannot simply print money. The Federal Reserve, through open market operations, will buy and sell securities from the public, which has an impact on interest rates and money supply used to pay for the purchases. The public markets act as the middleman essentially between the agencies. The Federal Reserve generates income through interest on its ownership of treasury and other securities, which is returned to the Treasury.

Deficit Spending

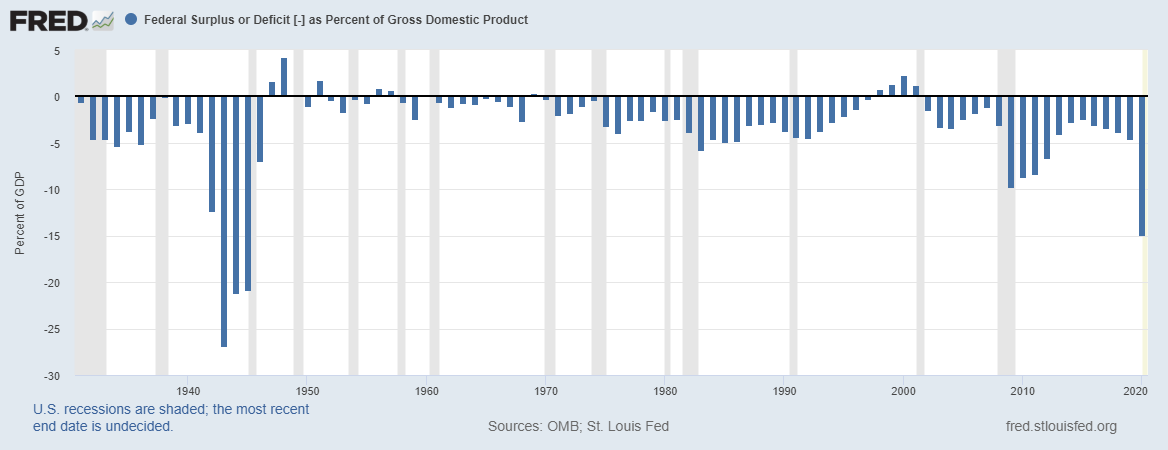

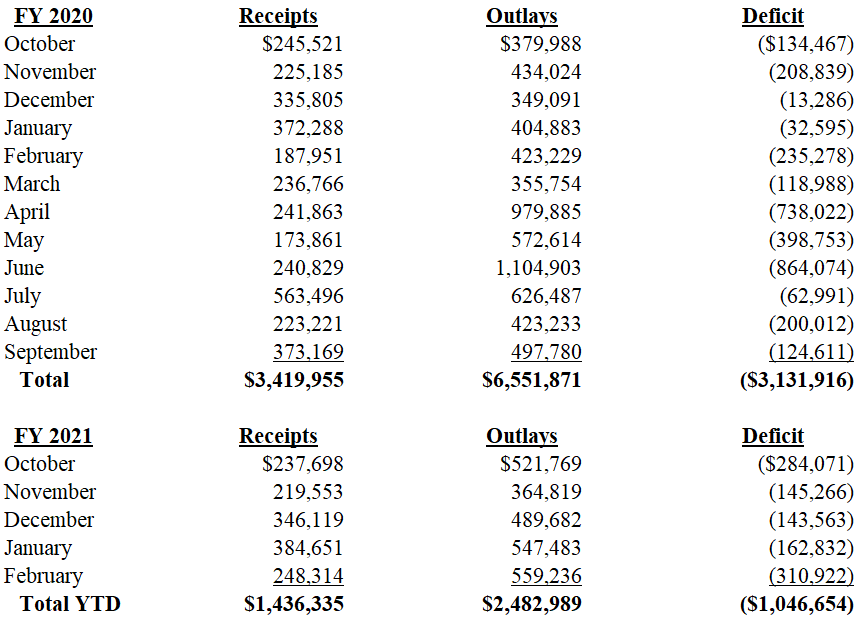

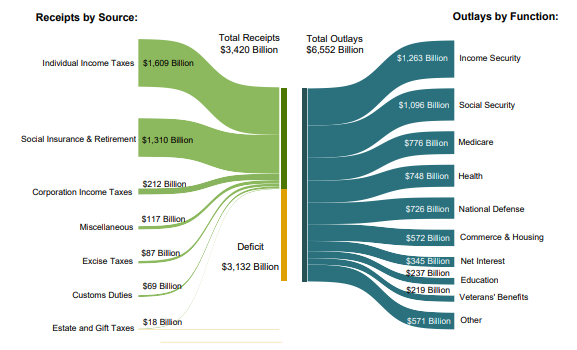

For almost the entire country’s existence, the Federal Government has generated deficits. The scale of annual deficits became more pronounced during the financial crisis. More generally though, the percent of deficit relative to GDP has been under 5% (Exhibit 2) except for the periods during WWII, the financial crisis, and now the global pandemic. Deficit spending is financed mainly by issuance of US Treasury Securities to many entities including foreign governments, US corporations, state and local governments, private pension funds, insurance companies and individuals. In FY 2020 (October to September 2020), the US generated a deficit of $3.1 trillion and through February the total for FY 2021 is $1.0 trillion. Total outlays in FY 2020 were $6.6 trillion (Exhibit 3) with Income Security (government retirement programs, unemployment compensation, housing assistance and other) the highest at $1.3 trillion.

Exhibit 1 US Historic Deficits (1931 – Sept. 2020)

Source: St. Louis Fed.

Exhibit 2 US Deficit as a % of GDP (1931 – 2020)

Source: St. Louis Fed.

Table 1 Summary of Receipts, Outlays, and Deficit (FY 2020, 2021)

($, millions)

Source: US Treasury.

Exhibit 3 Cumulative Receipts, Outlays and Deficit FY 2020

Source: US Treasury.

Debt Accumulation

The US Federal Debt has been steadily increasing over time due to the deficit spending. At the end of July 2020, total Public Debt as measured by the Federal Reserve Bank of St. Louis was approximately $27 trillion vs. $12.3 trillion at the end of 2009 and $23.2 trillion before the pandemic started.

Exhibit 4 US Debt (1966 – July 2020)

Source: St. Louis Fed.

The “CARES Act” and convergence of Fed and Treasury Operations

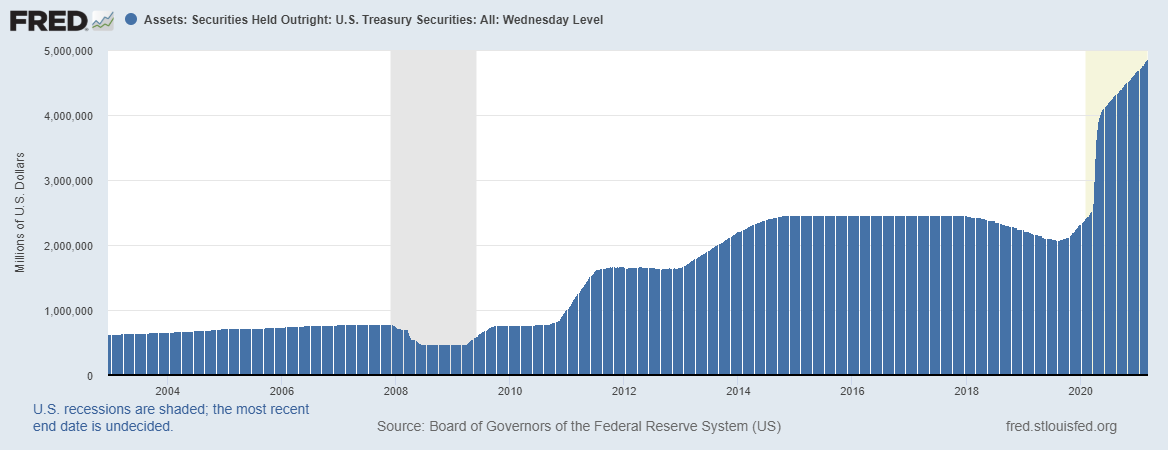

Historically, the Federal Reserve and US Treasury were meant to operate independently. With the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) (March 2020, $2.3 trillion economic stimulus), the institutions came together – the government committed to increase spending and paid for it with debt issuance, which the Federal Reserve committed to buying through open market purchases. At the end of March, total assets were $7.6 trillion and up from ~$4 trillion at the start of the pandemic. And of that balance, US Treasuries represented $4.9 trillion of assets, an increase of $2.3 trillion since March 2020.

Exhibit 5 Federal Reserve Balance Sheet (2002 – March 2021)

Source: St. Louis Fed.

New Stimulus Plan, Infrastructure Plan

Under the Biden administration, the new $1.9 trillion stimulus plan was just approved. Similar to the previous CARES Act, new Treasury issuance will have to be absorbed. In the past, foreign governments have made up a significant component of the demand for US Treasuries. According to Statista, Japan was the largest foreign holder of US Treasuries at $1.3 trillion, followed by China ($1.1 trillion) and the UK ($440 billion). However, given the significance of the program, the Federal Reserve will need to anchor the buying with a further increase in its balance sheet.

Exhibit 6 US Treasury Ownership (2002 – March 2021)

Source: St. Louis Fed.

Table 2 US Treasury Foreign Government Ownership (Dec 2020)

($, trillions)

Source: Statista.

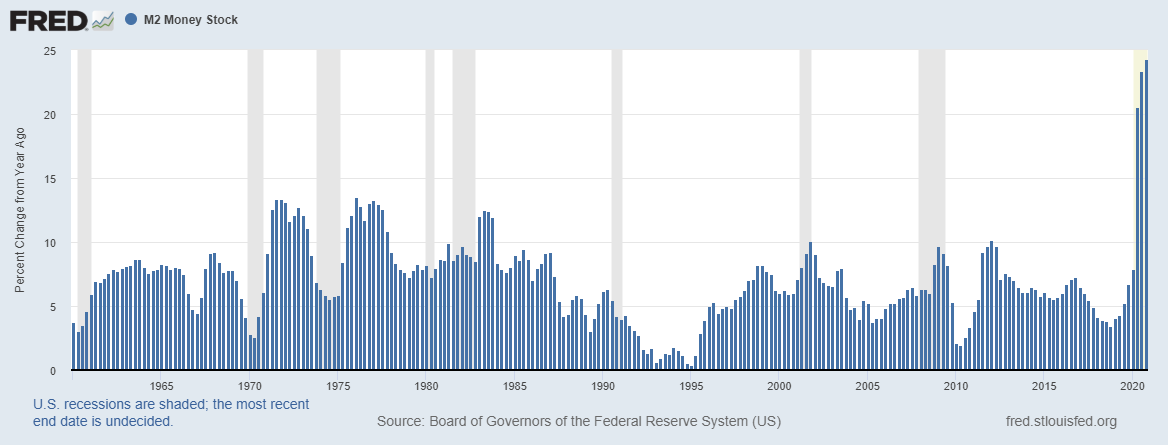

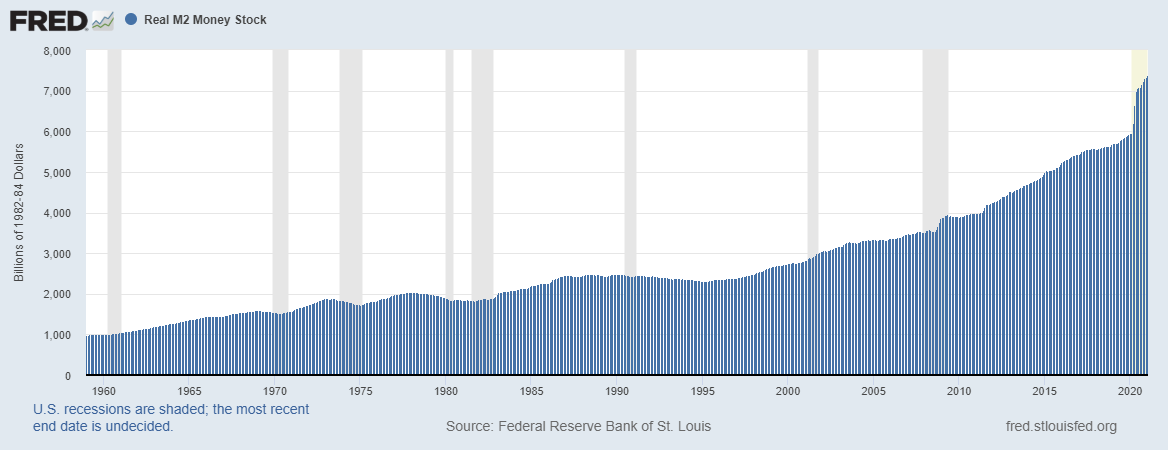

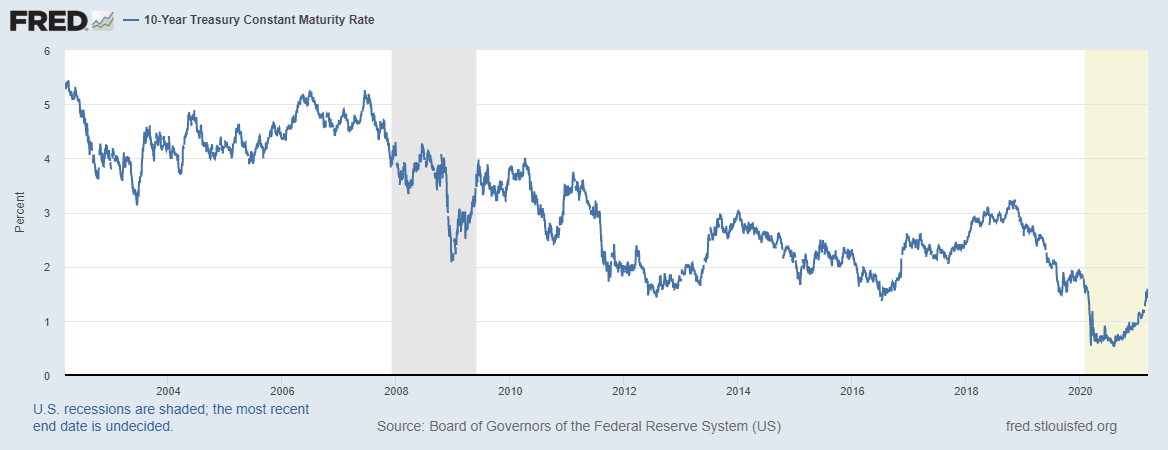

Implications for Inflation

Since the early ‘90s, inflation, as measured by the Consumer Price Index (“CPI”), has been relatively stable fluctuating between 0-3%. However, mainly due to the large stimulus plans there has been a significant increase in M2 (short-term deposits) as the money has flowed to individuals and businesses. That capital can then be used for consumption, later on, leading potentially to higher inflation rates. After reaching low yields (~50bps) in summer 2020, the 10-year Treasury has risen to 1.7%.

Exhibit 7 CPI (1962 – Feb. 2021)

Source: St. Louis Fed.

Exhibit 8 % Change M2 (1960 – Oct. 2020)

Source: St. Louis Fed.

Exhibit 9 Total M2 (1960 – Dec. 2020)

Source: St. Louis Fed.

Recent comments from the Federal Reserve

- Remains committed to a dual mandate of full employment and stable prices.

- Redefined stable prices as 2% inflation over the long term. Given that inflation has recently been running below this target, do not expect any preemptive monetary moves off of zero Fed Funds rate until the data confirms that the long-term targeted level has been achieved.

- Currently not overly concerned about the steepness of the yield curve.

Exhibit 10 10-Year Treasury Rate (2002 – March 2021)

Source: St. Louis Fed.

Conclusion:

Due to the significant actions of the Federal Reserve and US Treasury, the economy is in unprecedented territory. For the first time in many decades, there is a threat of inflation and the potential for higher interest rates. In the short term, the economy will benefit from this large infusion into the money supply, but at what expense in the future.