Follow Us x

Is a bubble in the NFT market forming?

Introduction

Non-Fungible Tokens (NFTs) have experienced massive growth recently, making apparent millionaires in the process, amid a speculative frenzy akin to the 1600’s Tulip-mania. In light of the recent headlines, we present a brief primer on the NFT market, highlighting some background on NFTs and current uses of the technology.

Non-Fungible Tokens are in the most basic form a unique digital asset. This compares to digital assets like Bitcoin and other cryptocurrencies, which are fungible. NFTs can be one of a kind, like a specific piece of rare artwork, or one of many, like trading cards. Like cryptocurrency, NFTs use blockchain technology that stores information about the asset and related transactions on the internet in a distributed ledger system. This underlying technology allows information to be simultaneously accessed, validated and recorded across a network in an immutable way. The first NFTs were developed around 2012, but became mainstream in 2017 with the rise of CryptoKitties, a game that allows you to breed and adopt digital kittens. Since then, the use of the technology has broadened, with corporations like Taco Bell getting involved (yes, you can buy a digital taco).

Exhibit 1 Cryptokitties

Source: cryptokitties.co

NFTs are created through a process called minting, where they are uploaded to an NFT marketplace and registered into the blockchain. They can use different blockchain networks, but the primary network at this time is Ethereum. Within Ethereum, NFTs use a different standard than cryptocurrencies. This standard is called ERC-721. What the blockchain effectively does is put a barcode on whatever asset is being formed by the NFT. This denotes this version of the digital asset as authentic, even though it may still be able to be replicated. Digital artists can build royalties into the NFT itself, so they can continue to monetize it beyond the initial sale of the NFT. While you will see prices discussed in terms of dollars, NFTs are generally purchased with a cryptocurrency like Ether (Ethereum’s currency). An objective of NFTs is to cut out the middleman and allow creators to reap more of the value from a sale of their work.

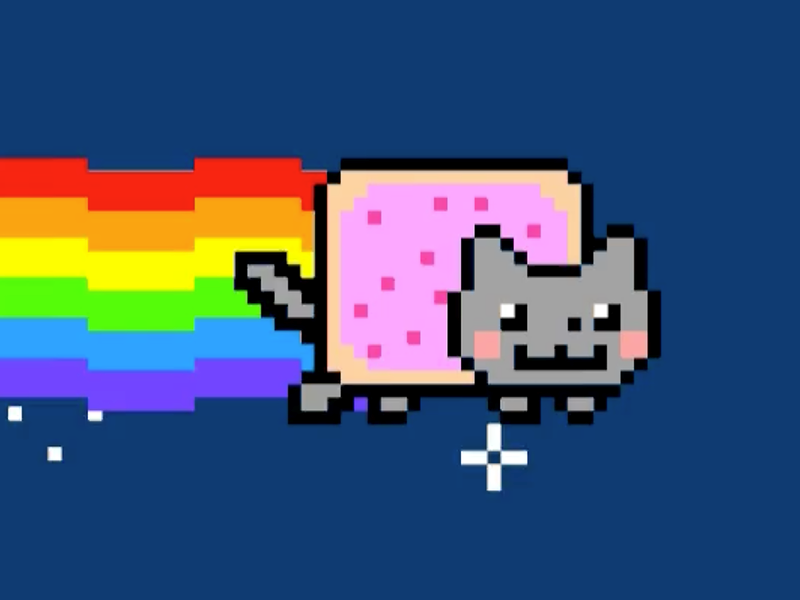

Exhibit 2 Nyan Cat, A $600,000 Meme

Source: npr.org

NFTs in 2021

NFTs have gained a lot of attention in 2021, as money has flowed into a variety of new asset classes, and have experienced explosive growth. In February, there was over $340 million in NFT trading volume, up from just $12 million in December 2020. There are dozens of platforms popping up to offer NFTs across a range of digital media. The musician Grimes sold $6 million worth of art on the NFT platform Nifty Gateway. The band Kings of Leon released a new album in the form of an NFT, with purchasers able to access perks like front row seats or vinyl records. An internet meme from 2011 of a cartoon Pop-Tart cat called “Nyan Cat” was turned into an NFT and sold for $590,000. More recently, a piece of NFT digital art sold for nearly $70 million (more on that below). This frenzy has caused many observers to wonder if a bubble in the NFT market is forming.

Notable NFT Platforms

NBA Top Shot

NBA Top Shot was launched in 2019 to allow NBA fans to buy/claim their favorite basketball highlights, called Moments, which are licensed from the NBA. The platform has already grossed more than $230 million in sales, and is operated by Dapper Labs, the same company behind CryptoKitties. Like traditional trading cards, they can be bought in packs or traded on their own, and some are rarer than others. Recently, a Lebron James Moment sold for over $200,000. All of the transactions are done on the Top Shots platform, and the NBA and Dapper Labs each get a cut of all transactions that occur.

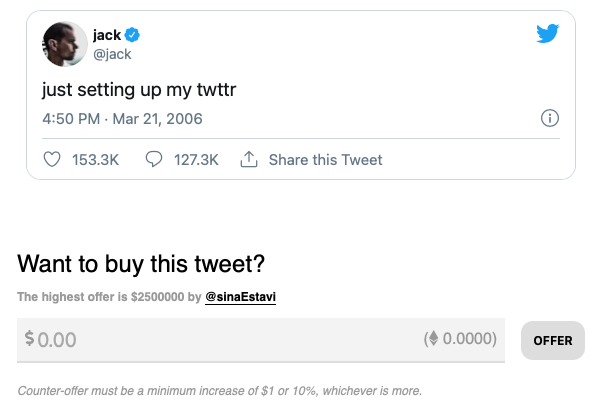

Exhibit 3 Jack Dorsey’s First Tweet Listed For Sale

Source: v.cent.co

However, just because you own the Moment on Top Shots, it does not mean you control the moment more broadly. Your ownership only exists within the confines of the platform. Anyone can go on YouTube and watch the highlight for free. You do not own the copyright and are not able to monetize your ownership outside of Top Shot.

Valuables

Valuables is a platform that allows users to mint their tweets into an NFT on blockchain. They are then able to be auctioned and resold or displayed in an online gallery on Valuables. Like NBA Top Shot, you only own the tweet within the Valuables Platform. The tweet will continue to appear on Twitter, and the original Twitter user can delete the tweet if they choose. Twitter co-founder Jack Dorsey is currently selling his first ever tweet on the platform, and the current bid is $2.5 million.

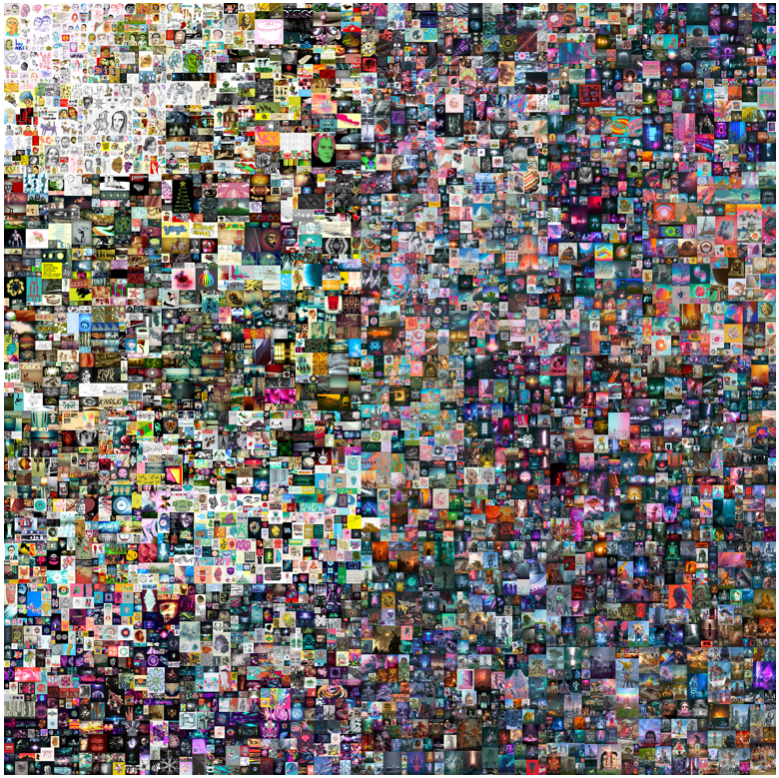

Exhibit 4 Beeple’s $69M NFT

Source: Christies.com

Nifty Gateway

Nifty Gateway is a platform for artists to sell digital art with NFTs. A digital artist named Beeple has gained a lot of attention on this platform. Beeple started out making NFTs of his digital art and selling them on Nifty Gateway for $1. He built in a 10% royalty on all future sales of these NFTs. These NFTs soon were being sold for hundreds of thousands of dollars, and in one weekend he made $3.2 million from NFT royalties alone on Nifty Gateway.

Christie’s auctioned off a Beeple NFT this week. The work, called Everydays: The First 5000 Days, is a collage of 5,000 images that Beeple published every day on social media. Christie’s held the auction as a trial for its first digital art sale. The bidding started at $100, and when the auction gaveled, the NFT was worth more than $69 million. For that sum, the winning bidder gets the code for the blockchain put into their crypto wallet and a high resolution digital file of the image.

Downsides to NFTs

Ownership. As previously discussed, many of these NFTs only allow you to own the asset within the platform. You do not gain copyright, trademark or other true ownership rights. Also, there is no system in place to ensure that the creator of an asset has control over it. For example, someone could steal a creator’s artwork, create an NFT and sell it. Already, NFTs have been created to mimic artwork by the artist Banksy, and have sold for more than $900,000 to unwitting buyers.

Fees. The most popular NFT blockchain network Ethereum charges fees called “gas.” This represents the cost of the computations needed to process the transaction. This price can fluctuate, and in the past has spiked to the hundreds of dollars, which can be significant for a low priced NFT. However, there are marketplaces that are offering “gas-free” NFT creation.

ESG. Like Bitcoin, NFTs require a lot of energy to produce. Some estimates peg the amount of energy used per Ethereum blockchain transaction at 48 kWh, or more energy than a US household uses in one day. Ethereum has plans to reduce the energy consumption of the technology, but it has still garnered significant criticism.

Conclusion

Will NFTs have staying power, or will they be a passing fad? It is still very early days in these emerging new digital marketplaces, and it is easy to dismiss some of the sillier applications of the technology. Also, the prices seem to have gotten out of control. Beeple himself said this week that there is a bubble in NFTs, and that was before one of his works went for near $70 million. However, our view is that while there are pockets of speculation and inflated valuations in the current NFT markets, the underlying technology may be enduring.

While in the midst of a speculative frenzy, ala Tulip-mania, we think there could be long-term value in the underlying technology and will continue to monitor as it emerges. As we move into a world increasingly populated by digital natives, the ability to track and monetize digital assets will continue to grow. Someone born when the iPhone debuted is almost 13 years old and the iPad has been around for over ten years. The generations that grew up on these devices see the world differently, and are willing to spend money on digital assets in a way previously hard to imagine. Evidence of this can be seen in the monetization of digital assets in apps like Roblox and Fortnite. According to Sensor Tower, nearly $111 billion was spent on mobile apps in 2020, up 30% from 2019. While there is limited specific spending data on digital assets, NFTs are clearly tapping into a large market within digital payments.

We expect NFT platforms to continue to mature and evolve. There are a lot of questions to be answered and issues to be resolved. Eventually, these platforms will allow for better integration and portability of digital assets between platforms. Beyond art, we think that there are countless use cases that this could apply. For example, things like concert tickets, video games, academic credentials, and supply chains could use NFTs to authenticate unique assets in a digital world. We anticipate that brands may continue to use NFTs to promote and monetize their products in new ways. NFTs could become more present in our lives than we could ever imagine.