Follow Us x

By Jennie Tsai

March 29, 2021

Updates on the largest manufacturers in the global orthopedic market

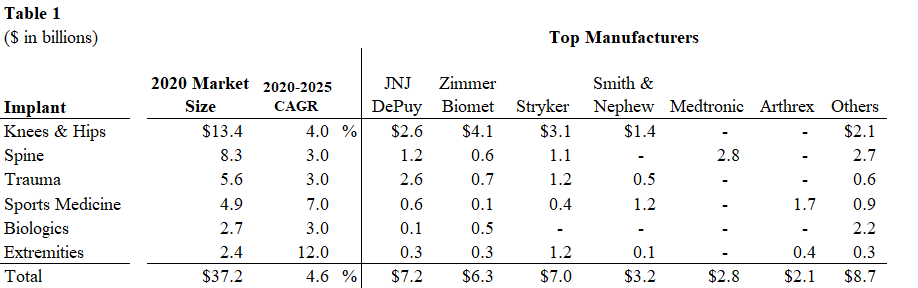

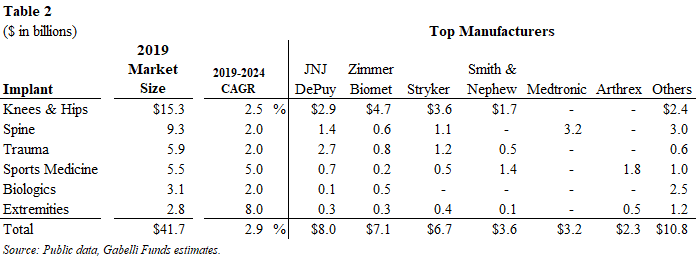

The worldwide orthopedic market was $50.0 billion in 2019 with orthopedic implants accounting for $41.7 billion and instruments and equipment representing the remaining $8.3 billion. In 2020, orthopedic implants declined 11% to $37.2 billion from $41.7 billion due to COVID impacts and restrictions on hospitals’ elective surgeries. We project the market will return to 2019 revenue levels in 2021 along with additional 0-2% growth depending on lingering COVID impacts. Beyond 2021, we project growth of 2-3% annually over the next several years, absent any unforeseen catastrophic events, as mid-single digit growth in procedures is offset by low-single digit price declines.

In this report, we include 2020 revenue from the major manufacturers along with 2019 revenue as it represents a “normal” year with no restrictions on elective surgeries and procedures by hospitals and other healthcare facilities.

We list the largest manufacturers in the global orthopedic market below:

Source: Zimmer Biomet, Medtronic, Stryker.

2020: Notable Events and Trends

As 2020 was an unprecedented year for the healthcare sector, we highlight some events and trends specific to the orthopedic sector:

· In March 2020, various government agencies and medical societies issued recommendations to postpone or cancel elective surgeries and procedures to preserve PPE and free up hospital bed capacity and other healthcare resources to deal with COVID-19 during the height of the pandemic.

· By late May 2020, most state agencies and medical societies recommended resumption of elective surgeries with safety procedures in place at healthcare facilities and COVID testing.

· Some simpler, less complex procedures are shifting more to the hospital outpatient setting or ambulatory surgical centers (ASCs), and about 5-10% of joint replacement surgeries are currently performed at ASC settings; COVID-19 has accelerated this shift of from hospitals to less acute care settings.

· Robotic systems for joint replacement surgeries were in good demand throughout 2020 despite COVID impacts; Robotic system adoption for orthopedics is still in the early innings with approximately 15% of operating rooms having access to a robot; in 2020, many hospitals that purchase robotic systems used various financing options to preserve cash during the height of the pandemic.

· Within orthopedics, there were no sizable announced M&A transactions in 2020; we expect more transactions in 2021 as companies have firmed up balance sheets and resume active product portfolio management.

· Within orthopedics, the only segment that did not experience a double-digit decline was trauma. We estimate trauma declined by 5% in 2020 due to a reduction in general activity, travel and recreation with COVID restrictions.

· Orthopedic companies are investing in technology, software, robotics, storage and data informatics to enable “smart” implants and provide the surgeons with data and analysis to achieve better surgical outcomes for their patients.

· 2020 was a big year for adoption of telehealth, virtual education and training. Many companies adopted a hybrid approach to assist surgeons in the operating room, given that, in some instances, sales reps were not allowed to be in the hospitals at specific times.

Market Share

2020 was a challenging year for medical companies, including orthopedic companies, due to COVID-19. Most companies pivoted quickly to digital technologies and solutions to navigate through uncertainty, sustain its business and stabilize its revenue. There were a few companies that performed well amid numerous challenges and gained market share. We believe 2020 was a difficult year to decipher market share gains and losses for individual companies. Comparing the sales decline of various companies does not factor in nuances with geographic exposure, especially international markets, and product portfolio composition differences. We believe that, given the negative impact COVID had on procedures and surgeries, companies that generated organic revenue growth or whose revenue declined slightly in 2020 gained market share. We highlight some companies that increased their market share in 2020.

· Globus Medical (#5 in spine) - Grew market share in the spine market in 2020 as revenue grew 0.5% to $789 million; its US spine business led the growth due to new product launches, competitive reps recruiting and robotic system implant pull through; management executed well given COVID challenges

· Alphatec (small spine co.) – Grew market share in the spine market as revenue increased 28% to $145 million due to new product launches and improving its sales distribution channel.

· SeaSpine (small spine co.) – Grew market share in the spine market as revenue declined 3% to $154 million, much better than the overall spine market decline of 11%; SeaSpine launched numerous new products to broaden its product portfolio and expanded its distribution partners.

· SiBone (niche orthopedic co.) – Grew market share as revenue grew 9% to $73 million due to superior sales execution, successful virtual surgeon training and improving reimbursement coverage.

· Orthopediatrics (pediatric co) – Revenue declined 2% to $71 million due to new product launches

Despite some market share gains by some smaller companies, market share did not materially change in 2020 as most large orthopedic companies experienced similar revenue percentage declines in the specific orthopedic categories. In general, market share shifts move gradually in the orthopedic market. We layout specific segments within the orthopedic market and market share positions as follows:

Knee and Hip Market

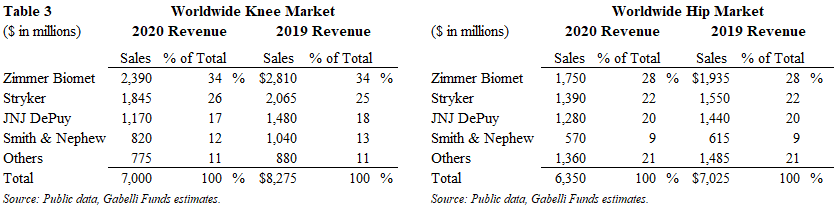

The 2020 worldwide knee and hip market generated $13.4 billion in sales and declined 13% from 2019 levels. The knee and hip implant markets were $7.0 billion and $6.4 billion, respectively, with knee implants down 15% and hip implants down 10%. Management at a large orthopedic company noted that knee implant procedures can be delayed more so than a hip implant procedure. Nonetheless, we expect both the knee and hips market to return to normal levels in 2021, assuming minimal impact from COVID. In 2020, price was a 2% decline, similar to historical levels.

The top-four companies dominate these two segments with approximately 80%+ share. In the knee market, Zimmer Biomet, Stryker and JNJ DePuy are the top-three market leaders with a 34%, 26% and 17% share, respectively, followed by Smith & Nephew with 12% share. In the hip market, Zimmer Biomet, Stryker and JNJ DePuy are the top-three market leaders with a 28%, 22% and 20% share, respectively, followed by Smith & Nephew with 9% share.

There is speculation that Smith & Nephew may be acquired as it is the largest remaining knee/hip asset available, although Smith & Nephew has also been acquiring smaller companies and assets.

Knees and Hips – Robotic Systems

The biggest trend in the knee and hip implant market is the rollout of robotic assisted surgery systems by all the major manufacturers.

· In late 2013, Stryker had the first mover advantage when it acquired MAKO Surgical and has approximately 1,000 systems installed worldwide at year-end 2020. Stryker’s MAKO system is also approved for Total hip applications in addition to Total knee and Partial knee.

· In 2016, Smith & Nephew acquired Blue Belt and launched the Navio system for knee arthroplasties. In mid-2020, Smith & Nephew launched its CORI surgical system, a handheld robotic solution, for its knee implants.

· In 2019, Zimmer Biomet launched its ROSA knee system for robotic-assisted knee replacement surgeries. We estimate there are more than 300 systems placed at end of 2020. Zimmer expects ROSA FDA approval for its partial knee and total hip application by year-end 2021.

· In early 2021, JNJ DePuy Synthes received FDA approval for its VELYS robotic system for its ATTUNE TOTAL knee system.

With the four large manufacturers having robotic assisted-surgery system offerings, the adoption of robotic for joint replacement surgeries will continue for the foreseeable future given that approximately 15% of operating rooms have access to a robotic system.

Spine

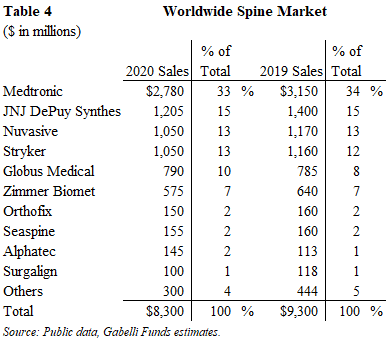

The 2020 worldwide spine market generated $8.3 billion of sales and declined 11% from 2019 levels. The top four spine companies all reported revenue decline in the range of 9.5%-14.0%. Globus Medical (#5 market share position) grew slightly in 2020, which is a testament to its new product launches, product portfolio and sales execution.

Beyond 2020, we expect the spine market to grow at a 3% CAGR over the next few years with 2021 catching back up to 2019 levels. In the US, mid-single digit growth in procedures has been offset by low to mid-single digit price declines.

This segment is dominated by two large companies, Medtronic and JNJ DePuy, with a combined market share close to 50%. Beyond Medtronic and JNJ, the spine market is relatively fragmented with many companies having 13% market share or less. We believe this market will continue to consolidate over the next few years.

The robotic trend is also happening in the spine market with Medtronic’s Mazor system and Globus Medical’s Excelsius system. Zimmer’s ROSA system is approved for spine use, but management has not been focused on its spine division. NuVasive expects to launch its Pulse navigation system in 2021 with robotic capabilities available soon after. Other companies are also working to bring their spine applications to market.

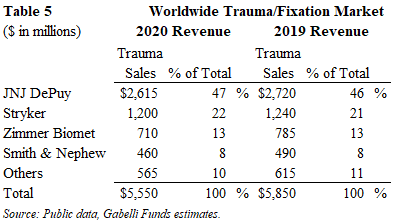

Trauma/Fixation

The 2020 worldwide trauma market generated $5.6 billion of sales and declined 5% from 2019 levels. This segment is driven by traffic accidents, violence, falls and other accidents. Unlike other orthopedic segments, the trauma market is not necessarily associated with aging demographics and its procedures are not necessarily elective, and often require immediate care.

Although this segment was the least impacted by COVID restrictions, its volume was down due to a reduction in general activity, travel and recreation with COVID restrictions.

This segment is dominated by JNJ DePuy which acquired Synthes in June 2012 for $19.7 billion. As a result of this acquisition, JNJ has a 45%+ market share of the worldwide trauma market. Stryker has emerged as a solid number 2 company in the trauma market over the past few years via small tuck-in acquisitions and new product introductions.

Over the past few years, the trauma market has slowed to low-single digit growth. Volume and mix are the main drivers of growth offset by pricing pressure. We expect the trauma market to grow at a 3% CAGR over the next several years.

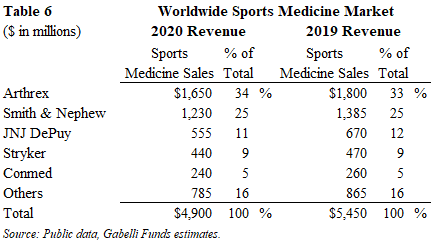

Sports Medicine

The 2020 worldwide sports medicine market generated $4.9 billion of sales and declined 10% from 2019 levels. This segment is driven by injuries related to sports and exercise. Given that many sports activities were suspended due to COVID, these procedures will return to pre-pandemic levels as team sports resume globally. Some companies declined less than 10% as their products were geared toward the ambulatory surgical centers (ASCs) and away from the hospital setting.

The market share leader is privately-held Arthrex with an estimated 34% share, followed by Smith & Nephew at 25%, which includes its May 2014 acquisition of Arthrocare. JNJ DePuy and Stryker have the #3 and #4 market share positions with 11% and 9% share, respectively.

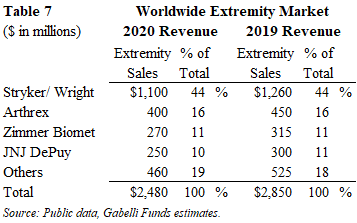

Extremities

The 2020 worldwide extremities market generated $2.5 billion of sales and declined 13% from 2019 levels. These procedures were negatively impacted by COVID. Excluding the COVID impact, we estimate the global extremity market would have been close to $3 billion in 2020 and expect a return to this level in the near-term.

This segment is experiencing the fastest growth due to new product innovations that are allowing surgeons to treat conditions that were previously often untreatable. This market is typically segmented into upper extremity (shoulder, elbow, hand and lower extremity (foot and ankle) as orthopedic surgeons treat the former and podiatrists and orthopedic surgeons treat the latter. Both large and small orthopedic companies compete effectively in this segment, whose growth is largely driven by innovation.

In November 2020, Stryker completed its acquisition of Wright Medical, becoming the #1 market share leader at 44% share. The remainder of this segment is relatively fragmented since innovation drives adoption and an innovative product line can drive sales growth for a new entrant.

We expect the global extremities market to grow at in the high-single digits CAGR over the next few years once it returns to a pre-pandemic levels. This market will be driven by new product innovation, which expands the market opportunity as more patients are able to get treated.

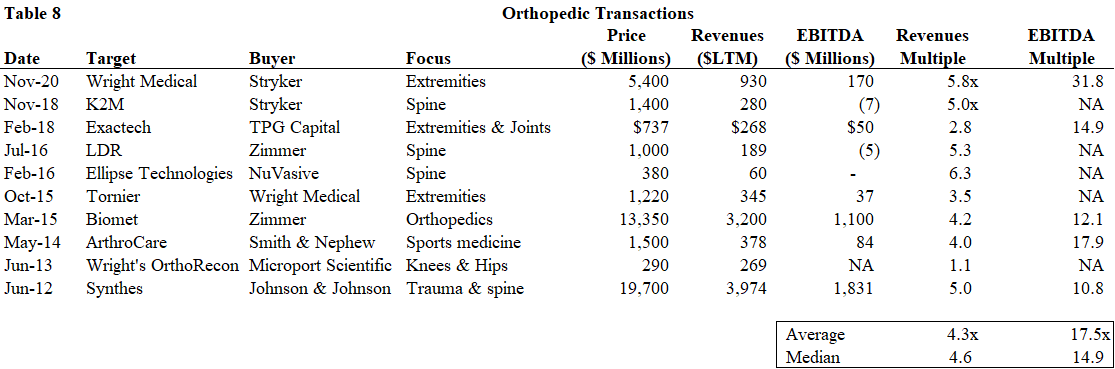

Consolidation in the Orthopedic Market

There is ongoing consolidation in the orthopedic market as scale and breadth of product portfolio matters. Additionally, there has been ongoing consolidation among hospitals due to economic pressure, thus resulting in aggregating purchasing decisions, limiting suppliers and lower price. As hospitals work with a limited number of orthopedic manufacturers, they prefer manufacturers with broad product portfolios and diversified product lines. In 2020, there were a few small, tuck-in acquisitions, but no announced deals valued at more than $500 million. Due to the COVID uncertainty on their businesses, many companies were cautious about their balance sheets and wanted to maintain financial liquidity during the COVID uncertainty.

We list the major orthopedic transactions since 2012 below. There are numerous other transactions of smaller, tuck-in product lines of small, private companies that are not listed. In general, the median revenue multiple paid is approximately 4.6x. For companies generating earnings, the median EBITDA multiple paid is approximately 15x. Products that are highly differentiated and/or growing at above market growth rates tend to command higher multiples.

Source: Public data, Gabelli Funds estimates

Stryker has been very active in the past few years, acquiring companies in orthopedics to round out its product portfolio and gain scale with recent acquisitions such as K2M in November 2018 and Wright Medical in November 2020. Further consolidation is expected over the next few years as large companies continue to fill in gaps in their product portfolios. We expect fragmented markets such as the spine market, the sports medicine market and the extremities market to consolidate driven by strategic M&A, as the acquiring company can realize revenue and expense synergies as it expands its product portfolio and service offerings.

Summary

We highlight orthopedic companies that could participate in ongoing consolidation trend, either as acquirers or targets, on the following pages.

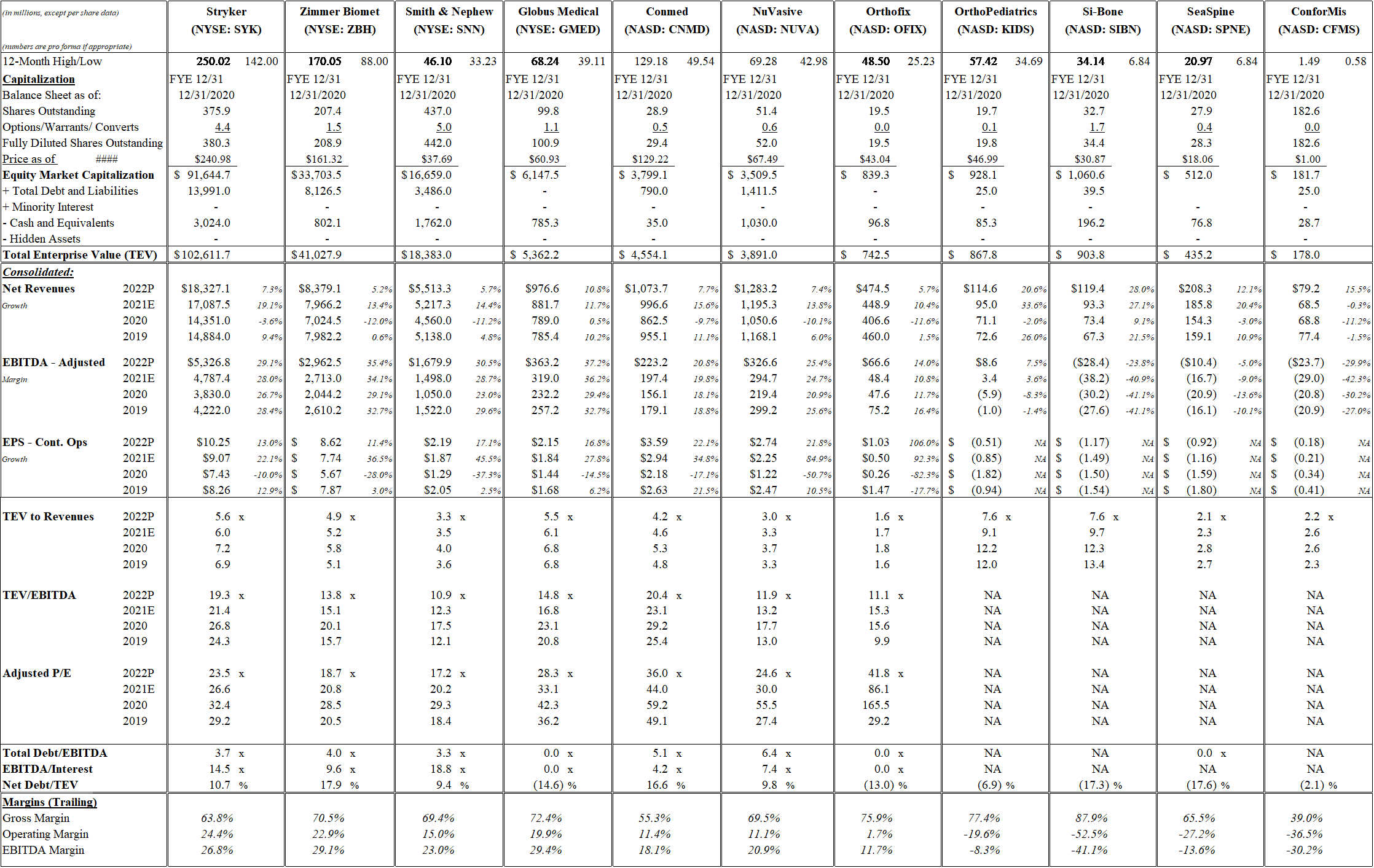

Table 9 Orthopedics Grid

Source: Public data, Thomson Reuters estimates.

Stryker Corp. (SYK - $240.98 - NYSE) Strategic Acquirer

Year

Revenue($Mils)

EPS

P/E

2023P

$19,600

$11.41

21.1x

Dividend: $2.52 Current Return: 1.05%

2022P

18,300

10.25

23.5

Shares O/S: 375.5 million

2021E

17,100

9.07

26.6

52-Week Range: $250.02 - $142.00

2020A

14,351

7.43

--

Source: Thomson Reuters consensus.

COMPANY OVERVIEW

Headquartered in Kalamazoo, MI, Stryker is one of the world’s leading medical technology companies with $14.4 billion of revenue in 2020. Approximately 42% of its revenue are from products in the orthopedic market where Stryker sells knee, hip, trauma, extremities and spine implants and related products, where it has leading market positions. Approximately 45% of revenue is in the MedSurg segment where Stryker sells instruments, endoscopes and medical beds/stretchers to hospitals. The remaining 13% of its revenue is from its neurotechnology segment. Approximately 73% of its revenue is derived from the US and 27% outside the US. Stryker has been active in acquisitions over the past decade with its most recent acquisition of Wright Medical for $5.6 billion in November 2020.

As M&A is a key component of its strategy to increase shareholder value, Stryker will continue to make strategic acquisitions, mostly tuck-ins. We highlight some key business and financial aspects:

· With its diversified product portfolio, Stryker’s overall revenue was less impacted in 2020 by COVID as its revenue was down 3.6% to $14.4 billion. Stryker’s decline in orthopedics and other elective procedures were somewhat offset by its MedSurg segment, which sells some critical supplies to hospitals.

· Specifically, its Medical segment grew 12% to $2.5 billion in 2020 due to high demand for beds and stretchers and the need for emergency care products and other related products.

· Stryker’s most notable acquisition was Mako Surgical, which was acquired in December 2013, for $1.7 billion; With its expertise in robotic-arm assisted surgery, Mako provided Stryker with a first mover advantage in robotic assisted joint reconstructive surgery, putting it years ahead of its competition and currently has over 1,000 systems installed. The key benefit of robotic systems is increased precision and accuracy to the surgeon and implant pull-through for the manufacturer/distributor, resulting in market share gains. At present, all four major manufacturers have robotic assisted-surgical systems offerings, thus creating a more competitive marketplace.

· Other key acquisitions in recent years include:

- November 2020 – Acquired Wright Medical for $5.6 billion to gain #1 market position (estimated 44% share) in the ~ $3 billion global extremity market; this acquisition strengthened Stryker’s postion in the lower extremities (foot/ankle), but more so in the upper extremities (shoulder) where Stryker had a small presence.

- November 2018 – Acquired K2M for $1.4 billion to increase its presence in the $9 billion global spine market; at present, Stryker is tied with NuVasive for the #3 market position at 13% share.

- April 2016 – acquired Sage Products, a manufacturer and distributor of disposable products used in the ICU setting for infection prevention and patient safety measures, for $2.9 billion

· With its Wright Medical acquisition, Stryker’s net debt to EBITDA is approximately 2.3x; the company is focused on tuck-ins in the near-term as it expects to pay down some of its debt.

· Within orthopedics, the only segment that Stryker may want to increase its presence in is sports medicine; we estimate Stryker has a #4 market position (<10% share) and management’s preference is to be in Top 3.

· Similar to other orthopedic companies, Stryker has experience pricing headwinds over the past few years with price declines between 1-2% annually.

Stryker’s M&A strategy has been consistent over the past decade as it has focused on transactions in current or adjacent segments that can leverage Stryker’s existing sales infrastructure to drive sales growth.

Zimmer Biomet, Inc. (ZBH - $161.32 - NYSE) #1 Knees/ Hips

Year

Revenue ($Mils)

EPS

P/E

2023P

$8,700

$9.01

17.9x

Dividend: $0.96 Current Return: 0.6%

2022P

8,400

8.62

18.7

Shares O/S: 207.4 million

2021E

8,000

7.74

20.8

52-Week Range: $170.05 - $88.00

2020A

7,025

5.67

--

Source: Thomson Reuters consensus.

COMPANY OVERVIEW

Headquartered in Warsaw, Indiana, Zimmer Biomet Holdings is the second-largest orthopedic implant company in the world. With $7.0 billion of revenue in 2020 and $8.0 billion in 2019, Zimmer Biomet was formed on June 24, 2015 when Zimmer merged with Biomet, thereby creating the largest global knee and hip implant manufacturer with approximately 31% market share. Its main products are knee implants, hip implants, sports medicine products, trauma/extremities implants, spine implants, dental implants and surgical products. Zimmer generated 62% of its revenue from the Americas, 20% from EMEA region and 18% from Asia Pacific region in 2020.

As the largest company in the global knee and hip implant market, Zimmer continues to shape its product portfolio to drive growth. We highlight some key business and financial aspects:

· In 2020, Zimmer’s revenue declined 12% from $8.0 billion to $7.0 billion due to COVID with the greatest impact from the EMEA region, down 21%; management believes procedures will return to normal levels augmented by deferred procedures.

· In February 2021, Zimmer announced the spinoff of its spine and dental segments into a new independent public company (NewCo) to be completed in mid-2022. These two segments generated $900 million and $1.0 billion of revenue in 2020 and 2019, respectively. With the spinoff, Zimmer can focus intently on its orthopedic surgeon call point with NewCo focused on spine surgeons and oral surgeons/ dentists along with focused investments and resources.

· Post the NewCo spinoff, Zimmer will have an estimated $7.6 billion of revenue in 2023 vs. $8.0 billion in 2019, consisting of three segments: knee implants, hip implants and S.E.T. (sports medicine, extremities, trauma).

· In the first quarter of 2019, Zimmer Biomet launched its ROSA knee system for robotic-assisted knee replacement surgeries. There were more than 300 systems placed at year-end 2020. Zimmer expects ROSA FDA approval for its partial knee and total hip application by year-end 2021. This system, along with new product launches, has enabled Zimmer to grow above market growth in the US in the fourth quarter of 2020.

· Zimmer will be launching the first smart implant, its Persona-IQ, later this year. Zimmer has been investing in data, storage and informatics to build an ecosystem that will help surgeons achieve better outcomes over time.

· Over the past three years, Zimmer’s CEO has transformed the company by resolving its manufacturing deficiencies at its North Warsaw campus, launching new products, bringing in new leadership and working on its ZB culture to improve accountability.

· Zimmer’s net debt to EBITDA is approximately 2.8x; it currently has the financial flexibility to make strategic M&A to re-shape its portfolio.

· In early 2020, management laid out multi-year restructuring initiatives that will extend through 2023 for greater strategic alignment, increased efficiency and resource allocation; the goal is to invest for growth, reallocating R&D investment toward robotics and informatics while streamlining the organization. Management is on track with this restructuring plan and fully committed to operating margin of at least 30% by end of 2023.

With its pending spinoff of its spine and dental segments, Zimmer Biomet is re-shaping its portfolio to focus its resources on its core knee, hip and SET segments. We expect Zimmer to be active in strategic M&A transactions, mostly tuck-ins, in the near term.

Smith & Nephew plc (SNN - $37.69- NYSE) #4 in Orthopedics/ Knees & Hips

Year

Revenue($Mils)

EPS

P/E

2023P

$5,800

$2.40

15.7x

Dividend: $0.75 Current Return: 2.0%

2022P

5,500

2.19

17.2

Shares O/S: 437 million

2021E

5,200

1.87

20.2

52-Week Range: $46.10 - $33.23

2020A

4,560

1.29

---

Source: Thomson Reuters consensus.

COMPANY OVERVIEW

Headquartered in London, UK, Smith & Nephew is global medical technology company, distributing products and solutions for joint reconstruction, advanced wound management, sports medicine and trauma and extremities. The company generated $4.6 billion and $5.1 billion of revenue in 2020 and 2019 respectively. It is the fourth-largest orthopedic company in the global orthopedic market. Its revenue consists of: 32% from joint reconstruction, 29% advanced wound products, 27% sports medicine/arthroscopy, 10% trauma/extremities and 2% ENT.

Smith & Nephew is the fourth largest orthopedic company in the world. We highlight some key business and financial aspects:

· In 2020, revenue declined 12% to $4.56 billion due to COVID with a 21% decline in knee implants, 7% decline in hips, 5% decline in trauma, 13% decline in sports medicine and 8% decline in advanced wound management.

· Management announced a new program to transform its operations and continuous improvements in processes, which is expected to deliver $200 million of annual cost savings by the end of 2023. For its operations, this program will simplify and increase flexibility with manufacturing and distribution networks along with lean manufacturing and increased automation. For its processes, the goal is to simplify end-to-end processes to enable various functional teams to work together more effectively.

· Key franchise areas include the following:

- Orthopedic Reconstruction (Knees/Hips) (32% of revenue) – Knee systems include JOURNEY II, ANTHEM, LEGION, GENESIS II, and VISIONAIRE instrumentation; Hip systems include the ANTHOLOGY, SYNERGY, SMF short modular femoral hip, the R3 Acetabular System, POLAR3 and REDAPT revision; NAVIO robotic system and CORI surgical systems.

- Sports Medicine/Arthroscopy/ ENT (29% of revenue) – Broad array of instruments, implants and technologies for minimally invasive repair of knees, hips and shoulder repairs; high-definition cameras, digital image capture, scopes, light sources and monitors, RF probes, electromechanical and mechanical blades.

- Advanced Wound Management (29% of revenue) - Products for the treatment of acute and chronic wounds, including leg, diabetic and pressure ulcers, burns and post-operative wounds; traditional and single-use negative pressure wound therapy (‘NPWT’) and hydrosurgery systems.

- Trauma & Extremities (10% of revenue) - Internal fixation products include TRIGEN family of IM nails and EVOS and PERI-LOC plating systems; various extremities and limb restoration products.

· Revenue by geography: 51% US, 32% EU/Japan/Australia/Other, and 17% Emerging Markets; China represents one-third of emerging markets revenue

· The company continues to make small acquisitions with products that strategically fit into its portfolio. In January 2021, the company acquired the extremity orthopedic portfolio of Integra Lifesciences for $240 million.

· In October 2019, Smith & Nephew named Roland Diggelman as its new CEO; he was the former CEO of Roche Diagnostics where he spent 11 years of his career and spent 12 years in the orthopedic sector prior.

· The company generates approximately $1 billion of annual operating cash flow, re-invests approximately $400 million for capex and instrument sets, pays a dividend and makes strategic acquisitions.

We believe Smith & Nephew is a possible acquisition candidate for a large medical company. It has an approximate 25% share in the global sports medicine market, approximate 20% share in the advanced wound care market and an approximate 10% market share in the global knee and hip implant market.

Globus Medical, Inc. (GMED - $60.93 – NYSE) #5 in Spine, #2 Pure play

Year

Revenue($Mils)

EPS

P/E

2023P

$1,079

$2.44

25.0x

Dividend: None Current Return: Nil

2022P

977

2.15

28.3

Shares O/S: 99.8 million

2021E

882

1.84

33.1

52-Week Range: $68.24 - $39.11

2020A

789

1.44

---

Source: Thomson Reuters consensus.

COMPANY OVERVIEW

Headquartered in Audubon, PA, Globus Medical, founded in 2003, is the fifth-largest spine company in the $9 billion global spine market. Globus Medical has a comprehensive spine portfolio of over 200 products for spine surgery that fall into two categories: Musculoskeletal Solutions and Enabling Technologies. Its Musculoskeletal Solutions segment (95% of revenue) include pedicle screws, rods systems, plates, interbody spacers, biologics and instruments that address a broad array of spinal pathologies such as degenerative, deformity, tumor and trauma conditions using open or minimally invasive surgical techniques. This segment also includes orthopedic trauma solutions to treat a variety of traumatic injuries and fractures. Its Enabling Technologies segment (5% of revenue) consists of computer assisted intelligent systems with imaging, navigation and robotics (INR) solutions to enhance surgeons’ capabilities to improve patient outcomes. The company has grown revenue from $16 million in 2004 to $789 million in 2020.

Globus Medical is currently one of two companies with a robotic system spine offering. We highlight some key business and financial aspects:

· Fifth largest spine company in the world behind #1 Medtronic, #2 JNJ DePuy, #3 NuVasive, and Stryker (tied), but the second-largest pure-play spine company in the world.

· In 2020, Globus Medical was the only spine company in the top 5 to generate positive revenue growth (up 0.5%) despite COVID challenges. The company executed well with its new product launches, sales execution and competitive reps recruiting and robotic system implant pull. In 2020, Globus gained market share in spine vs. all other spine companies, including Medtronic, JNJ, Stryker and NuVasive.

· Similar to most medical companies, Globus’ revenue was adversely impacted during the second quarter of 2020 due to COVID restrictions on elective procedures, but rebounded quickly in the second half of 2020, aided by some backlog in procedures.

· In 2020, Globus generated approximately $41 million from its Excelsius GPS™ system, which we estimate equates to 37 systems sold, and was less than 2019’s revenue of $47 million.

· In any given year, management’s goal is for the company to introduce 10-15 new products in spine.

· Its 3D printed spine products continue to perform well and management continues to increase manufacturing capacity to meet demand.

· 2020 was the second year of entry for Globus into the global $5.5+ billion trauma market; Globus will continue to invest in its trauma business with new product launches, instrument set investments and new sales rep hires.

· With its entry into two areas, robotics and trauma, Globus is expected to grow above market rate for the foreseeable future.

· Globus generated free cash flow of $135 million in 2020; with more than $785 million of cash and no debt on its balance sheet at year-end 2020, management is focused on strategic acquisitions.

· International sales represented 16% of 2020 net revenue.

We view Globus Medical as an attractive acquisition candidate. Globus continues to invest in many areas in addition to broadening its robotic platform to expand its application in various orthopedic procedures. With its continuous sales rep recruiting and investing, Globus is growing above market in the US. Its entry into the trauma market is early, but is expected continue to gain traction over the next decade as management launches new products and increases its sales organization.

Conmed Corp. (CNMD - $129.22 - NASDAQ) Sports Med & General Surgery

Year

Revenue($Mils)

EPS

P/E

2023P

$1,144

$3.92

33.0x

Dividend: $0.80 Current Return: 0.6%

2022P

1,074

3.59

36.0

Shares O/S: 28.9 million

2021E

997

2.94

44.0

52-Week Range: $129.38 – 49.54

2020A

863

2.18

---

Source: Thomson Reuters consensus.

COMPANY OVERVIEW

Headquartered in Utica, NY, Conmed is a manufacturer and marketer of products for orthopedic surgery and general surgery. Its general surgery products (57% of revenue) include its AirSeal insufflation management system, Buffalo filter smoke evaluation products, electrosurgical and endomechanical products, endoscopic products, and critical care products. Its orthopedic surgery products (43% of revenue) include sports medicine repair products, allograft tissue, powered surgical instruments, and visualization products. In the US, Conmed sells its products using its direct sales reps for general surgery and a hybrid sales model for orthopedics. It has a direct sales presence in 17 countries and approximately 44% of its net sales are from international markets. The company generated $863 million and 955 million of revenue in 2020 and 2019, respectively. Conmed has been acquisitive with its acquisition of SurgiQuest for $265 million in January 2016 and Buffalo Filter for $365 million in February 2019.

We highlight some key business and financial aspects:

· In 2020, Conmed’s business declined 9% to $863 million due to COVID restrictions on elective procedures with its orthopedic surgery products down 18% and its general surgery products down 1%.

· General surgery products demonstrated resilience as its Buffalo filter and AirSeal products benefitted from hospitals’ desire to improve operating room safety.

· With investments put in the place along with strategic acquisitions over the past few years, Conmed expects to deliver high-single revenue growth and double digit earnings growth organically over the next few years.

· More than 80% of its revenue are single-use, recurring revenue.

· Main products include the following:

- Sports medicine and allograft- Arthroscopes, tissue repair sets, metal and bioresorbable implants.

- Powered instruments- Hall surgical brand name for large and small bone procedures, trauma.

- Surgical visualization- 2DHD and 3DHD vision technologies for general surgery and MIS surgeries.

- AirSeal – Insufflation system for stable pneumoperitoneum, constant smoke evacuation, and valve-free access to the abdominal cavity during surgery.

- Electrosurgical and endomechanical offerings – Monopolar and bipolar generators, handpieces, tissue retrieval bags, trocars, suction irrigation devices, graspers, scissors and dissectors.

- Endoscopic offerings - Minimally invasive diagnostic and therapeutic products used in conjunction with procedures which utilize flexible endoscopy.

- Critical care - Line of vital signs, cardiac monitoring and patient care products.

- Buffalo Filter – Surgical smoke evaluation pencils, evaculators, filters and accessories.

· Conmed’s two key acquisitions, AirSeal and Buffalo Filter, represents about 25% of revenue and is expected to grow double digits, thereby driving overall sales growth; additionally, gross margin is improving due to product mix and in-sourcing manufacturing of new products and other products.

· With its recent acquisitions, Conmed’s net debt to EBITDA is approximately 4.5x.

We believe Conmed is a possible acquisition candidate for any company who would like to expand its presence in sports medicine and general surgery and strengthen its international presence.

NuVasive, Inc. (NUVA - $67.49 - NASDAQ) #3 in Spine; #1 Pure Play

Year

Revenue($Mils)

EPS

P/E

2023P

$1,360

$3.04

22.2x

Dividend: None Current Return: Nil

2022P

1,280

2.74

24.6

Shares O/S: 51.4 million

2021E

1,200

2.25

30.0

52-Week Range: $69.28 - $42.98

2020A

1,050

1.23

---

Source: Thomson Reuters consensus.

COMPANY OVERVIEW

NuVasive is the third-largest spine company in the $9 billion worldwide spine market. NuVasive’s spine portfolio for minimally disruptive spine fusion surgery includes access instruments, spinal implants, biologics, software systems for surgical planning, navigation and imaging solutions, and intraoperative monitoring service offerings. It offers procedural solutions to improve upon traditional procedures to deliver reproducible and clinically proven surgical outcomes. The company was founded in 1997 and has grown revenue from approximately $100 million in 2006 to $1.0+ billion in 2020.

NuVasive is the third-largest spine company in the world. We highlight some key business and financial aspects:

· Largest pure-play spine company and leader in MIS spine.

· In 2020, NuVasive’s revenue declined 10% due to COVID impacts on elective surgical volumes; its international segment declined 1% due to strength in Japan offset by weakness in parts of Europe.

· Its main products and solutions include the following:

X360 – Lateral, single position surgery, integrates surgical intelligence tools and minimally invasive products and solutions.

C360 – A comprehensive portfolio of implants and technologies to support anterior and posterior cervical spine surgery.

Implants/ fixation products – PEEK and titanium implants of various sizes and shapes; VuePoint, Armada, Percept, and Reline posterior fixation products.

iGA platform – Consists of implants, fixation devices, neuromonitoring, computer assisted and surgical planning technology, to increase the predictability of achieving global alignment in spine procedures.

Maximum Access Surgery® platform – Allows surgeons to perform surgery in a minimally invasive way using nerve monitoring system, MaXess blade system and specialized implants, and fixation systems.

Nerve monitoring systems – Various platforms to monitor the proximity and directionality of nerves during surgery.

Biologics – Allograft Osteocel Plus and Pro cellular bone matrix, Propel DBM, and FormaGraft and AttraX bone substitute and graft.

Pulse surgical intelligence platform – Integrated platform with various options - navigation, global alignment, intraoperative monitoring, rod bending, radiation reduction, imaging, robotics, smart implants; Enables better spine surgery; Supports 100% of spine cases and operating rooms; Open architecture for access anywhere, anytime with any application; expect to launch in summer 2021.

· Management expects to improve its operating margin improvement to 20%+ in 2024 attributable to increased in-house manufacturing, increased asset efficiency with inventory and instrument sets, sales force efficiencies and increased international scale.

· In February 2021, NuVasive acquired Simplify Medical, a developer of an artificial cervical disc, for $150 million; currently approved for one-level, awaiting FDA approval for two-level cervical disc.

NuVasive is an attractive acquisition candidate as it is the largest pure play spine company in the world. Management is focused on launching new products and growing its market share in the US and internationally over the next few years.

Orthofix Medical, Inc. (OFIX - $43.04 - NASDAQ) Spine & Extremities

Year

Revenue($Mils)

EPS

P/E

2023P

$497

$1.44

29.9x

Dividend: None Current Return: None

2022P

474

1.03

41.8

Shares O/S: 19.5 million

2021E

449

0.50

86.1

52-Week Range: $48.50 - $25.23

2020A

407

0.26

---

Source: Thomson Reuters consensus.

COMPANY OVERVIEW

Headquartered in Lewisville, TX, Orthofix Medical is a manufacturer and marketer of products for the repair and regenerative solutions for the spine and orthopedic markets. The company operates in four strategic business units (SBUs) – Bone Growth Therapies, Spinal Implants, Biologics, and Extremities that are aligned into two pillars – Global Spine and Global Extremities. Its main products include non-invasive regenerative stimulation products for the spine and long-bone, external and internal fixation devices, biologics, and spinal implant products. In September 2019, new CEO Jon Serbousek joined Orthofix and has outlined a new strategy to accelerate growth.

Orthofix is a diversified orthopedic company with four strategic business units. We highlight some key business and financial aspects:

· Seventh-largest spine company in the world with its combined spine fixation and biologics SBUs.

· In 2020, revenue declined 12% to $407 million due to COVID impacts on surgical procedures with its global extremities segment down 18% to $85 million due to non-urgent deformity correction procedures being postponed.

· Its spine implants segment was flat at $95 million in 2020 due to surgeon adoption of its M6 cervical disc.

· In 2020, new CEO Jon Serbousek outlined a new strategy to accelerate growth including four key areas of investment focus:

Structuring leadership – New leaders in key roles throughout 2020; build out certain teams.

Operational execution – Becoming a faster, more efficient organization by refining global supply chain.

Product innovation – R&D and strategic tuck-ins to drive new product launches.

Commercial channel development – Leadership changes, add high-quality, long-term strategic distributors.

· Orthofix’s business units include the following:

- Bone Growth Therapies (42% of net revenue) - Portfolio of devices for enhancing bone fusion that utilize Orthofix’s patented pulsed electromagnetic (PEMF) technology; FDA-approved Class III medical devices indicated as an adjunctive treatment to enhance fusion success in cervical and lumbar spine non-healing fractures outside of the spine.

- Spine Implants (23% of net revenue) – Portfolio of repair and regenerative products that allow physicians to successfully treat a variety of spinal conditions. Key products include Firebird spinal systems, Pillar® SA PEEK spacer system, FORZA spacer systems and M6 cervical disc.

- Biologics (14% of net revenue) – Portfolio of regenerative products that allow physicians to successfully treat a variety of spinal and orthopedic conditions; partnership with MTF to exclusively market its Trinity Evolution® and Trinity Elite™ tissue forms for musculoskeletal defects to enhance bony fusion.

- Extremity Fixation (21% of net revenue) - Portfolio of repair and regenerative products that allow physicians to successfully treat a variety of orthopedic conditions including products used in fracture repair, deformity correction and bone reconstruction; various external and internal fixation products and systems.

· In January 2020, Orthofix announced the acquisition of FitBone for its limb lengthening system for $18 million in cash; fits well with extremities pediatric deformity correction portfolio

We believe Orthofix Medical is a possible acquisition candidate for any medical company.

OrthoPediatrics, Corp. (KIDS - $46.99- NASDAQ) Pediatric Orthopedics

Year

Revenue($Mils) a

TEV to Sales

2023P

$137

6.3x

Dividend: None Current Return: Nil

2022P

115

7.6

Shares O/S: 19.7 million diluted

2021E

95

9.1

52-Week Range: $57.42 - $34.69

2020A

71

---

Source: Thomson Reuters consensus. a) Expected EPS loss for the next three years.

COMPANY OVERVIEW

Headquartered in Warsaw, IN, OrthoPediatrics is a manufacturer and marketer of implants and products for pediatric patients with orthopedic conditions. The company was founded in November 2007 and went public in October 2017 at $13.00 per share. The company’s products include its trauma and deformity product line (69% of revenue), its scoliosis systems (29% of revenue) and sports medicine products (2% of revenue). The company has the broadest pediatric specific orthopedic offering with 35 surgical implant systems. The company markets its products in the US using 36 sales agencies employing 171 sales reps being exclusive to the company. The company generated $71 million of revenue in 2020. International revenue was 11% of total revenue in 2020.

Orthopediatrics is an orthopedic implant company focused on pediatric patients. We highlight some key business and financial aspects:

· In 2020, revenue declined 2% to $71 million due to a 54% decline in international revenue as its stocking distributors did not purchase inventory given uncertainty in their markets.

· US revenue increase 14% to $63 million due to new product launches and recent small tuck-in acquisitions.

· Excluding 2020, management’s goal is to grow revenue of at least 20% annually in the near term.

· Main Products include the following:

- Trauma and deformity (~67% of revenue) - More than 5,200 implants and bone fixation devices for the femur, tibia and upper and lower extremities including cannulated screws, distal femoral osteotomy system, locking cannulated blade, locking proximal femur, Pediflex flexible nailing system, PAO instruments, clavical plates, wrist fusion plates, locking plate systems, PediNail intramedullary nail, PediPlates, PediLoc, etc.

- Scoliosis (~29% of revenue) –Includes RESPONSE systems for treating spinal deformity, ApiFix system for adolescent idiopathic scoliosis, BandLoc 5.5mm/6.0mm sub-laminar banding system, BandLoc DUO, and FIREFLY® pedicle screw navigation guides.

- Sports medicine (4% of revenue) – ACL and MPFL Reconstruction system and Telos.

· The company aspires to launch at least one new surgical system and multiple product line extensions every year.

· In 2020, the company invested $18 million in instrument sets to support its growth in existing and new markets.

· In the US, the company has 36 sales agencies employing 171 sales reps who are present in the operating room with the surgeon customer; the company provides extensive training to these sales reps.

· Outside the US, the company has 42 stocking distributors and 11 independent sales agencies in 44 countries. It has direct sales programs in the most of the European countries, Australia, New Zealand, and Canada.

· In April 2020, the company acquired ApiFix for $35 million in stock and cash with some payments based on milestones. In June 2019, the company acquired Orthex Hexapod system for $60 million and sold the adult assets to Squadron Capital for $25 million in December, for net cash outlay of $35 million; this product is used in pediatric trauma and deformity cases and increases Orthopediatrics’ addressable opportunity from 60% to 80% of this market

· In June 2020, the company issued 1.6 million shares @ $47 for net proceeds of $70.2 million

We believe Orthopediatrics is a possible acquisition candidate for any medical company who wants to expand its pediatric product offering.

Si-Bone, Inc. (SIBN - $30.87 - NASDAQ) iFuse Implant

Year

Revenue($Mils)a

TEV to Sales

2023P

$141

6.4x

Dividend: None Current Return: Nil

2022P

119

7.6

Shares O/S: 32.7 million

2021E

93

9.7

52-Week Range: $35.68 - $9.75

2020A

73

---

Source: Thomson Reuters consensus. a) Expected EPS loss for the next three years.

COMPANY OVERVIEW

Headquartered in Santa Clara, CA, Si-Bone is a manufacturer and marketer of the iFuse implant system for minimally invasive surgical treatment of the sacroiliac jointa(SIJ) in the lower back. The company was founded in 2008 and went public in October 2018 at $15.00 per share. The company’s products include its iFuse-3D implant system and iFuse enabling technology solutions for the surgical procedure of the sacroiliac joint. The company markets its products using its 100+ field sales reps and clinical support specialists in the US. Outside the US, the company has 20 direct sales reps and works with 31 exclusive distributors to market and sell its products in 35 countries. The company generated $73 million of revenue in 2020. International revenue was 7% of revenue in 2020.

We highlight some key business and financial aspects:

· In 2020, revenue increased 9% to $73.4 million due to higher sales rep productivity, increased sales team and improving reimbursement coverage in the US.

· During 2020, the company rolled out its SI-Bone stimulator surgeon training program, whereby the medical training team goes to the surgeon’s hospital on demand and bypasses the cadaver lab and minimizes travel.

· The iFuse implant system includes a series of patented triangular implants, instruments and diagnostic and surgical techniques to perform the surgical treatment of the sacroiliac joint for lower back pain.

· The US market opportunity for sacroiliac joint treatment is approximately 280,000 patients per year or $2.5 billion opportunity; Si-Bone’s had 7,500 iFuse procedures in 2020.

· According to management, iFuse is the market leader with over 50,000 worldwide procedures to date.

· Benefits of the iFuse-3D implant system; a) significant decrease in mean pain and disability improvement scores, b) 91% patient satisfaction rate; 3.5% revision rate at 4 years, c) significant reduction in opiod use post surgery, d) 312 US million lives covered by insurance, e) long-term five year data.

· There are more than 90 peer reviewed published papers and 6-year long-term data on the iFuse system, which is the most for any SIJ implant.

· Management is focused on increasing its sales reps and its sales coverage in the US along with medical training and education; currently has 64 field sales reps and 58 clinical support specialists in the US.

· iFuse implant averages $10,000 with gross margins ~ 90%; manufacturing is outsourced.

· In March 2020, the company received FDA approval for its iFuse implant for traumatic injuries to the sacroiliac joint.

· The company has more 50 issued patents covering the iFuse through 2024 and the iFuse-3D patents through 2035.

· In January/February 2020, the company issued 3.1 million shares of stock @21.50 for net proceeds of $63 million; in October 2020, the company issued 3.5 million shares @ $22, raising $71.6 million in net proceeds.

We believe Si-Bone is a possible acquisition candidate with its unique iFuse implant system.

a The sacroiliac joint connects the base of the spine to the hip joint.

SeaSpine Holdings, Corp. (SPNE - $18.06 - NASDAQ) Spine + Biologics

Year

Revenue($Mils)a

TEV to Sales

2023P

$233

1.9x

Dividend: None Current Return: Nil

2022P

208

2.1

Shares O/S: 27.9 million diluted

2021E

186

2.3

52-Week Range: $20.97 - $6.84

2020A

154

---

Source: Thomson Reuters consensus. a) Expected EPS loss for the next three years.

COMPANY OVERVIEW

Headquartered in Carlsbad, CA, SeaSpine Holding is a manufacturer and marketer of implants and biologics for various spine disorders. The company was spun-off from Integra Lifescience on July 1, 2015. The company’s products include its spinal implants (49% of revenue) and orthobiologics products (51% of revenue) used primarily in spine procedures, but also orthopedic and dental applications. The company markets its products using independent stocking distributors in the US and in international markets. The company generated $154 million of revenue in 2020. International revenue was 10% of revenue in 2020.

We highlight some key business and financial aspects:

· In 2020, revenue declined 3% to $154 million due to COVID impacts on elective surgeries, but less than the spine market decline of 11% due to new product launches expanding its product portfolio and superior sales execution and surgeon education and training.

· In 2020, the company launched 19 new products, the most in any given year.

· The company has focused on new products launches and expects robust product launches in 2021 and 2022; new products have contributed to more than 68% of US spinal implant revenue in the fourth quarter of 2020.

· Main Products include the following:

- Orthobiologics (51% of revenue) – Various orthobiologics products in the form of putties, pastes, strips and DBM in a resorbable mesh; particulate and fibers-based DBM, collagen ceramic matrices, demineralized cancellous allograft bone and synthetic bone void fillers.

- Spinal implants(49% of revenue) – Includes iPassage MIS retractors, NewPort tube retractors, Coral MIS solutions, Dayton deformity system, various PEEK and NanoMetalene interbody devices, various Reef interbody devices, Mariner posterior fixation system, various screw and plating systems, Shoreline anterior cervical system, etc.

· In addition to launching new products, management has been upgrading and expanding its distributor base to drive growth.

· Management is focused on innovation by investing in product development, education and training for its distributor base, and improving its customer service for its surgeon customers and distribution partners.

· In March 2021, Seaspine announced an agreement to acquire 7D Surgical, a manufacturer of a machine-vision, image-guided surgery platform used in spine surgeries, for $110 million (25% cash/ 75% stock).

· In 2021, SeaSpine expects to launch more than a dozen new products including its Mariner system with an adult deformity indication and four 3D printed interbody systems; also will migrate many alpha launches to full commercial launches

· Stock issuance: In January 2020, the company issued 7.8 million shares at $12.50 for gross proceeds of $98 million for operating activities to drive revenue growth and for general corporate purposes.

We believe SeaSpine is a possible acquisition candidate for any medical company who wants to expand its spine and biologics product offering.

ConforMIS, Inc. (CFMS - $1.00- NASDAQ) Customized Implants

Year

Revenue(Mils)a

TEV to Sales

2023P

$83

2.1x

Dividend: None Current Return: Nil

2022P

79

2.2

Shares O/S: 182.6 million

2021E

69

2.6

52-Week Range: $1.49 - $0.58

2020A

69

---

Source: Thomson Reuters consensus. a) Expected EPS loss for the next three years.

COMPANY OVERVIEW

Headquartered in Billerica, MA, ConforMIS manufactures and markets customized knee and hip implants for patients requiring knee or hip replacement surgeries. The company participates in the $15+ billion global knee and hip implant market. Currently, its main products are its iTotal PS total knee implant, iTotal CR total knee implant, iUni partial knee implant, iDuo partial knee implant and its ConforMIS hip system. Due to the customization, ConforMIS’s implants have demonstrated improved fit and alignment and overall cost savings compared to traditional implants. In the US, ConforMIS’s sales and marketing organization consists of primarily independent sales agents. The company also sells via direct sales reps in Germany and sells to distributors in other international markets. The company has grown product revenue from $48 million in 2014 to $69 million in 2020.

We highlight some key business and financial aspects:

· In 2020, the company’s product revenue declined 24% to $51 million as its knee implants were impacted greatly by COVID; knee implants represent more than 95% of its product revenue.

· ConforMIS has a robust and broad intellectual property portfolio. Its 290 patents cover customized orthopedic implants and patient specific instruments. It has 59 pending patents.

· It currently has licensed agreements with Stryker, Wright Medical, Microport and Smith & Nephew for some of its patents for off-the-shelf traditional implants and patient specific instrument technology. ConforMIS’s patent portfolio presents a huge barrier to other orthopedic companies that may desire to manufacture and market customized orthopedic implants.

· As of December 31, 2020, Conformis had $28.7 million of cash and $25 million of debt on its balance sheet. In February 2021, Conformis issued 80.9 million shares of stock at $1.05 for net proceeds of $79.6 million.

· Main products include the following:

˗ iTotal PS – Posterior stabilized customized total knee replacement system

˗ iTotal CR – Cruciate-retaining, customized total knee replacement system

˗ ConforMIS Hip System – Customized primary total hip replacement system, new Cordera off-the-shelf Hip system

˗ iDuo – Customized bicompartmental knee replacement system

˗ iUni – Customized unicompartmental knee replacement product for the treatment of the medial or lateral component of the knee

˗ iTotal Identity – newest patient specific knee system

· In 2021, Conformis will be launching its Cordera™ hip system and its new knee system in the second half, pending FDA approval.

· Outside the US, Germany is Conformis’s largest international market at 11% of product revenue; 2% for other countries

· In October 2019, ConforMIS entered into an asset purchase agreement with Stryker for certain assets related to its patient specific instrument (PSI) technology for an upfront payment of $14 million plus an additional $16 million in milestone payments plus payments and royalties associated with a distribution supply agreement; expect to supply Stryker with its first shipments upon FDA approval in 2021.

We believe ConforMIS is a possible acquisition candidate for any company who would like its robust patent portfolio and its differentiated customized knee and hip implants.