Follow Us x

By Timothy Winter, CFA, Brett Kearney, CFA, Chong-Min Kang, José Garza, and Simon T. Wong, CFA

March 17, 2021

De-Carbonization is a Global Goal and Provides Long Runway for Growth

Over the next two decades, we expect an increasingly favorable investment environment for renewable energy, including wind power. The global climate treaty, The Paris Accord, calls for significant reductions in global carbon emissions and increases in renewable energy. Over 130 governments representing 70% of the global population are calling for carbon neutrality (many by 2050) and 100% renewable energy by 2030-2040. With improving renewable economics, carbon reductions targets are becoming increasingly more achievable, more aggressive and higher on government priority lists.

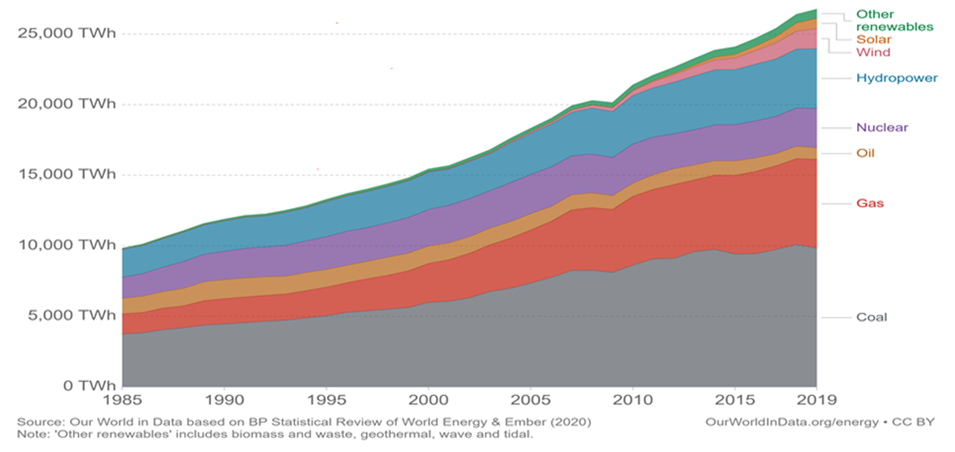

In 2019, 37% of the world’s electricity was generated by coal, including 65% of China’s electric power, 73% in India, and 20% in the US. Roughly 37% of global electricity was generated from non-emitting generation including 16% hydro, 10% nuclear, 5% wind, 3% solar and 3% other renewable. Many North American and European utilities have made some progress in reducing greenhouse gas (GHG) and other harmful emissions, but the global economy remains in the early stages of a long-term power transition where coal-fired power plants and less-efficient nuclear and gas plants are being shut-down and replaced with renewable energy.

Exhibit 1 Global Electric Fuel Mix

Source: BP Statistical Review 2020

The massive investment needed to transition the global power industry to 100% renewable will likely provide significant investment opportunities and drive substantial long-term growth. While renewable and carbon-reduction targets could prove aggressive, we expect a constructive landscape featuring low financing costs, political and regulatory support, and improving economics to produce a lucrative wind-power ecosystem.

In this report, we outline the regional targets and identify the leading players in the wind energy development and equipment supply business. The global landscape is teeming with optimistic utilities, developers and suppliers and ripe for ongoing consolidation. We expect small, mid-cap and large cap renewable and wind developers to consolidate and be consolidated as multi-national utilities, energy and infrastructure companies transform themselves to meet the new world order.

Climate Goals Supported by Governments, Corporations, Investors

De-carbonization is a global goal supported by governments, corporations, investment firms, utilities and even major oil and mining companies. Further, China, which represents 27% of the world’s electricity market, recently ramped up its carbon reduction targets and implemented a major boost in wind investment and installations. Most of the developed world has instituted policy changes with ambitious renewable targets, including the US, which represents roughly 17% of the world’s electricity market, Japan (5%), Germany (2%), Canada (2%) France (1%) and the UK (1%)(Source: CIA Factbook). In addition, electric demand growth is likely to accelerate with the adoption of the electric vehicle and associated charging stations further increasing the demand for renewables energy. The larger global electricity markets and carbon targets are highlighted below and serve the purpose of reinforcing the significant future for renewable energy:

· USA: As of year-end 2020, the US had ~1,100 GW’s of installed electric capacity and the 2020 US fuel mix was 39% gas (up from 23% in 2010), 20% coal (down from 56% in 1986), 21% nuclear, and 20% renewables (8.8% wind, 7.0% hydro and 3.4% solar). A proposed US Federal energy plan calls for 100% renewables by 2035 and a net-carbon zero economy by 2050. Many US states have set ambitious renewable energy standards, including 100% renewable energy in New York (2040), California (2045), Hawaii (2045), New Mexico (2045) and New Jersey (2045).

· Canada: Installed capacity totals ~140 GW’s. In 2020, it generated 82% from non-emitting sources and 67% from renewables (hydro 60% and 7% wind/solar), 18% from fossil fuels, and 15% from nuclear. Canada aims to be carbon neutral by 2050 and generate 90% of its power from non-emitting sources by 2030.

· China: The world’s largest consumer of electricity and country houses nearly 2,000 GW’s of installed capacity. In 2019, China’s electric fuel mix consisted of a very high 65% coal, followed by hydro (17%), nuclear (5%), gas (3%), wind (3%), solar (2%) and biomass (2%). In December 2020, President Xi increased China’s commitment of 20% share of non-fossil fuel energy consumption by 2030 to 25%. China targets peak carbon emission by 2030 and carbon neutrality by 2060. Few details were shared in how China would achieve this in the draft 14th Five Year Plan (2021-2025) submitted last week. The plan targets the share of non-fossil fuel to comprise 20% of China’s energy mix – over the course of the last Five Year Plan, non-fossil fuel’s share increased from 12.3 to 15.9%. China has set a 2021 GDP target of at least 6%. This framework allows for an increase in carbon emissions over the next several years. It has been noted that a 5-yr GDP growth target and a target for limiting total energy consumption, included in prior plans, were not included in this plan. China is expected to release a five-year plan for energy and electricity and a climate five-year plan and emissions peaking plan this year. The country will require significant renewable additions to achieve its longer term targets.

· Japan:In 2019, 73% of Japan’s electric output was generated by fossil fuels (63% in 2009), 17% from hydro, 14% from nuclear and less than 5% from renewables. Installed electric capacity totaled roughly 300 GW’s. In October 2020 Prime Minister Yoshihide Suga committed to net-zero carbon by 2050. Prior to this, Japan’s goal was for carbon neutrality was as soon as possible in the second half of the century. In 2020 Japan’s installed new wind power capacity of 449 MW vs 271 MW in 2019, bringing its total capacity of wind power generation for 2020 to 4,372 MW. Offshore and semi-offshore capacity represents only about ~2% of wind power capacity, or 85MW.

· Europe:In 2019, Europe generated 26% from nuclear, 22% from oil, 15% from coal, 11% from hydro, 7% biomass, 13% wind and 4% solar. Installed electric capacity totaled ~930 GW’s. The European Green Deal calls for Europe to reduce GHG’s 55% by 2030 and enshrines climate neutrality into law by 2050. In order to meet the European Commission’s 55% target, the share of renewables in the electric mix needs to increase to 65% by 2030, from 32% today, at a cost of $430 billion (Eurostat). The EU has set EU-wide targets to give a framework around which each country may build its strategy. On November 19, 2020, the European Commission, released its offshore renewable energy strategy targeting 60 GWs by 2030, up from 12 GW installed today, and 300 GW’s by 2050. The plan also calls for 1 GW of tidal capacity by 2030 and 40 GW’s by 2050. The EU has put offshore wind on track for 25-fold increase to reach 300 GW by 2050.

More than Government Support for Renewable Power

De-carbonization is also a priority of corporations, customers, investors, energy companies and utilities. Utilities across the world have embraced the policy targets due to the increased investment in rate base as well as the potential to displace higher-cost assets with lower cost and cleaner assets.

- S&P Global Market Intelligence reports that 21 of the 30 biggest utilities in the U.S., 11 of the 30 biggest metals and mining companies in the world, and 11 of the 30 largest oil and gas companies in Europe and North America have set net-zero targets by 2050.

- In addition, many of the world’s more influential corporations are championing clean energy and have committed to 100% renewable electricity. The RE100 is a global initiative made up of nearly 300 of the world’s more influential companies (3M, Apple, American Express, Anheuser-Busch, AXA) that share a mission to accelerate change towards net-zero carbon.

- Further, numerous investment firms, including the world’s largest asset manager, Blackrock ($8 trillion assets under management), and the nation’s third-largest pension fund, the New York State Common Retirement Fund, have instituted increasing climate-related requirements. On December 11, 2020, a group of 30 asset managers (Fidelity International Ltd., Calvert Research & Management, DWS Group GmbH & Co. KGaA, Nordea Asset Management and UBS) representing more than $9 trillion in assets launched the Net Zero Asset Managers initiative to achieve net-zero emissions by 2050 largely by convincing companies in their portfolios and client investors to follow suit. The growth in ESG investing and numerous green energy indices and funds creates significant and growing interest in clean energy stocks and those using clean energy.

The Future is Blowing in the Wind

Wind power has proven to be an efficient and effective renewable source and is growing ever more competitive given the abundance of the resource and improving technology. The top countries by installed capacity are as follows: China (236 GW’s), US (105 GW’s), Germany (61 GW’s), India (38 GW’s), Spain (26 GW’s) and the UK (24 GW’s). (WWEA 2019). Over the next ten years, the Global Wind Energy Council (GWEC) expects nearly 700 GW’s of new wind power capacity installations, which would bring cumulative installations to 1,160 GW by the end of 2027 up from today’s 651 GW in 2019. Such an aggressive buildout would still leave the world significantly short of global targets. GWEC highlight the following:

2020 was expected to be a record year for wind energy, with GWEC forecasting 76 GW of new capacity in stalled. (2020 date expected from GWEC on March 25, 2021)

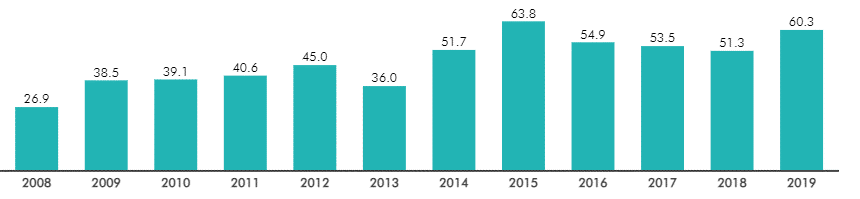

Exhibit 2 Global Wind Capacity Additions by Year (GW’s)

Source (GWEC)

60.3 GW’s of wind energy capacity was installed globally in 2019, a 19% increase from installations in 2018 and the second-best year for wind historically.

Total capacity for wind energy globally is now over 651 GW, an increase of 10% compared to 2018. China and the US remain the world’s largest onshore wind markets, together accounting for more than 60% of new capacity in 2019.

Offshore wind is playing an increasingly important role in driving global wind installations, with the sector installing a record 6.1 GW in 2019, accounting for a record share of 10% of new installations.

Exhibit 3 Global Offshore Wind Capacity Additions by Year (GW’s)

Source (GWEC)

Renewable Costs Declines Driving Competitiveness with Fossil Fuels

Regardless of policy incentives and societal pressure, utilities, corporations, and customers benefit from adding renewable generation given that significant cost declines have made new wind and solar generation more economical than older fossil-fired and nuclear generation.

Exhibit 4 Declining Renewable Costs

Source: American Wind Energy Association; Solar Energy Industry Association

From 2010-2020, the leveled cost of wind power has declined from $60/MWH to $10-15/MWH (includes tax credits). Post 2023 and excluding any tax credits, NextEra Energy (the world’s largest renewable player) expects that new wind ($20-30/MWH) will be more competitive than combined cycle gas ($30-40/MWH) and existing coal ($35-50/MWH) and nuclear ($35-50/MWH).

Growing Offshore Wind

Offshore wind is becoming an increasingly important form of renewable generation primarily due to geography and NIMBY limitations as well as improved economics. Offshore wind farms have become almost commonplace in Western Europe and are expected to be an integral part of several Asian countries’ as well as the Northeastern and Mid-Atlantic US’ future development plans. As of year-end 2020, total offshore wind capacity totaled 35 GW’s with the UK totaling 10.2 GW’s, China 9.9 GW’s, Germany 7.7 GW’s, the Netherlands 2.6 GW’s and Belgium 2.2 GW’s. In 2020, developers installed over 6 GW of new offshore wind capacity driven by a record year in China, which lead the world for the third year in a row, with 3 GW’s. Steady growth in Europe accounted for the majority of remaining new capacity, led by the Netherlands, which installed nearly 1.5 GW of new offshore wind in 2020.

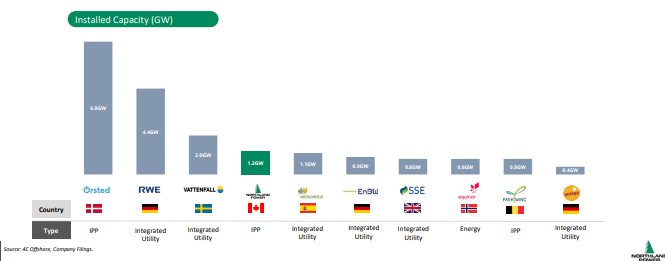

Exhibit 5 Leading Global Offshore Wind Developers

Orsted, the world’s leading offshore wind player, expects global offshore wind auctions and tenders to reach 25 GW’s in 2021, including 12 GW’s in the UK and 5.4 GW’s in the US. By 2030, the largest offshore wind markets are expected to be as follows:

China (52 GW’s), the United Kingdom (40 GW’s), the U.S. (26 GW’s), Germany (20 GW’s), the Netherlands (12 GW’s), South Korea (12 GW’s), and Japan (10 GW’s).

- On November 19, 2020, the European Commission, released its offshore renewable energy strategy targeting 60 GW’s by 2030, up from 22 GW installed today, and 300 GW’s by 2050. The plan also calls for 1 GW of tidal capacity by 2030 and 40 GW’s by 2050. The EU has put offshore wind on track for 25-fold increase to reach 300 GW by 2050.

- In the US, several large offshore wind projects have been awarded to developers and are awaiting Bureau of Ocean Energy Management (BOEM) final authorization to begin construction. The Northeastern US (alone) is poised to build 25 Gigawatts (GWs) of offshore wind at a cost of $75-100 billion by mid-decade. In 2019 and 2020, several coastal states conducted initial phases for major offshore wind RFP’s, including New York, Connecticut, New Jersey, Massachusetts, and Rhode Island. Each of these states expect several more RFP’s to achieve renewable goals and several other states, including Virginia, Maryland, and North Carolina, are also considering offshore wind. The country’s deployable offshore wind capability totals 85-90 GW’s.

- In February 2021, the South Korean government signed a 48.5 trillion won ($43.2 billion) plan to build the world’s largest offshore wind farm by 2030. The 8.2 GW project would be a key piece to South Korea’s goal to reach 16.5 GW of wind generation by 2030 and carbon neutrality by 2050. Companies involved in the project, include Korea Electric Power Corp. (KEPCO), SK E&S, Hanwha Engineering & Construction Corp, Doosan Heavy Industries., CS Wind Corp, and Samkang M&T Co. The UK’s Hornsea 1 is currently the world’s largest offshore wind farm with 1.12 GW of generation capacity.

Currently offshore wind cost estimates range from $3000-5,000/Kw compared to inland wind farms at $1,000-1,500/kw. Offshore wind farms are more capital intensive given that they are significantly larger, use higher towers, larger turbines (10-14 MW turbines vs. 2-4 MW’s and must be either linked to the sea floor or installed in a floating platform).

Floating Wind

Floating offshore wind power will likely become a growing part of the net-zero solution, starting in the Asia Pacific (Japan, Korea and Taiwan). Consulting firm Wood Mackenzie expects average capital costs of floating offshore wind plants to decline by around 40% to US$2,500-4,000 per kW by 2025-2030, from current pilot levels of $8,000-10,000 per kW. In late 2020, several major developers in Japan, South Korea and Taiwan announced plans to develop demonstration projects with capacity of 1.56GW ($8 billion). In addition, EDP Renováveis SA and Engie SA's 25-MW began construction of the WindFloat Atlantic project in Portugal last year and Scotland's Kincardine floating wind plant was financed during 2020 at a cost of €8.3 million/MW.

The Wind Ecosystem and the Players

The cost of transforming the global electric systems, including generation, transmission and distribution, to totally renewable energy in the next 10-20 years will be enormous. Reputed consulting firm Wood Mackenzie notes that the US alone will need $4.5 trillion in investment to achieve 100% renewable by 2035. As noted the global wind ecosystem is teeming optimistic players, including the wind developers (utility or independent power producer), the turbine manufacturers, equipment suppliers, and the electric grid suppliers. Utility scale wind generation is normally developed, owned and operated by either wind developers and/or utilities, but can also be owned by large corporations. The utilities and developers are key beneficiaries.

Turbine Manufacturers

One of the major and most valued piece of the wind plant is the turbine. According to BizVibe, the global wind turbine market size was valued at around $100 billion in 2019, and it is expected to reach $134.6 billion by 2023, representing a strong CAGR of 7.2%. The turbine market is highly competitive, but also growing significantly. With the advent of offshore wind, including Europe’s new target of 300 GW of offshore wind capacity by 2050 and the US’ expected 25 GW’s by 2030, renewable energy developers and turbine manufacturers will compete for dozens of gigawatts worth of US and European government contracts. Onshore, the turbine manufacturers also benefit from repowering existing wind farms from the 1990s and early 2000s and replacing them with new machines. Turbine manufacturers will likely be challenged to deliver on demand. The wind turbine market has been dominated by the top handful of major players. In 2020, the leaders in installed capacity were as follows:

Table 1 Leading Global Turbine Manufacturers

1. Vestas 9.6 GW’s Denmark (Aarhus) 5. Envision 5.8 China (Shanghai)

2. Siemens Gamesa 8.8 Spain (Biscay) 6. MingYang 4.5 China (Zhongshan)

3. Goldwind 8.3 China (Bejing) 7. Windey 2.1 China (Zhejiang)

4. GE 7.4 USA (Boston) 8. Nordex 2.0 Germany (Hamburg)

Source: Gabelli Funds

Table 2 Global Wind Player Ecosystem

Source: Gabelli Funds

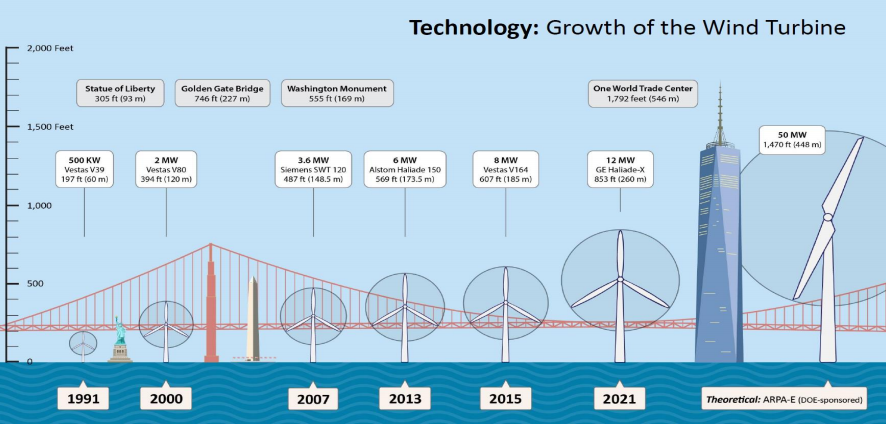

In 2020, the majority (71%) of turbines installed were rated between 2-3 MW, while 28% were over 3 MW. There are now thirteen projects utilizing 4 MW class turbines totaling 2,229 MW operating in the U.S. For offshore projects installed in 2020, the average was 8.2 MW and the most widely connected machine was an 8-8.4-MW turbine from Siemens Gamesa Renewable Energy SA. Turbines set to be used at projects coming online after 2022 range between 10 MW and 13 MW in size, coinciding with the rollout of GE's new 12 MW to 13 MW Haliade-X machine. In 2020, Siemens Gamesa announced a 14 MW machine that will become available by 2023. Exhibit #6 highlights the technological improvements in wind turbines and then we discuss the manufacturers.

Exhibit 6 The Growth of Turbines

Source: Avangrid Wind Analyst Day Presentation

Vestas Wind Systems (VWS: COP) Vestas Wind Systems (Aarhus, Denmark) is the world’s largest wind turbine manufacturer. Vestas has a 16% global market share and has installed over 60,000 turbines with a total joint capacity of 82 GW, across 76 countries. It has manufacturing facilities in North and Latin America, Europe and Asia. The company has a strong presence in western markets and recently bought out joint venture partner Mitsubishi Heavy Industries to wholly own MHI Vestas Offshore Wind. Vestas formed a 50/50 JV with Mitsubishi Heavy industries in 2014 in an effort to break into the much faster growing offshore wind market.

Siemens Gamesa Renewable Energy (SGRE: BME) Siemens Gamesa Renewable Energy (Bizkaia, Spain) is the 2nd largest European wind turbine manufacturer, and the largest offshore wind OEM worldwide. Customers include large-scale windfarms, to whom it offers operation and maintenance services, as well as to 3rd party windfarms. SGRE was formed by the 2017 merger between Siemens Wind Power and Gamesa Corporacion Tecnologica in 2017 (the 3rd and 4th biggest wind turbine manufacturers). With different technological and geographical focus Gamesa had a very strong onshore segment with a special focus in Spain and developing markets while Siemens WP was the first offshore wind OEM, with onshore operations in Europe and North America.

General Electric (NYSE: GE) is one of the larger Western producers of onshore wind turbines, with a strong positon in the North American market, although this $10B+ business has recently operated at very thin margins. With over 25,000 wind turbines installed globally, its portfolio of turbines features rated capacities from 1.7 MW to 4.8 MW (Onshore) and 6 MW to 12 MW (Offshore). Its 14 MW Haliade-X offshore turbine was introduced after competitors’ offerings, but has received over 5.7 GW of commitments, most notably the three phases of the Dogger Bank UK wind farm and the Avangrid Vineyard Wind project, where it replaced Vestas.

Nordex SE (NDX1: ETR) Nordex SE, headquartered in Rostock, Germany, is one of the leading European companies in the Wind turbine manufacturing landscape. Additionally, the company offers operation and maintenance services to own as well as 3rd party wind farms. Nordex SE was founded in 2016 when Acciona Wind Power (Subsidiary of Acciona SA) and Nordex merged. Nordex SE was formed in 2016 as a result of the merger of German turbine manufacturer Nordex and Acciona Wind Power. The two companies had a very different focus across all dimensions setting up for a combined company able to strongly take advantage of synergies. It is the 5th largest wind turbine manufacturer (ex. China) with ~4% of global installed capacity and ~5% of annual installations in 2018.

North American Wind EcoSytem

The cost of transforming the U.S. electric grid to totally renewable energy in the next 10-20 years would be $4.5 trillion (translating to $300 billion per year over 15 years) given current technology, according to a study by energy-and-industry consultant Wood

Mackenzie. Wood Mackenzie estimates that to reach 100% renewable energy would require a “massive investment” to build 1,600 GW of new wind and solar generation and a nearly doubling of high voltage transmission (HVT). The U.S. power grid currently has 1,060 GW of nameplate capacity and 200,000 miles of HVT. All new generation under construction or in development is or will be renewable, renewable/battery-storage and/or natural gas-fired.

Exhibit 7 US Wind Capacity Additions Per Annum

Source: American Wind Energy Association

In 2020, developers commissioned 16,913 MW, representing an 85 percent increase over 2019. There are now 122,468 MW of operating wind power capacity in the United States, with over 60,000 wind turbines operating across 41 states and two U.S. territories. The largest states are: Texas 33.1 GW’s, Iowa 11.7 GW’s, OK 9.0, KS 7.0, C 5.9 GWs, MN 4.3, ND 3.9.

Exhibit 8 Largest Wind Developers in North America

Source: Company documents, presentations and Gabelli Funds

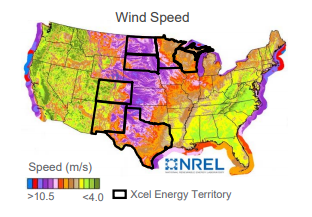

An analysis by S&P Global Market Intelligence shows a pipeline of 172.5 GW of renewable capacity through 2024, with 75.7 GW of wind power projects and 96.8 GW of solar power projects. At the end of December 2020, wind projects totaling 34,757 MW were under construction (17,302 MW) or in advanced development (17,455 MW) (Source: AWEA). Wind developers target regions where the wind blows (Exhibit 9) and where renewable targets and incentives are the greatest (Exhibit 10).

Exhibit 9 US Wind Resources (measure in Wind Speed)

Source:NREL

Many US states have set ambitious renewable energy standards, including 100% renewable energy in New York (2040), California (2045), Hawaii (2045), New Mexico (2045) and New Jersey (2045). Currently 29 states have RPS standards.

Exhibit 10 State Renewable Standards

Source: S&P Global

Offshore wind projects represent 9,079 MW of total development activity, representing 26% of the total development pipeline. Texas hosts more activity than any other state with 13% of the pipeline, followed by Wyoming (10%), Oklahoma (7%), Kansas (5%), and New Mexico (4%). A total of 14 states have over 1,000 MW of wind capacity in the pipeline.

Exhibit 11 Rapid Growth in US Wind Capacity to Accelerate With Offshore Development

U.S. federal, state and local governments have established incentives to encourage the development of renewable energy projects, including accelerated tax depreciation, production tax credits (PTCs), investment tax credits (ITCs), cash grants, tax abatements and renewable portfolio standards (RPS). Given the U.S. federal Modified Accelerated Cost Recovery System (MACRS) wind and solar projects are fully depreciated for tax purposes over a five-year period. Owners of utility-scale wind can choose an investment tax credit or a production tax credits. In late December 2020, the wind development industry received an added incentive in the form of tax credit extensions:

· Wind Power Extension: The new law extended the 1.5 cents/KWh ($15 MWh) PTC eligibility by one year at the current 60% level for projects that start construction before the end of 2021 (formerly 2020) and in service by 2025 (formerly 2024).

· Offshore Wind Credit Extension: The ITC for offshore wind facilities would remain at 30% for construction that begins before 2025, without any step down during the full eligibility period.

As mentioned, the Canadian renewable market is more developed than the US primarily due to the natural resources and geography available. Canada's diversified geography has substantial renewable resources such as moving water, solar, wind, biomass, geothermal and coastal tides that can be utilized to produce energy. Canada gets 67% of its electricity demand from renewables, with hydro power accounting for 68%, followed by nuclear at 15%, coal at 7%, gas/oil/others at 11% and non-hydro renewables at 7%. In 2020, it generated 82% from non-emitting sources and 67% from renewables. Canada aims to be carbon neutral by 2050 and generate 90% of its power from non-emitting sources by 2030. Canada is home to numerous renewable developers and renewable-oriented utilities, which are eager to take advantage of opportunities in the US.

On the next several pages, we highlight the major North American renewable developers and equipment suppliers:

Avangrid Inc. (AGR), based in New Haven, CT, comprises eight regulated utilities in New York, Connecticut, Maine and Massachusetts serving ~2.2 million electric and ~1.0 million gas customers. Iberdrola (Madrid, Spain) owns 81.5% of AGR.

AGR Renewables segment owns 8.5 GW renewable portfolio, which makes it third largest in US, and its 21 GW pipeline (5 GW’s of offshore wind, 4 GW’s of onshore wind, and 12 GW’s of solar) rivals that of NEE’s. The company has 690-MW’s under construction in 2021 and is expected to grow to 13.2 GW’s in 2025, including 2.5 GW’s of solar, 9.0 GW’s onshore wind and 1.6 GW’s offshore wind. In the second half of 2021, AGR expects Bureau of Ocean Energy Management (BOEM) approval of its 800-MW offshore wind project, Vineyard Wind (50/50 partnership with CIP). Further, the Vineyard Wind site has capacity for 5 GW’s of wind and proposed projects were submitted into several pending RFPs. In late 2019, AGR’s Park City Wind project (Partner with CIP) was chosen in the CT RFP. The proposed 804-MW project is located south of Martha’s Vineyard and Nantucket with a COD expected by year-end 2026.

NextEra Energy, Inc. (NEE), based in Juno Beach, FL, is the parent of primary subsidiary, Florida Power & Light (FP&L), is the largest electric utility in FL, and NextEra Energy Resources (NER), is a leading wholesale power generator. FP&L serves 5.0 million customers in Eastern, Southern and Central-Western Florida (25 GWs of generation; 73% gas; 14% nuclear; 14% other).

NER owns 24 GW’s of net generation, including the nation’s largest wind portfolio. NEE owns 101.4 million common units (~58%) of NextEra Energy Partners (NEP) (2,700 MW’s), NextEra Energy has the largest pipeline for U.S. wind and solar projects, with projects totaling 13.6 GW of capacity under development, 8.3 GW of which is solar. In 2020, NER commissioned 5.75 GW’s of wind, solar and storage projects, compared to 2.7 GW’s in 2019. The company also added 7.0 GW’s to its backlog and significantly increased construction outlook to 23-30 GW’s of new renewables from 2021-2024, from 12-19 GW’s over 2019-2022. NER expects to add 9.3 GW’s of renewables (3.7-4.4 GW’s of wind, 4.8-5.6 GW’s of solar, 0.4-0.7 GW’s of repowering and 1.7-2.0 GW’s of energy storage) in 2021-2022 and 12-17.3 GW’s (2.3-3.5 GW’s of wind, 7.0-8.8 GW’s of solar, 2.7-4.3 GW’s of energy storage, and 0.2-0.7 GW’s of repowering) in 2023-2024. NER’s 24 GW’s operating portfolio (includes 5.7 GW’s at NEP), includes 13 GW’s of wind, 3 GW’s of solar, 2.2 GW’s of nuclear, and 3 GW of natural gas/oil. In addition, NER has 8 Bcf of natural gas pipeline capacity operating or under development.

NextEra Energy Partners, LP (NEP), based in Juno Beach, FL, is a limited partnership formed by NextEra Energy to represent a pure play clean energy growth vehicle. In July 2014, NEE IPO’d 20% of NextEra Energy Partners, LP, at $25 per share, and currently owns ~58%. NEE benefits from the ability to “drop-down” assets into NEP to recycle capital for further renewable development, optimize tax credits with gains, maintain a favorable regulated/non-regulated business mix and “highlight” the value of its renewable portfolio. NEP’s current 5,700 MW (4,575 MWs wind; 750 MW’s solar) portfolio represents a small portion of NEE’s non-regulated 24 GW renewable portfolio. NEP also owns natural gas pipelines in Texas.

XCEL Energy (XEL), based in Minneapolis, MN, is a major U.S. regulated utility serving 3.7 million electric and 2.1 million gas utility customers in eight states, including portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas and Wisconsin, through four subsidiaries. XEL also owns two transmission-only subsidiaries.

XEL plans to reduce carbon emissions 80% by 2030 (over 2005 levels) and deliver 100% carbon-free electricity by 2050. XEL owns 3,700 MW’s of wind capacity, contracts for another 6,400 MW’s, expects to add another 800 MW’s in 2021 and 12 GW’s of renewables (4.8 GW’s wind) by 2030.

Berkshire Hathaway (BRK’A/B), owns Energy's operations organized as eight business segments: PacifiCorp, MidAmerican Energy, NV Energy (Nevada Power and Sierra Pacific), Northern Powergrid plc, BHE Pipeline Group (which primarily consists of BHE GT&S, Northern Natural Gas and Kern River), BHE Transmission and BHE Renewables and HomeServices. The Utilities serve 5.2 million electric and natural gas customers in 11 states in the United States, Northern. Powergrid serves 3.9 million end-users in northern England and AltaLink serves approximately 85% of Alberta, Canada’s population.

As of December 31, 2020, the company owns 33,700 MWs of generation capacity in operation and under construction, 29,000 MWs of regulated generation and 4,700 MWs of nonregulated, which is 38% wind and solar, 32% natural gas, 24% coal, 5% hydroelectric and geothermal and 1% nuclear. Cumulative investments in wind, solar, geothermal and biomass generation facilities is $34 billion. New wind-powered generating facilities totaling 674 MWs were placed in-service during 2020 with another 516 MWs expected to be placed in-service during 2021.

WEC Energy Group (WEC), based in Milwaukee, WI, is the holding company for Wisconsin Electric (WEPCO), Wisconsin Gas (WG) and We Power. In 2015, WEC acquired Chicago-based Integrys Energy Group and its five regulated utilities including Peoples Gas (PGL), Wisconsin Public Service (WPS), Minnesota Energy Resources (MERC), North Shore Gas (NSG), and Michigan Gas Utilities (MGU). The combined company serves 1.6 million electric and 2.9 million gas customers in WI, Illinois, Michigan and Minnesota as well as owns 60% of American Transmission Corporation (ATC), the WI transmission grid owner/operator.

WEC set targets for its electric generation fleet to be carbon neutral by 2050 (70% below 2005 by 2030). In 2020, WEC installed capacity was 7.7 GW’s (31% coal, 31% gas, 5% renewables, 32% purchased. Over 2021-2025, WEC plans to invest $4.1 billion on renewables to add 1.8 GW‘s of wind, solar, and battery storage. Since late 2018, WEC has acquired 1.3 GW of six separate wind farms in NE, IL, and SD. Management noted that it would likely increase its appetite for renewable projects should the corporate tax rate be raised.

Duke Energy(DUK), based in Charlotte, NC, includes three business segments: Electric Utilities and Infrastructure, Gas Utilities and Infrastructure and Commercial Renewables. DUK serve 7.9. million customers in IN, OH, KY, NC, SC, and FL. Duke Energy Carolinas, Duke Energy Progress, Duke Energy Florida, Duke Energy Indiana and Duke Energy Ohio. Gas Utilities and Infrastructure distributes natural gas to retail customers in its North Carolina, South Carolina, Tennessee, Ohio and Kentucky service territories. Total 2020 rate base was $82 billion Carolinas ($45 electric; $6 Piedmont), (FL-$16). The company owns 53 GW’s of capacity, including 49 GW’s regulated (30% nuclear, 18% coal, 31% gas, 19% purchased and 2% hydro/solar. DUK targets net zero by 2050 and will retire all 15 GW’s of coal by 2030.

The renewable development segment owns 2,763 MW (1,426 MW’s of wind) across 21 states from 21 wind facilities, 150 solar projects, 70 fuel cell locations and two battery storage facilities. Renewables deployment expected to accelerate through 2025 to reach 16 GW goal. By 2050, renewables projected to be Duke Energy’s largest source of energy, making up over 40% of our generation capacity

Dominion Energy (D), based in Richmond, VA, is one of the larger electric (Virginia Power serves 2.7 million customers in VA and NC; SCANA serves 760,000 electric and 405,000 gas customers), and gas (3.1 million customers in 5 states) utilities in the U.S. The company owns 30 GW (26 GW’s regulated and 3.5 GW’s non-regulated) of generation and 10,500 miles of electric transmission. In 2020, D’s regulated fuel mix was 10% coal, 45% gas and 45% zero carbon (nuclear and hydro) non-regulated (3,475 MW’s) was 58% nuclear and 42% solar.

D plans to invest $17 billion in offshore wind (5.2 GW’s) and $20 billion (16 GW’s) in onshore wind, solar and battery storage over the 2020-235 period. The company estimates its first major offshore wind farm totaling 2.6 GW’s will cost $8 billion, or $3,000/kW (includes transmission) with a levelized cost of $80-90 per MWH. The plant plans to use Siemens-Gamesa 188 14 MW turbines and begin construction 2024 and be in service by 2028.

Evergy, Inc. (EVRG), based in Topeka, KS, is an electric and gas utility serving 1.6 million electric customers in central and eastern KS, including the cities of Topeka and Wichita and western MO, including Kansas City. EVRG’s 14,800 MW generation portfolio consists of 5,900 MW’s of coal, 4,000 MW’s gas, 3,600 MW’s wind, and 1,100 MW’s nuclear. In mid-2018, Westar Energy and Great Plains Energy combined to form Evergy. In February 2021, EVRG entered into agreements with Bluescape Energy and Elliott Investment Management. which puts John Wilder of Bluescape, and former U.S. Senator Mary L. Landrieu on the 14-person Evergy Board of Directors, effective March 1. Bluescape plans to buy $115 million of newly issued EVRG common shares with the option to purchase additional shares over the next three years. In March of 2020, Elliott also added two board members, reduced the board from 17 members to 13 members, and formed a committee to explore ways to enhance shareholder value. The activist investors are pushing a greater renewable energy mix as well as other shareholder value items. We expect EVRG’s pending integrated resource plans in MO and KS to include significant investments in new wind.

EverSource Energy (ES),formerly Northeast Utilities, is New England’s largest energy delivery system, serving 3.6 million customers in CT, NH and MA. In 2012, NU merged with NSTAR (Boston, MA). Regulated utilities include: The Connecticut Light and Power Company (CL&P), NSTAR Electric, NSTAR Gas, Public Service Company of New Hampshire (PSNH), Western Massachusetts Electric Company (WMECO) and Yankee Gas (YES). In late 2017, ES purchased Aquarion Water (AW) for an enterprise value of $1.675 billion ($770 million rate base), including $795 million of assumed debt. AW serves nearly 230,000 customers in CT, MA, and NH. ES targets carbon neutrality by 2030.

ES’ pending offshore wind projects are Orsted-JV’s and located on the same 250-square mile tract, 30-miles east of Long Island’s Montauk Point. Construction has been delayed as the Bureau of Ocean Energy Management (BOEM) reviews projects and policy of the nascent US offshore wind industry. They include South Fork Wind Farm (130-MW), Revolution Wind (704-MW) and Sunrise Wind (880-MW). A separate ES/Orsted joint venture, Bay State Wind (BSW), has proposed a large-scale offshore wind project (4,000 MW potential) on 550 square miles south of Martha’s Vineyard, MA.

Ameren (AEE), based in St. Louis, MO, has four regulated electric and gas utilities, including Ameren-Missouri (AEE-MO). AEE-MO is a fully integrated electric utility serving 1.2 million electric (0.1 million gas customers) throughout MO and owns 10.3 GW’s of generation (71% coal, 19% nuclear, 10% other). AEE’s 2020 Integrated Resource Plan (IRP) targets net-zero carbon goal by 2050, 85% carbon reduction by 2040, and 50% by 2030. The plan calls for the exit from coal-fired generation by 2042, including Sioux Energy Center (2028) and the Rush Island (2039) and adding 3,100 MW ($4.5 billion) of new wind/solar by 2030 and 5,400 MW ($8 billion) by 2040. AEE also seeks to extend the operating license of the Callaway Nuclear Energy Center beyond 2044. In December 2020 and January 2021, AEE-MO acquired the 400-MW High Prairie Renewable Energy Center (REC) and the 300-MW Atchison REC. The Build-transfer agreements result in 700-MW’s of wind ownership for roughly $1.2 billion.

ALLETEInc. (ALE), based in Duluth, MN, is an energy utility with its largest segment being traditional regulated electric utilities, including Minnesota Power & Light (MPL), Superior Water Light and Power (SWL&P) and 8%-interest in the American Transmission Company (ATC). In addition, ALLETE Clean Energy is the non-regulated renewable power company with 740-MW’s of nameplate capacity and 600-MW’s of wind under construction.

Alliant Energy (LNT), based in Madison, WI, is a mid-cap regulated electric and gas utility operating through Interstate Power & Light (IPL) and Wisconsin Power & Light (WPL). IPL serves 490,000 electric and 225,000 gas customers. WPL serves 480,000 electric and 195,000 gas customers in south and central WI and owns 16% of American Transmission Company (ATC), an independent transmission company. LNT plans to reduce carbon by 50% from 2005 levels by 2030, eliminate all coal by 2040 and net zero carbon by 2050. In 2020, LNT’s generation fuel mix was 41% gas, 34% renewables, and 25% coal.

By 2030, LNT expects to be 53% renewable, 40% gas and 7% coal. In 2020, LNT completed its 1,150 MW Iowa wind program and is now the third largest owner and operator of wind in the US. LNT owns and operates 1,957 MW’s of renewables and is engaged in purchased power agreements for another 1,082 MW’s. In 2019 and 2020, LNT placed into service 470-MW’s and 680-MW’s, respectively. The company also plans to add 1.4 GW’s of solar by the end of 2023, including 400 MW’s in Iowa and 1 GW’s in WI. IPL’s Iowa Clean Energy Blueprint outlines the company’s plans to increase the use of renewable resources, including solar power, add more battery storage and build out the connected energy network.

American Electric Power (AEP), based in Columbus, OH, regulated utility serving 5.4 million customers in 11 states. The company owns 24 GW’s of generation and the 2020 fuel mix was 43% coal, 29% gas, nuclear 8%, renewable 18%, and 2% efficiency.

By 2030, AEP forecasts the fuel mix to be 24% coal, 26% gas, 39% renewables, 4% efficiency. AEP targets 70% carbon reduction by 2030 and 80% by 2050. The company currently owns 2.4 GW’s of renewable capacity and purchases another 2.9 GW’s under contract. AEP highlights that its significant transmission system is interconnected with 16.3 GW’s of renewable generation. In addition to significant coal retirements, AEP plans to add 1.8 GW’s of wind and 300 MW’s of solar in 2021-2022 and 5 GW’s of wind and 2.2 GW’s of solar between 2023-2030. The company’s pending North Central Wind project totals 1.5 GW’s spanning OK, AR, and LA is expected to be complete in phases between March 2021-2022.

Algonquin Power & Utilities Corp. (AQN)is a diversified utility company and owns and operates a diversified portfolio of North American rate-regulated and non-regulated electricity, natural gas, and water utility businesses. The company acquires and operates green and clean energy assets including hydroelectric, wind, thermal, and solar power facilities, as well as sustainable utility distribution businesses (water, electricity and natural gas) through its two operating subsidiaries: Liberty Power and Liberty Utilities. Roughly 70% is regulated water, electric and gas utilities across 16 jurisdictions and 30% is North American Renewables. The company has 3 GW’s of renewables in operation and under construction and another 3.4 GW pipeline.

Brookfield Renewable Partners (BEP), based in Toronto, Canada, operates one of the world’s largest publicly traded, pure-play renewable power platforms. BEP’s tracking stock trades under symbol BEPC with one BEPC for each for every four shares of BEP. BEPC is 1099-paying C-Corp traded on both the TSX and NYSE, while BEP shareholders in US receive a K-1 and Canadian a T5). BEP and BEPC are economically equal and shares of BEPC are fully exchangeable into shares of BEP. Brookfield Asset Management (BAM) owns 330 million shares, or 51% of BEP. BEP’s 19,000 MW Portfolio including 7,924 MW’s of hydro-capacity, 4,727 MW’s of wind capacity, 3,333 MW’s of solar capacity, 2,698 MW’s of storage and 590 MW’s of other as well as a 23 GW development pipeline, including 4.2 GW’s under construction.

Boralex (BLX-TSE), based in Kingsey Falls, Quebec, and originally formed in 1990 to operate a cogeneration plant, has become a growing pure play renewable energy (80-85% wind energy) as an owner, operator and developer with 2,455 MW of capacity in Canada (40%), France (42%), and the US (12%). Larger projects include 272 MW Seigneuries De Beaupre wind farm in Quebec, 250 MW Niagara region Wind Farm in Ontario, and the 200 MW Apuiat Wind Farm in Quebec. BLX-T considers France and the US to offer significant growth potential given dependence on aging nuclear fleets. The company’s renewable pipeline totals 2.5 GW’s, including 480 MW’s of secured projects.

Innergex Renewables (INE-TSX), founded in 1990, is an independent renewable power producer, which develops, acquires, owns and operates hydroelectric facilities (800 net MW’s), wind farms (1,600 net MW’s), and solar farms (370-net MW’s). The company has operations in Canada (53%), the United States (32%), France (9%), and Chile (7%). The asset portfolio consists of interests in 75 operating facilities with a net installed capacity of 2,742 MW (gross 3,694 MW), including 37 hydroelectric facilities, 32 wind farms, and six solar farms. Innergex also holds interests in 10 projects under development, four of which are under construction, with a net installed capacity of 556 MW (gross 630 MW) and an energy storage capacity of 329 MWh, as well as prospective projects at different stages of development with an aggregate gross capacity totaling 6,875 MW. The renewable pipeline consists of 10 projects under development and several prospective projects at different stages of development. In February 2020, Hydro-Québec

committed an initial $500 million to be entirely and exclusively dedicated to co-investment projects with Innergex. Hydro-Québec also made a $660.9 million investment in Innergex, through a private placement of Innergex common shares

Northland Power (NPI-TSX), based in Toronto, Canada and publicly-traded since 1997, NPI is an independent power developer that owns 2.3 GW (net) of operational capacity in natural gas-fired and renewable power generation. The company targets 7 GW’s by 2030 and has an active growth pipeline, including more than 2,300 MW (net) of wind farms in development in North America, Taiwan, Japan, South Korea and Europe. With 1.2 GW (net) in operation in offshore wind in three assets, NPI is one of the few independent companies with high exposure to offshore wind. Northland is 60% owner of the Hai Long 1,030 MW offshore wind project (40% partner Yushan Energy Co. Ltd.) located 50-70 km from the Shore of Changhua County. The project is targeted for 2024-2025 and committed to using the Siemens Gamesa's 14 MW offshore wind turbine. The company is also developing three separate wind projects (324-MW’s) in the state of New York. NPI has visibility on opportunities to deploy $15-20 billion of capital investment into new renewable projects over the next five years, anchored by offshore wind projects that are currently in active development. NPI has contract offers for its NY Wind and Hai Long projects and could soon see a contract for its recently announced Baltic Power project

TransAlta Renewables (RNW-TSX) owns a diversified Canadian renewable asset base, including 1,446 MW’s of wind, 112 MW’s of hydro, and 21 MW’s of solar and 10 MW’s of battery storage. The company also owns 949 MW’s of gas plants in Australia. The company has announced $3.4 billion of acquisitions since its 2013 IPO in 2013, including its December 2020 announcement of a $439 million acquisition of wind & cogeneration. TransAlta Corporation’s intention is to remain a long-term majority shareholder and to operate and maintain the assets under a service agreement with TransAlta Renewables. TransAlta Renewables has the potential to access other assets remaining within TransAlta, as well as to pursue and capitalize on strategic growth opportunities through the acquisition. Future development is primarily focused in North America (1 GW wind development pipeline) and Australia. Total development pipeline is 2 GW’s.

AES Corp (AES), based in Arlington, VA, is a global energy company operating via four market-oriented business units: US and Utilities (United States, Puerto Rico and El Salvador); South America (Chile, Colombia, Argentina and Brazil); MCAC (Mexico, Central America and the Caribbean); and Eurasia (Europe and Asia). The company owns 30.3 GW’s (20.4 GW’s net) of generation (37% renewable, 27% coal, 33% gas, and 3% oil/diesel/pet). AES' six utility businesses distribute power to 2.5 million people in two countries, including two utilities in the U.S. (IPL 3,973 MW and DPL) and four utilities in El Salvador. AES’ joint venture with Siemens, Fluence, is the global leader in the fast-growing energy storage market, which is expected to increase by 15 to 20 GW annually. In December 2020, the Qatar Investment Authority agreed to invest $125 million in Fluence.

AES targets 7% to 9% CAGR for adjusted EPS and plans on renewables growth of 3 to 4 GW’s annually. AES targets to achieve portfolio-wide net zero carbon emissions from electricity sales by 2040 and to reduce coal generation to below 10% by 2025. At year-end 2020, AES owned 3.1 GW’s of renewables with 32 GW pipeline, including 7.5 7W’s from wind.

Atlantica Sustainable Infrastructure PLC (AY), (formerly Atlantica Yield plc), based in Brentford, UK, completed an IPO in 2014 as a yieldco sponsored by Abengoa. On November 1, 2017, Algonquin (AQN) agreed to acquire 25.0% from Abengoa and is AY’s largest shareholder. On November 27, 2018, Algonquin acquired from Abengoa the remaining 16.5% and currently owns 44.2%. Atlantica is a sustainable infrastructure company that owns and manages renewable energy, efficient natural gas, transmission and transportation infrastructures and water assets. The company currently own 27 assets, comprising 1,551 MW of aggregate renewable energy installed generation capacity, 343 MW of efficient natural gas-fired power generation capacity, 1,166 miles of electric transmission lines and 17.5 Mft3 per day of water desalination assets located in North America (United States, Canada and Mexico), South America (Peru, Chile and Uruguay) and EMEA (Spain, Algeria and South Africa). Core geographies are North America, South America and Europe.

Clearway Energy (CWEN), based in Princeton, NJ and formerly NRG Yield, is a publicly-traded energy infrastructure company with 2,600 MW’s of wind, 2,500 MW’s of natural gas plants, 1,200 MW’s of solar across and 1,400 MW’s of steam and chilled water. North America. (42.4% owned by global infrastructure funds and sponsored by Global Infrastructure Partners -GIP) through GIP's portfolio company, Clearway Energy group (CEG). The company was formed in 2012 as NRG Yield, CWEN was formed by NRG. CWEN has a right of first offer for roughly 1,200 MW’s of assets including 510-MW’s of wind projects in WV and TX, and 650-MW’s

Wind Equipment Component Suppliers

Eaton Corporation (ETN) is a leading provider of electrical hardware and software (with approximately $11 billion, or 70%, of total revenue coming from global electrical markets. As renewable power sources such as wind and solar comprise an increasing proportion of the grid, frequency regulation becomes more important (given the intermittent nature of wind and solar power). Eaton’s electrical transformers, reclosers, and software help meet the load balancing and frequency response needs of utilities. We expect Eaton to benefit from higher content for its electrical solutions as the U.S. and global markets move towards a distributed grid and renewable power sources.

ABB (SIX: ABBN) is a key global supplier of electrical components, systems, and services to the wind industry with products and services covering power generation to collection and transmission. Its products include yaw and pitch systems for the mechanical movement of the turbine’s nacelle relative to the wind, generator and convertors for the electrical drivetrain, turbine controller (PLC) to ensure performance within defined values, other auxiliary systems, transformers, substations and switchgears for the grid connection. ABB’s consulting unit helps customers with system planning, feasibility studies, and site analysis in the design phase as well. With a global, complete, and customizable offering, we expect ABB to benefit as wind power increases its share in the global energy market.

Arcosa Inc. (ACA) has played a key role in the wind value chain for many years as the largest independent producer of wind towers in North America, where it competes with Broadwind Energy, Vestas (captive), Canada-based Marmen, and new Texas entrant Gestamp Renewables. The towers have grown in size with the turbine blades. The fortunes of Arcosa’s wind business, both sales and profitability, have varied with the number and MW of turbines shipped in the US, and currently account for about $300mm of Arcosa’s $2 billion of sales. Arcosa’s utility structures business also benefits from wind installations as such installations necessitate more transmission, which supports the demand for Arcosa’s transmission poles.

General Electric (GE) is one of the largest Western producers of onshore wind turbines, with a strong positon in the North American market, although this $10B+ business has recently operated at very thin margins. Its 14 MW Haliade-X offshore turbine was introduced after competitors’ offerings, but has received over 5.7GW of commitments, most notably the three phases of the Dogger Bank UK wind farm and the Avangrid Vineyard Wind project, where it replaced Vestas.

Timken Co. (TKR) has a strong position in the renewables supply chain as a supplier of large diameter tapered roller bearings and gearboxes for wind turbine installations. Its renewable business comprised about 12%, or $425mm of its $3.5 billion 2020 revenues, of which 75% was tied to wind. Its revenues as a supplier to the wind turbine manufacturers are skewed towards Asia, where it derives over half of its wind revenue, with a large presence in China. The business is essentially all OE today but should drive aftermarket revenues towards the end of the decade. Other bearings companies also supply the industry, however they 1. have emphasized the wind market less; 2. benefit less as tapered roller bearings replace spherical bearings in larger turbines; and 3. see their wind revenue diluted by bearings offerings in automotive end markets.

American Superconductor Corporation (AMSC)provides software and super-conductor based systems for megawatt-scale power flow. The company’s Wind segment accounted for $14 million, or 22%, of total revenue in Fiscal 2020 though operated at a loss (of $8 million). Customers include Fuji Bridex in Singapore, Consolidated Power Projects Pty in South Africa, Ergon Energy in Australia, and Vestas. The company is targeting further growth for its Wind business in India and South Korea.

Valmont Industries, Inc. (VMI),headquartered in Omaha, Nebraska, manufactures fabricated metal products serving irrigation and global infrastructure markets as well as coating services. The company operates in four primary segments: Engineered Support Structures (ESS), Utility Support Structures (USS), Irrigation and Coatings. The company’s wind exposure is primarily in its Valmont SM business, which Valmont acquired in 2014. This business manufactures tower support structures for both onshore and offshore wind markets, as well as rotor housings, for European customers. This business is estimated at around $90 million, or 3% of total company revenue. Importantly, VMI has exposure to the growing renewable generation profile in the rest of its Utility Support Structures business ($800 million), which supports transmission development and grid resiliency.

TPI Composites (TPIC), based in Scottsdale, AZ, manufactures composite wind blades for OEM wind turbine manufacturers. The company maintains a global manufacturing presence, with approximately 30% of its revenue generated from its manufacturing of wind blades in China, where it maintains several facilities, 30% of revenue served from its facility in Juarez, Mexico, and 30% served from its facility in Izmir, Turkey. The company maintains several facilities in the US as well.

Altra Industrial Motion (AIMC), headquartered in Braintree, MA, is a leading industrial global manufacturer and supplier of highly engineered motion control, automation, power transmission, and engine braking systems and components. Altra's portfolio consists of 27 well-respected brands including Bauer Gear Motor, Boston Gear, Jacobs Vehicle Systems, Kollmorgen, Portescap, Stromag, Svendborg Brakes, TB Wood's, Thomson and Warner Electric. The company’s Stromag business, acquired in 2017, produces yaw and rotor brakes and couplings for wind turbine applications in extreme conditions, with its own testing facility in France. We estimate the business generates approximately $70 million, or 4% of revenue.

AZZ Inc. (AZZ), based in Ft. Worth, TX, is an industrial products and services company providing galvanizing and metal coating services, welding solutions, and specialty electrical equipment to the power generation, transmission & distribution, refining, and industrial end markets. It is the largest hot-dip galvanizing provider of fabricated steel in the US, servicing fabricators or manufacturers across a broad variety of infrastructure end markets, including the utility and renewables sectors. Additionally, AZZ provides a full range of solutions for wind energy collector and interconnect substations in its Energy segment, including protective relay and control systems, metal-clad switchgear and e-houses.

SPX Corp (SPXC), based in Charlotte, NC is a diversified, global supplier of infrastructure equipment with scalable growth platforms in heating, ventilation and air conditioning (HVAC), detection and measurement, and engineered solutions. In utility markets, SPX is a leading manufacturer of medium and large power transformers under the Waukesha brand, as well as equipment for various types of power plant, including cooling equipment for power generation and industrial markets. Additionally, in 2020 SPX acquired ULC Robotics, a leading developer of robotic systems, machine learning applications and inspection technology for the energy, utility and industrial sectors.

Schaeffler AG (Xetra: SHA) is a Germany-based company primarily engaged in the manufacture of automotive parts. Its activities are divided into two business segments: Automotive and Industrial. The Automotive segment produces rolling bearing solutions, products for belt and chain drives, as well as valve train components, torsion and vibration dampers, clutches and double clutch systems, torque converters, and power-assisted steering systems. The Industrial segment produces bearings, including for renewable energy applications.

European Utilities

In order to meet the European Commission’s 55% target, the share of renewables in the electric mix needs to increase to 65% by 2030, from 32% today, at a cost of $430 billion (Eurostat). In 2020, Europe's offshore wind market attracted a record €26.3 billion of investments to finance 7.1 GW of new capacity. (WindEurope). According to WindEurope, European government commitments add up to 111 GW of capacity to be developed by 2030. To make this happen, they urged for further regulatory support.

EDP (Lisbon- EDP), based in Lisbon, Portugal, is a Portuguese electric utility. In 2007, EDP bought Horizon Wind Energy, the Texan-based wind power producer, which helped boost the company’s renewable platform. The firm's renewables operations (including Horizon) are now contained within its majority-owned subsidiary EDP Renováveis, 25% of which was floated on the Lisbon Stock Exchange in 2008. In late 2018 EDP's largest shareholder, China Three Gorges Corporation, proposed a hostile takeover of EDP. This was ultimately rejected at the shareholders meeting on April 24, 2019.

EDP Renewables (Lisbon- EDPR), based in Lisbon, Portugal, is the world’s third-largest wind energy producer serving 15 markets (Belgium, Brazil, Canada, France, Greece, Italy, Mexico, Poland, Portugal, Romania, Spain, the UK, US, Colombia and Hungary). EDPR 12.2 GW’s of installed capacity (5 GW’s in Europe, 6.7 GW’s in North America and 0.5 GW’s in Brazil) and a significant development pipeline.

EnBW (Xetrea: EBK), based in Karlsruhe, Germany, is a German electric utility serving the German state of Baden-Wurttemberg. The renewable project pipeline totals 1,700 MW, including construction of Germany’s biggest solar farm, the 180 MW Weesow-Willmersdorf project in Brandenburg. The company expects to bid on the large volume of onshore wind projects in the pipeline in Germany and added 609 megawatts via the Albatros and Hohe projects in 2019.

Enel (Milan- ENEL), based in Rome, Italy, is one of the largest utilities in the world. The company was privatized in 1999 and the Italian state still owns 23.6%. The company also owns Endesa, Spain’s largest utility, Enel Green Power, and interests throughout the world, including 90 GW’s of generation (43.4 GW’s of renewables). Roughly 44% of 2018 EBITDA of E16.2 billion was derived in Italy, 27% from South America, 22% from Iberia, and the rest from the rest of Europe and North America. In addition, roughly 47% is derived from the utility or networks business and 28% from renewables. The company strategy is to grow its networks and renewable business in a sustainable and disciplined manner.

Enel Green Power, based in Rome, Italy, was founded in December 2008 inside the Enel Group to develop and manage power generated from renewable resources worldwide. In November 2010, following Enel's acquisition of Endesa in June 2009, the

company made an initial public offering of 30.8% of Enel Green Power in the Italian Stock Exchange and the Bolsa de Madrid. Enel Green Power is one of the larger renewable energy companies in the world with 47 GW’s of renewable capacity around the world, including 5.0 GW’s of solar, 13.4 GW’s of wind, 27.8 GW’s of hydro, 0.9 GW’s of geothermal, and 0.1 GW’s of biomass. Roughly 23 GW’s in Europe, 14 GW’s in central and South America, and 9 GWs in North America. The company has a global renewable pipeline of 110 GW’s (51 GW’s mature pipeline).

Engie (Paris- ENGI), based in La Defense, France, formed after the 2008 merger of Gaz de France and is a French multinational electric utility company. The company operates in the fields of energy transition, electricity generation and distribution, natural gas, nuclear, renewable energy and petroleum. The company is involved in both upstream (engineering, purchasing, operation, maintenance) and downstream (waste management, dismantling) activities. Since 2016, ENGIE has been in transition, exiting coal activities and by investing in renewable and in May of 2020, the company determined to accelerate the transition towards a carbon-neutral economy, through reduced energy consumption and more environmentally-friendly solutions.

EDF (Paris- EDF), based in Paris, France, is a French multinational electric utility company, largely owned by the French state. EDF operates a diverse portfolio of 120+ gigawatts of generation capacity in Europe, South America, North America, Asia, the Middle East, and Africa. Its 58 active nuclear reactors (in France) are spread out over 19 sites (nuclear power plants). In 2017 EDF took over the majority of the reactor business of Areva, in a French government sponsored restructuring. Via state order, 17 of EDF’s nuclear power reactors could be retired by 2025 to meet legislative targets. In 2019, the French government asked EDF to develop proposals for three new replacement nuclear power stations.[10] Until 19 November 2004, EDF was a state-owned corporation, but it is now a limited-liability corporation under private law (société anonyme), after its status was changed by statute.

E.ON (Xetra- EOAN), based in Essen, Germany, network business serves 14 million customer in Germany, 10.5 million in the UK, and 28 million in Sweden, CEE and Turkey. The company also owns 74 GW’s of renewable capacity.Engie (1,108), RWE In 2019 RWE transformed itself into a global renewable energy. The company completed an extensive asset swap with E.ON, where RWE sold its 76.8 % investment in Innogy and received in return E.ON’s renewable energy business, a 16.67 % stake in E.ON, and the minority interests in RWE’s nuclear power stations Gundremmigen (25 %) and Emsland (12.5 %) held by the E.ON. In July 2020, RWE took ownership in the renewable energy business, the German and Czech gas storage facilities, and a 37.9 % stake in the Austrian energy utility Kelag.

Iberdrola (MCE- IBE), based in Madrid, is one of the larger electric and gas utilities in the word, including ownership of 55.1 GW’s (52.1 GW’s in 2020) of power generating capacity 34.8 GW’s of renewable capacity (18.5 GW’s on shore wind, 1.3 GW’s offshore wind, 12.9 GW’s hydro, 3.2 GW’s nuclear). In 2020, Iberdrola’s rate base was E31.1 billion (Spain E9.3 billion, UK 6.9 billion pounds, US $10.9 billion, and Brazil 26.5 billion BRL). Spain is 30%, US is 31%, UK 25%, Brazil 14%. In 2020, roughly 34% of the company’s EBITDA was generated in Spain, 23% in the US, 21% in the UK, 22% in Brazil. Over 2020-25, Iberdrola plans to invest 75 billion euros with 51% in renewables and 85% in Europe and the US.

Orsted (CPH- ORSTED), based in Denmark, has, over a period of 15 years, transformed itself from a Danish utility company based on coal, oil and gas to an international renewable energy company and offshore wind champion based. In 2017, the company began to phase out coal divested its oil and gas business. At year-end 2020, Orsted owned 11.3 GW’s of installed capacity, including 7.6 GW’s of offshore wind, (4.4 GW’s in the UK, 1.4 GW’s in Germany, 1.0 GW’s in Denmark, 800 MW’s in the Netherlands and 30 Mw’s in the US.), 1.7 GW’s of onshore wind and 2 GW’s of thermal capacity. The company has 4 GW’s of renewables under construction (2.3 GW’s offshore) and 5 GW’s awarded and contracted. The offshore build out plan includes major projects won in the UK, Tawain, the US, and Germany. The company targets 15 GW’s of offshore capacity and 5 GW’s of onshore capacity by 2025.

RWE (Xetra- RWE) targets to phase out of its 12.7 GW’s of coal capacity by 2038 and achieve carbon neutrality by 2040. The company plans to grow its 9.2 GW’s (38% in the US, 24% in the UK, 16% in Germany, other-Eurpe-16%) of installed capacity to 13 GW’s by 2022. RWE has a 20 GW development pipeline including several projects under construction. Projects under construction include the Triton Knoll (UK) and Kaskasi (Asian) offshore wind projects, 840--MW’s of US onshore wind projects, and 500 MW’s of solar projects. RWE acquired Nordex’s 2.7 GW European Onshore Wind/Solar development pipeline, which underpins its future growth ambitions.

Chinese Companies in the Wind Ecosystem

According to the National Energy Administration (NEA), 71.7GW of new wind capacity was installed in 2020. Excluding volume that was installed in 2019 and grid connected in 2020, the Chinese Wind Energy Association estimates new grid wind power capacity for 2020 was 45.4GW. The IEA estimates China’s onshore wind net capacity additions will represent 48% of global additions in 2020, or 29GW of 60GW. Onshore wind capacity, which represents over 95% of wind power is expected to grow in the teens.

Offshore additions are growing rapidly off a small base, with some estimates at over 50% growth. According to a 2019 Global Wind Energy Council report, China represented 40% of global offshore wind capacity additions (2.5GW, +51% yoy) in 2019, and represents 23% of global offshore wind capacity. The Global Wind Energy Council expects continued accelerated China offshore wind installations ahead of the expiration of the Feed-in-Tariff (0.75-0.85RMB/kWh for 20 years) for offshore before the end of 2021 – after 2021, GWEC expects an average of 4.77GW/year of capacity to be added from 2022-2030.

As China continues to develop its own technologies and innovations to lessen its dependence on others, domestic wind companies stand to benefit from growth at home, as well as from global demand. As might be expected, many of the companies have high State ownership. Companies include:

Baoding Tianwei Baobian Electric Company (600550-SH) is primarily a manufacturer of power transformers, but also a manufactures wind power equipment and turbines. SOE: China South Industries Group owns 44.6% and Baoding Tianwei Group owns 19.1%

CECEP Wind Power Corp (601016-SH) develops and operates wind power projects. SOE: China Energy Conservation and Environmental Protection Group owns 47.9% and National Social Security Fund owns 5.6%

Century Wind Power (2072-TW) is a Taiwan based manufacturer of offshore wind power components for underwater construction such as jackets, pin piles and monopiles.

China Longyuan (916-HK) constructs and operates wind power and coal power plants. State owned CHN Energy controls 58.4% and is one of the world’s largest energy companies – it was born from the state orchestrated combination of China Guodian Corp. and Shenhua Group in 2017.

Dongfang Electric Corp. (600875-SH) manufactures power generation equipment for thermal, hydro, wind, nuclear and gas power generation. SOE: 62.1% owned by Dongfang Electric

Xinjiang Goldwind Science & Technology (2208-HK; 002202-SZ) remains the third largest turbine company in the world as of 2020. As China continues to be the world’s largest wind energy market and number one wind turbine installer, Goldwind significantly benefits by this soaring demand, making it the largest wind turbine manufacturer in China. By late 2019, Goldwind has installed a total capacity of over 50GW wind turbines in more than 20 major countries around the world.

Guodian Tech’s (1296-HK) Wind Power Products and Services segment sells turbines and other components as well as maintains and repairs wind turbine generators. This segment represented ~41% of the company’s RMB12.0 billion ($1.8 billion) in 2019 revenue. SOE: CHN Energy and Guodian Power each own 39.2%.

Minyang Smart Energy Group (601615-SH) manufactures wind turbines, solar products and is a clean energy integrated solution provider. According to the company, it invests in and runs more than 400 wind farms globally. The company is mainly engaged in the wind energy and solar energy sectors, ranking the 37th among the World Top 500 New Energy Enterprises and the 1st in offshore wind innovation. In early 2020, MingYang Smart Energy has revealed plans to develop a 10 MW typhoon-resistant floating wind turbine, the project is valued at CNY 2.5 billion.

SANY Group is primarily a construction machinery company, but also manufactures wind turbines and builds wind farms. Listed subsidiary SANY Heavy Equipment (631-HK) is a beneficiary of increased construction of wind farms and other projects.

Shanghai Electric (601727-SH, 2727-HK) designs and manufactures electric power and industrial equipment. Its energy equipment segment includes onshore and offshore wind power equipment and turbines, and the company is China’s largest offshore equipment manufacturer. The company is looking to spin off its wind business for listing on Shanghai’s STAR market. SOE: Shanghai Electric Group owns 66.4%.

Shanghai Taisheng Wind Power Equipment (300129-SZ) manufactures and sells offshore wind power generation equipment, including wind towers, jackets, pipe piles, offshore engineering platforms and marine engineering equipment. The company also operates and maintains wind farms.

Taiyuan Heavy Industry (600169-SH) is a heavy industrial equipment manufacturer that also sells wind turbines and offshore construction equipment.

Zhejiang Windey (300772-SZ) is the oldest wind turbine manufacturer in China. The company also invests in and operates wind farms, and provides services covering the life-cycle of wind power projects. Its headquarters and R&D centre are seated in Hangzhou, with other three production bases across China. Its products are mainly 1.5 MW, 2.XMW and 3.XMW wind turbines.

Japan Wind Players

In October 2020 Prime Minister Yoshihide Suga committed to cutting greenhouse gases to zero on a net basis and becoming a carbon neutral society by 2050. Prior to this, Japan’s goal was for carbon neutrality was as soon as possible in the second half of the century. In 2020 Japan’s installed new wind power capacity of 449 MW vs 271 MW in 2019, bringing its total capacity of wind power generation for 2020 to 4,372 MW. Offshore and semi-offshore capacity represents only 2% of wind power capacity, or 85MW. On the equipment side, European wind power companies have a greater presence than domestic companies in japan, often aided by partnerships or JVs with Japanese companies. Japanese wind players include:

Electric Power Development aka J-Power (9513-TO):Electric utility in Japan, primarily from coal and hydroelectric power stations, but has some exposure to renewable.

Eurus Energy develops, constructs and operates wind and solar farms. It is a JV between Toyota Tsusho and Tokyo Electric Power (9501-TO).

Hitachi (6501-TO) is a conglomerate operating in a number of sectors and businesses including equipment and plants for power generation. The company manufactured wind turbines prior to 2019, after which it partnered with German Enercon, to market Enercon’s turbines and equipment, and focus on providing services and solutions for the industry.

Komaihaltec (5915-TO) primarily manufactures and constructs steel structures, bridges, and construction equipment, but also manufactures wind turbine systems.

Mitsubishi Heavy Industries (7011-TO) operates in several areas including energy, infrastructure and heavy equipment, logistics, space/defense systems and aviation. MHI sells wind power generators and has teamed up with Vestas Wind to form a JV specializing in offshore wind power systems.

South Korean Players

South Korea: In 2019, renewable energy represented a small 6% of South Koreas electric output, which compares to 1% ten years ago. Over 2009-2019, fossil fuels share of electricity generation has increased from 66% to 69% as natural gas increased from 16% to 26%, coal decreased from 46% to 40%, oil decreased from 4% to 3%, and nuclear energy decreased from 33% to 25%. In July of 2020, President Moon Jae-In announced the country’s Green New Deal, as part of the Korea New Deal, a national development strategy with planned investments of 160 trillion won. The Green New Deal has budgeted 73.4 trillion won (US$67. 5 billion), of which about 42.7 trillion won (58%) will come from the government. South Korea targets net zero by 2050 and for renewables to account for 20% of the country’s generation capacity by 2030 and 30-35% by 2040. Implementation of the Green New Deal should continue to support the growth of renewable energy and the Korean companies that operate in the wind space. Some of these include:

CS Wind Corp. (112610-SE) is a leading wind tower manufacturer, and also manufactures transition pieces, tower internals and plant equipment. CS Wind has production facilities in Vietnam, China, Canada and the UK. Co-CEO/Director Kim Seong Gwon owns 71% and the National pension Service owns 19.9%.

Daehan Green Power (060900-KQ), formerly known as Korea Renewable Power & Energy Corp., manufactures and sells biofuel oil and operates a wind power generation business.

Doosan Heavy Industries (034020-SE) manufactures heavy equipment such as excavators and engines; power generation equipment, such as turbines, energy storage systems, micro grids; and constructs power and desalination plants, buildings and infrastructure projects.

Korea Electric Power Corp. (015760-SE)is Korea’s largest electric utility company and develops electric power projects in nuclear, wind and coal. The company is 51.1% owned by the government (Korea Development Bank 32.9%; Korean government 18.2%) and the National Pension Service owns 6.16%.

Samkang M&T Co. (100090-KQ) manufactures shipbuilding products and steel pipes used in offshore structures.

SK E&S (Subsidiary of SK Holdings 034730-SE) is a clean energy service provider ranging from overseas gas field development to power generation, district energy and city gas. SK E&S develops and operates new and renewable energy plants and equipment

in solar, wind and Energy Storage Systems. Although, wind is a small part of the overall business, the company is participating in onshore wind power project in Shinan and looking at opportunities for large-scale offshore projects in Shinan.

Unison (018000-KQ) develops, builds and manages wind projects. The company also produces wind turbines and wind power towers and designs wind turbine generator units and systems.

Energy Companies and Major Oil Companies

Major oil companies are well aware that their fossil fuel business is being disrupted by renewables long term. In recent years, they have stepped up their investments in renewables technologies to diversify their portfolios. Given their experience in offshore exploration and development, and being accustomed to spending billions to secure offshore rights and leases, one area of renewables where many of these majors have an expertise in is offshore wind. European majors have been particularly active in this area.

BP plc (LSX- BP.), based in the U.K., was the first oil major to invest significant capital to renewable projects, particularly wind and solar, beginning in 1980. It sold or closed most of its previous green energy investments in the aftermath of the 2010 Deep Water Horizon oil spill incident in the Gulf of Mexico. The company reintroduced investment in renewables recently and has been especially aggressive in offshore wind power. Last year, the company announced a paid Norway based Equinor $1.1 billion for a 50% stake in the Empire Wind 2 (off the coast of New York) and Beacon Wind 1 (off the coast of Massachusetts) projects. In February 2021, BP teamed with German utility Energie Baden-Wurttemberg to secure the winning bid for two 1.5 GW projects for two locations in the Irish Sea. BP estimates that it will pay about $2.5 billion over four years for the two tracts it won, the highest price per unit of potential power generation.

Total Energy (Paris- FP), formerly called Total, has been has also been expanding its renewable portfolio, which includes offshore wind. The company plans to invest $500 million per year in clean energy technologies. In February 2021, Total Energy was the other top bidder in the U.K. Crown Estate seabed leases. The company partnered with Macquarie’s Green investment Group to pay $1.2 billion as the winning bidder to develop 1.5 GW off the coast of Humberside on the east coast of England. Last year, Total Energy acquired Global Wind Power France, a company with a 1 GW portfolio of onshore wind projects.

Royal Dutch Shell (RDS’A/B), based in the Netherlands, through its subsidiary Shell New Energy, first entered the onshore wind business in the U.S. in 2001. Currently, it has four operating wind farms located in Wyoming (Rock River), Texas (Brazos) and California (Whitewater Hill and Cabazon). The company also entered the offshore wind market in 2000 as part of a consortium that installed the first offshore wind turbine in UK waters. Currently, the company has only one operational offshore wind project, which is located in the Dutch coast. In addition, Shell has four offshore projects currently in development: 79% ownership of the CrossWind consortium (off the Dutch coast); 20% ownership of the Baluwwind consortium (off the Dutch coast); 50% ownership in Atlantic Shores development (in New Jersey) and 50% ownership in the Mayflower consortium (off the Massachusetts coast).

Players in Oilfield Services:

NOV Inc (NOV) is expected to generate $200 million in revenue related to equipment for offshore wind construction (less than 5% of total 2021E revenue) by the end of 2021. The company is well-positioned in the offshore wind construction vessel business, where it has long been a leader as an equipment supplier. The company claims that most of the world’s 30 GW of installed offshore wind power was installed with NOV designed vessels and equipment it had supplied. Currently, NOV is involved in constructing or upgrading about a dozen vessels that install wind turbines where it on which it can sell as much as $80 million equipment per vessel. Additionally, NOV is pursuing opportunities in the floating offshore wind market, which will require equipment that it designs and supplies, such as cranes, winches, mooring systems, cable-lay, ballasting systems, chain connections, and tensioners.